Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder. Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Indian startups in the Agribusiness Marketplaces category raised a total of $86 million in funding during the last financial year (FY21) – almost three times the $30 million they’d hauled in during FY20, according to AgFunder’s recently published ‘India 2021 Agrifood Startup Investment Report‘.

Deal activity also increased from 14 transactions in Fy20 to 25 in FY21, indicating that investor interest in the category continues on an upward trend with both established players and newer entrants securing funding over the 12-month period. This also made it the joint-second largest agrifoodtech category by deal volume alongside eGrocery and Premium Branded Foods & Restaurants.

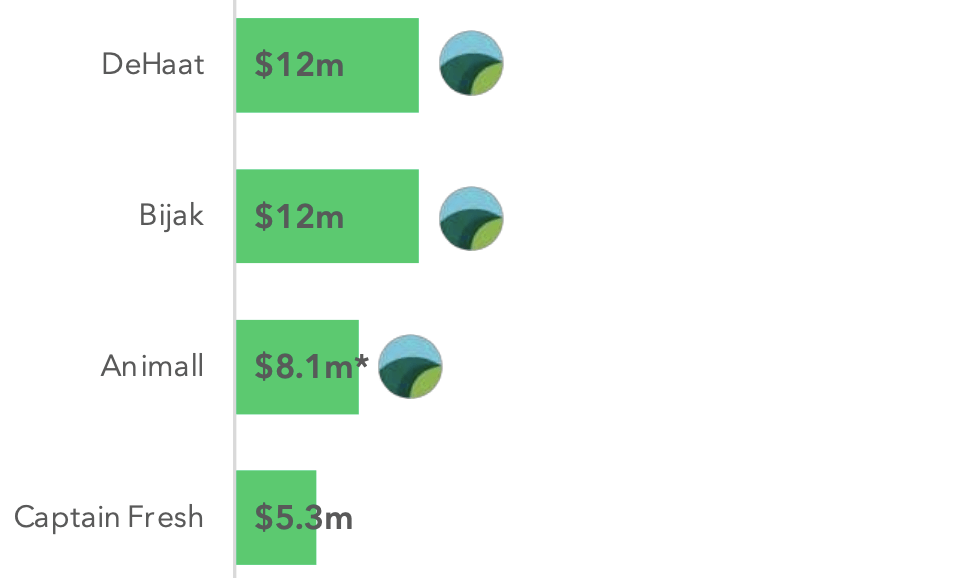

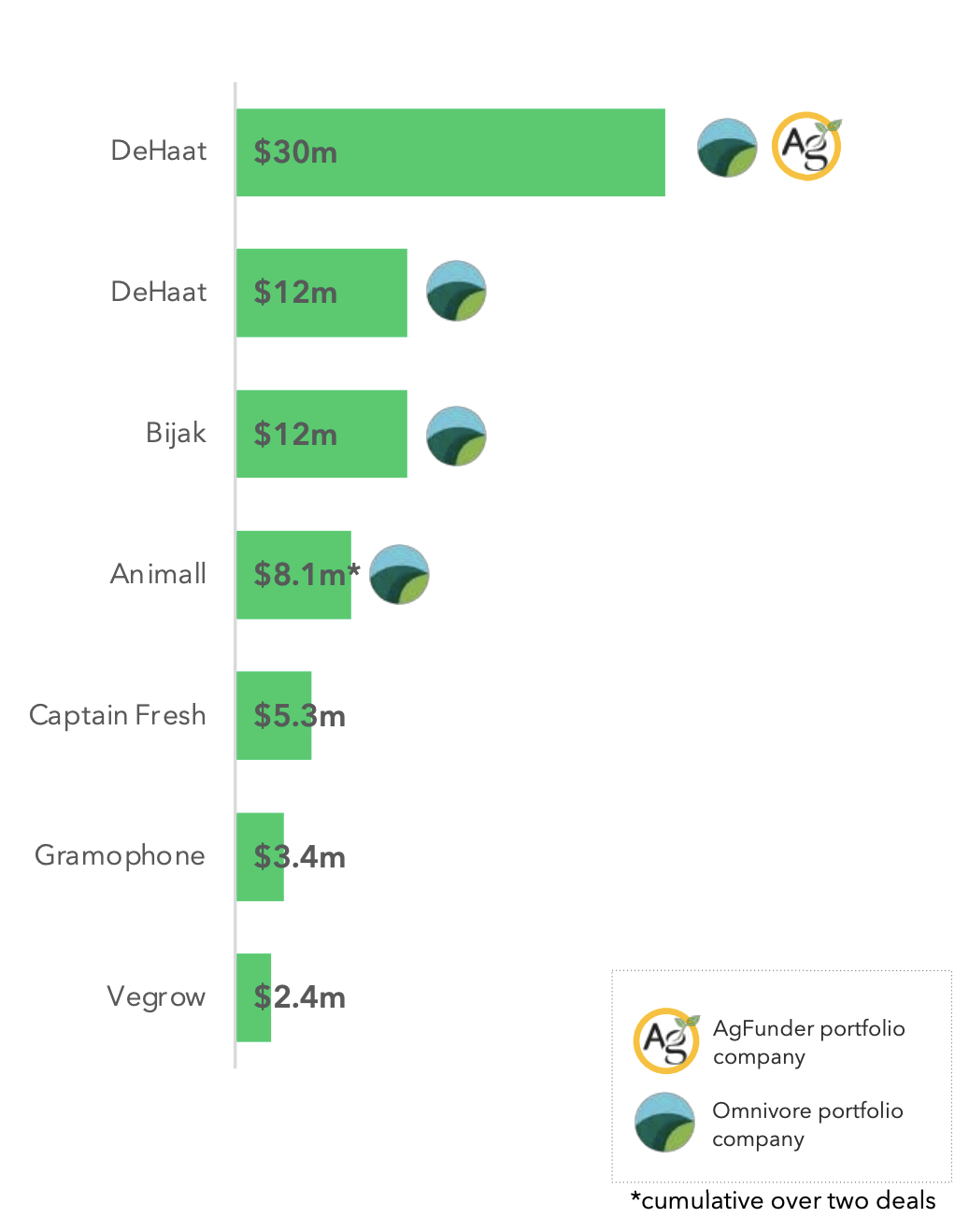

The chart below shows the top Agribusiness Marketplaces deals in India during FY21 [transactions involving AgFunder and our India data partner, Omnivore, are marked for clarity.]

India’s top Agribusiness Marketplace deals, FY21

“Full-stack” farmer marketplace DeHaat scored $12 million for its Series A round in April 2020, following up with a $30 million Series B in January 2021 – the category’s biggest of FY21 [disclosure: AgFunder and Omnivore are both investors in DeHaat.]

Wholesale agri-commodity trading platform Bijak, livestock portal Animall, and seafood-focused Captain Fresh were among the other startups to secure substantial rounds during the year.

Why are investors piling in to India’s Agribusiness Marketplaces?

Agribusiness Marketplaces are online e-commerce platforms developed for farmers, primarily as a means of purchasing inputs, equipment, and other supplies for their operations.

Many of these marketplaces have since evolved to connect farmers with additional products and services, such as financing, insurance, transport and other logistical support – as well as access to buyer markets, including both B2B customers and end consumers.

As the new report indicates, investment into these areas was driven by a series of challenges in India’s agriculture sector – such as highly fragmented supply chains, low farm yields, and low farmer incomes, to name a few. At the same time, an increase in smartphone users across rural areas in India has created more opportunities for digitalization.

The Covid-19 pandemic pulled these factors into ever-sharper focus, as farmers’ markets were shuttered, transportation services halted, and access to agricultural labor was diminished – creating further opportunities for online marketplace startups.