Editor’s Note: Pam Marrone is CEO and founder and Keith Pitts is senior VP of regulatory and government affairs and chief sustainability officer at Marrone Bio Innovations, Inc., a California-based producer of biological crop inputs. Here they respond to an article published by AgFunderNews last month.

Recently, AgFunderNews published an insightful article by Spencer Maughan and Kieran Furlong, “Crop Protection: Biologicals vs. Chemicals.”

The authors are generally bullish on biologicals and hence the title, which implies a conflict, is a misnomer. Biologicals are best suited to be integrated into pest management and crop production programs as they can:

- Increase yields and quality compared to chemical-only programs,

- Reduce pesticide residues at time of harvest, which has become increasingly important for both domestic and export markets,

- Allow shorter field re-entry allowing labor flexibility, which is an absolute must for high value, fresh produce in particular and,

- Reverse, reduce or delay the development of resistance to single-site or single-pathway chemicals.

That said, I would like to address some of the excellent points they make in their article.

Maughan and Furlong: “Under-Investment in Biologicals Efficacy Trials”

“The agrochemical majors like Bayer/Monsanto, Dow/DuPont, ChemChina/Syngenta spend almost $50 million on field trials for each newly introduced chemical. The vast majority of this expenditure is focused on efficacy trials – different locations, different crops, different pests. If biological products are being brought to market for $10 million in total, they are not coming anywhere close to this level of “in-the-field” testing. Farmers hold biologicals to the same standard as chemical products, but biologicals have not been tested in field trials to nearly the same extent. So while there are financial benefits, this may be at the root of the skepticism often heard about biologicals—“They work sometimes, but not always”.

First, there is a perception that chemicals work all the time and biologicals don’t. That is just not the case. Chemicals fail. In field trials with consultants, university researchers and large companies themselves comparing biologicals and chemicals, we frequently get reports back with chemical failures – no separation statistically from the untreated. It is quite interesting (and amusing) how the conclusions are written.

Some examples are: “The biological did not work so we cannot recommend it.” “The biological provided no advantage so we are not interested in it.” So I always ask, “how did the chemical perform?” A dive into the data may show that BOTH the established chemical or chemical tank mix (on the market for many years) and the biological did not separate from the untreated control. Yet, the biological is singled out. Or, the chemical was slightly better numerically, but not statistically differentiated, and the report will pronounce, “the chemical performed better than the biological.” But, when the biological is numerically better, we see “the biological was no better than the chemical.”

Recently we received an email with a summary fungicide field research conducted by land grant university researchers. The report went out broadly to thousands. What caught my attention was the statement, “Biological Product X was inconsistent on powdery mildew.” Since I knew that Biological Product X was quite effective and consistent on powdery mildew, I took a deeper dive into the data. What I found was that Bio Product X was remarkably consistent and as effective as the chemical standards across eight powdery mildew trials on a particular crop. On a second crop, the researcher conducted ONE trial, did not apply the product according to the label instructions (using the product curatively rather than preventively, as clearly advised on the label) so Product X did not separate from the untreated, but it was also not statistically different from the chemical. But the public report had the damning statement, “Biological Product X was inconsistent on powdery mildew,” which is actually not a true statement. When the researchers were asked about it, one comment came back, “I don’t apologize for products that don’t perform well.” Excuse me, but the product was tested off-label! And it was only one trial. More than one trial would be needed to assess consistency. What about the other eight trials showing remarkable consistency?

Also, when thinking about field trials, it is important to keep in mind that many trials for synthetic chemicals are actually for the purpose of establishing accurate measurements of residues in order for regulatory agencies to ensure a “reasonable certainty of no harm” to consumers, which often must be done across several crop groupings. These residue studies are labor and lab intensive and quite expensive. In fact, the expense incurred to support acceptable residues in crops is the primary reason synthetic chemical registrants choose not pursue uses on specialty crops, which are high value, but on relatively limited acres when compared to corn, soybeans, cotton, and wheat.

Fortunately, for most biological products, the US Environmental Protection Agency (EPA) and other regulatory agencies, after reviewing toxicology data submitted by registrants, are able to determine that these reduced-risk products are “exempt from the requirement of a food tolerance” which abrogates the need for expensive residue studies. As you can expect, this situation also explains why the earliest and most rapid adoption of biological products has been with specialty crops. Of course, I am happy to say that in recent years, the biological products industry has been making headway entering the row crop sector, particularly as seed treatment.

Confusion about Different business models

One of the misunderstandings about biopesticides is the different business model compared to the business model for developing and launching a synthetic chemical pesticide. Because of the long time (10-12 years) and up front capital cost (more than $280 million) for developing a chemical, by the time a chemical pesticide reaches the market, as stated in the article, there are thousands of field trials and demos, the manufacturing process and formulations are perfected and global regulatory approvals are pending. Therefore, when a chemical is launched, it is launched big. Peak sales are expected in three years.

One of the misunderstandings about biopesticides is the different business model compared to the business model for developing and launching a synthetic chemical pesticide. Because of the long time (10-12 years) and up front capital cost (more than $280 million) for developing a chemical, by the time a chemical pesticide reaches the market, as stated in the article, there are thousands of field trials and demos, the manufacturing process and formulations are perfected and global regulatory approvals are pending. Therefore, when a chemical is launched, it is launched big. Peak sales are expected in three years.

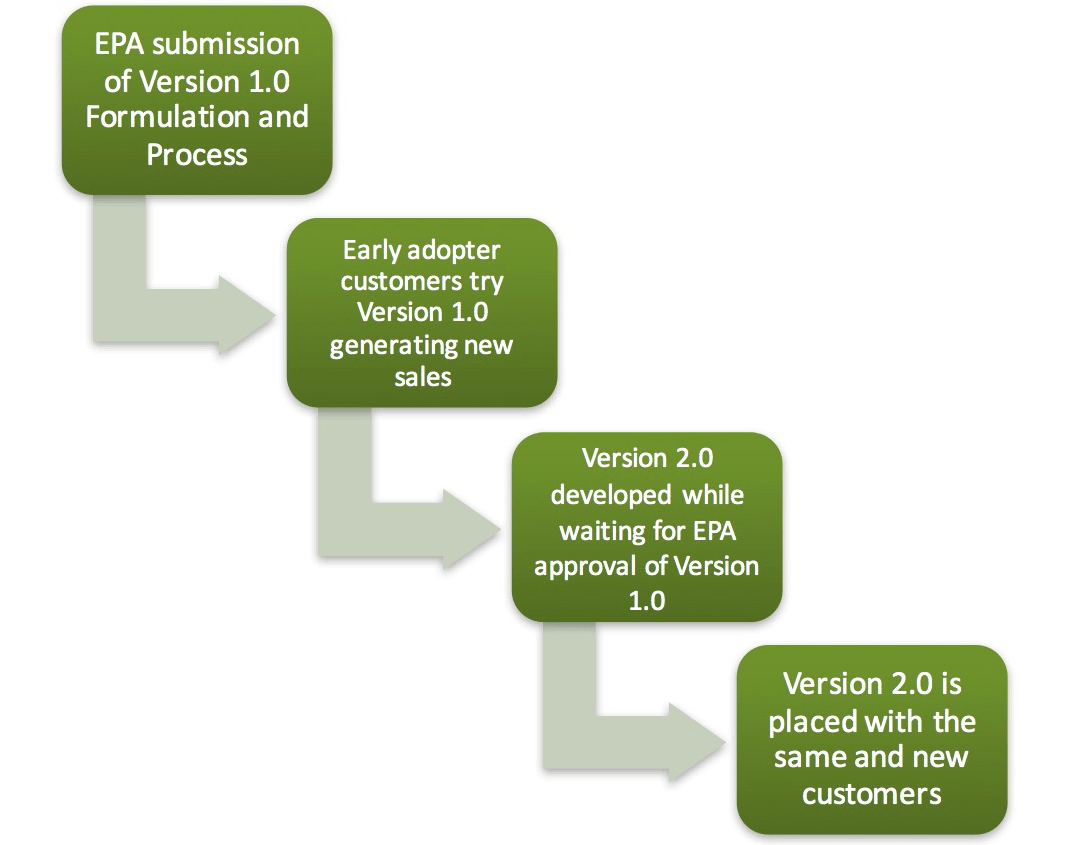

For a biopesticide, often developed by smaller companies without the deep pockets of multi-billion dollar companies, there is a different “capital-lite” model applied, which could be called the ‘Innovate at Speed’ or ‘Agile Innovation Model,’ which is capital efficient and “fund as you go” model. Because of the 70-year history of safety and low risk of biopesticides and short development time and favorable regulatory process in the U.S., a small company can enter the market with Version 1.0 biopesticide and place the product in a controlled fashion with a few early adopter grower customers.

This provides valuable early insight from customers and feeds back into R&D for the next generation product, Version 2.0, allowing rapid and continued innovation. Because an early version may have only a US label with a few crops and uses, peak sales do not occur in three years, but will take longer (5 or more), as more uses and crops and international approvals are achieved over time.

Neither the capital-intensive model nor the capital-lite “Agile Innovation Model” are “right” or “correct”. They are simply different and understanding this will lead to better expectations for biopesticides when they enter the market. Many growers love to get access to a product early and it is amazing how much you can learn from their experiences with it. The “Agile Innovation Model” is used widely in places like Silicon Valley and consumers are accustomed to having continued new versions released of their iPhone hardware and software (and helping the companies de-bug the new version). Imagine if a biopesticide had $280 million in R&D (instead of $3-7 million) behind it before being launched? It would be a very different product! But then, biopesticide innovation would decrease because only large companies could afford the cost.

Maughan and Furlong: “New Chemicals Often Bear the Burden of Failed Investments.”

“The $300 million figure for a new chemical product is essentially the cost of a portfolio of development projects from which only one emerges for sale. In contrast, the $10 million-$15 million estimate for new biologicals is the cost of just one project; failed or halted products (or even other startups) are not wrapped into that number.”

Maybe not. Most small companies can’t afford to take more than one candidate into development and therefore are extremely selective in what goes into the development pipeline to insure expensive failures do not occur. Inexpensive toxicology limit tests are run before starting the full toxicology tests and commercial media and scalability are assessed from the start and early field trials with whole cell broths can tell you if your microbe can cut it. Certainly one benefit of working with microbes in particular is that even if one effort with a specific microbe results in a dead end, it is not necessarily the end of the line for that microbe. Increasingly, new biological product companies, like MBI, that focus on natural product chemistry and closer scrutiny of the genomics of their microbes are learning that modifications to fermentation processes and downstream processing and new formulations can give us several “bites at the apple” with any given microbial collection. Very rarely will a chemical that has been abandoned over efficacy, scalability or safety concerns have a chance of resurrection.

Maughan and Furlong: “However, venture capital has an incredibly important role to play in crop protection innovation – the early, high-risk stage of development. Rather than waiting to exit on the basis of commercial sales, VCs should seek to pass the baton to the agrochemical majors (or other acquirers) at an intermediate point where the high-risk product development activity has been significantly completed, but before the capital-intensive stages of extensive field trials and widespread market entry. Such a staged model has become the norm in the pharmaceutical industry and – while there are many differences – it is worth looking to that model for ag lessons.”

Yes, the model of the start-up company doing the drug discovery and early development and then finding a large pharma partner is well established. The difference in the ag versus pharma world is the difference in the upfront and milestone-based funding that goes to the small pharma biotech compared to agriculturally focused startups. Large deals with significant upfront funding are rather rare now (they were more common during the heady days of $7.00/bushel corn). And in talking with many biopesticide entrepreneurs, problems consistently arise when protocols are not followed, when testing is conducted in an information vacuum, when internal R&D departments, with a synthetic chemical focus, have “not invented here” biases against “outside” or non-chemical candidates.

It is not a surprise if poor results are obtained when communication is often one-sided. Progress is slow, putting the small company at risk unless it does more by itself in parallel. Definitely, there is a tremendous opportunity to change this to be more like the pharma model. That would invariably jumpstart innovation, create many more startups and an established, predictable model for successful investment in IPOs. In some instances, we at MBI are experiencing a more collaborative and communicative relationship with potential partners that only a few years ago would not have even given a look at a biological product. Also, many companies with a biological focus are looking across our small, but growing sector, and looking for pure-play biological collaborations for opportunities combining products with modes of action that increase value, spectrum, and performance for our customers. We will certainly be pressing to make such collaborations less the exception and more the norm.

So, rather than set up the discussion as bio vs. chem, we’d like to propose that the better discussion is bio + chem or even bio + bio to better serve our customers–and our workers, consumers, and the environment—as we pursue more sustainable approaches to feeding a growing population.