Editor’s note: Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

2020 was one of the busiest years on record as far as agtech M&A and IPO activity was concerned – even as the Covid-19 pandemic ravaged the global economy. And AgFunder data indicates that 2021 could see even more in the way of big exits for agritech startups.

According to AgFunder’s 2021 Farm Tech Investment Report, 37 agtech M&A deals completed in FY 2020. As is typically the case, financial details for most of these transactions were not disclosed; however, of those where figures were made public, Singapore state fund Temasek‘s $365 million acquisition of a majority stake in Israeli irrigation tech firm Rivulis was the biggest.

The next largest deal by value was agrochemical firm ICL‘s $60 million takeover of precision ag company Growers.

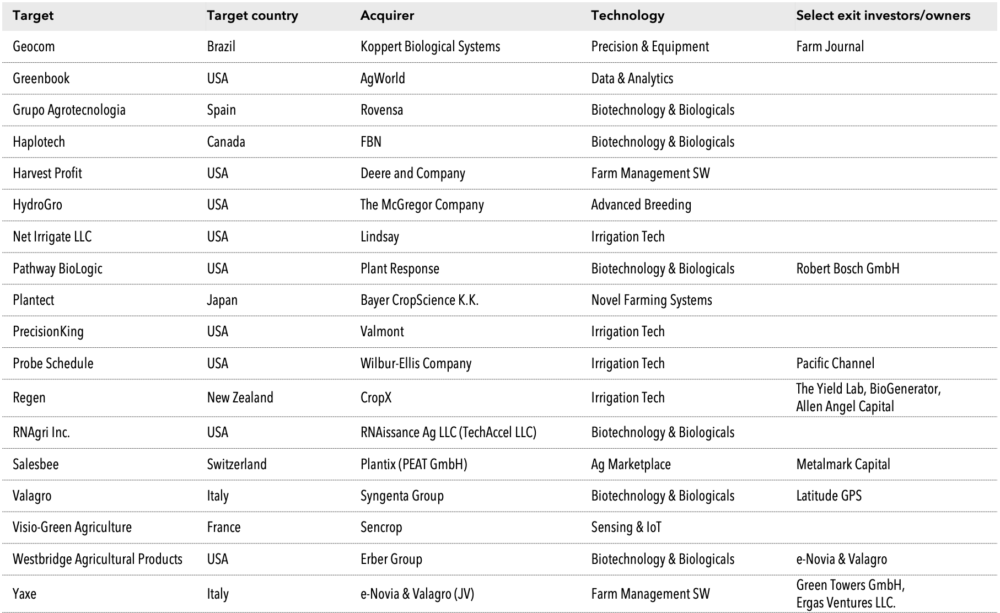

The table below — put together in collaboration with Verdant Partners — lists acquired companies with disclosed values in order of size first, followed by acquired companies of undisclosed value in alphabetical order:

Agtech M&A deals, 2020

In terms of geography, a little more than half of 2020’s agtech M&A deals were US-based, echoing 2019 figures. Europe accounted for 19% of deals, with 11% taking place in Asia Pacific.

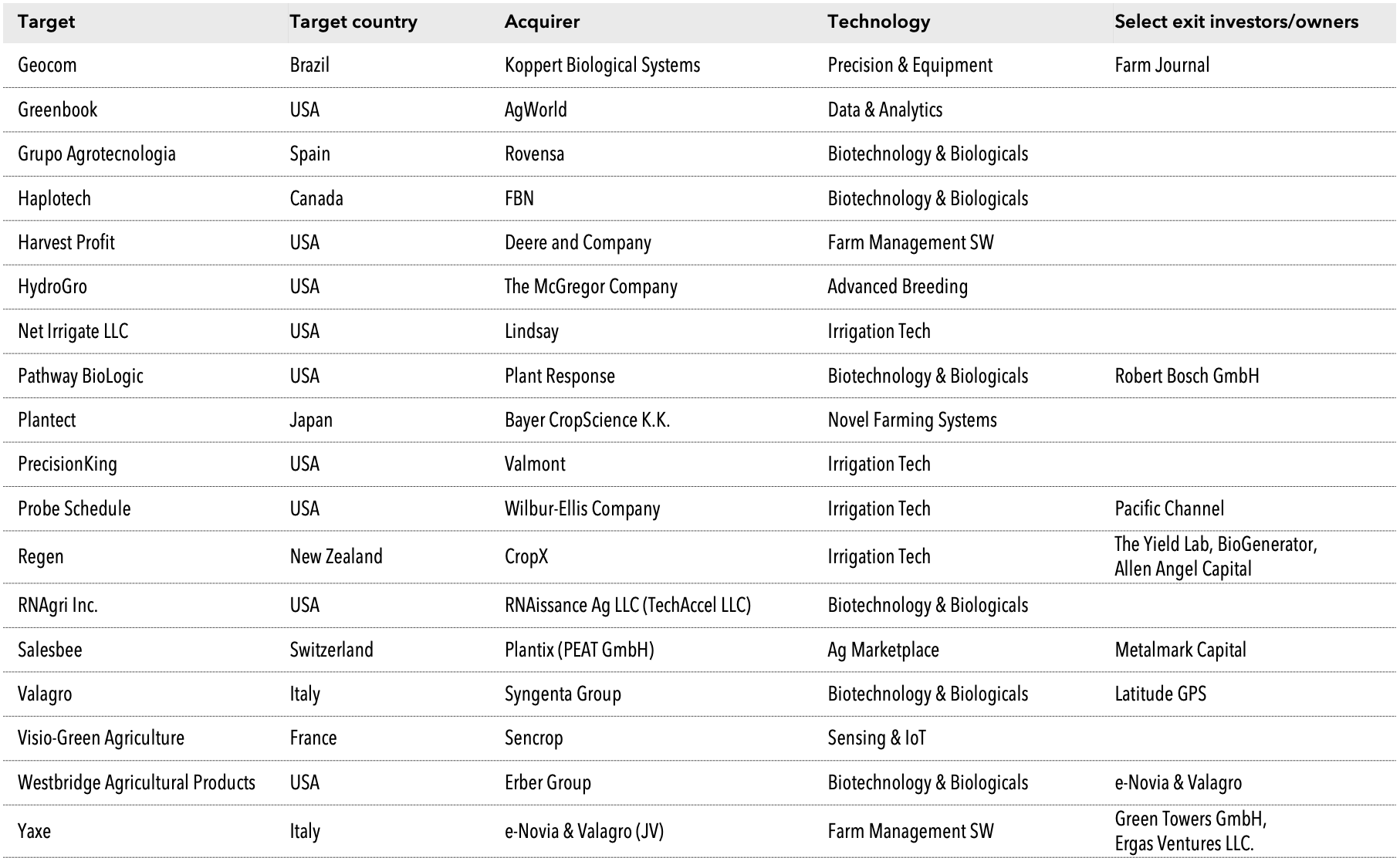

Glancing down the list, one notable trend is repeat acquirers engaged in ‘rollups’ of multiple agtech startups. These include Israeli ag data company CropX, US irrigation equipment maker Valmont Industries, and — coming from outside the typical agrifood landscape — Canadian communications giant Telus.

Many 2020 agtech M&A deals appeared to be directed towards consolidation rather than diversification, particularly in areas like precision irrigation and novel biological inputs.

Agtech M&A deals 2020 (cont.)

Going by AgFunder’s preliminary data for 2021 so far, it’s shaping up to be another big year for agtech M&A. The largest 2021 deal with a disclosed value is Valmont’s $300 million purchase of Israeli crop analytics startup Prospera, announced in May. Other major transactions include John Deere‘s $250 million acquisition of farm equipment ‘upfitter’ Bear Flag Robotics [disclosure: AgFunder is an investor in Bear Flag] and US-based vertical farm Kalera‘s $153 million buyout of German counterpart &ever, both of which were announced last month.

Please note that the M&A data discussed above does not include SPAC deals, where privately-held businesses merge with listed shell companies to go public. We’ll take a look at those separately in next week’s Data Snapshot – see you there!