Editor’s Note: Brett Morris is a principal at Kansas-based venture development organization TechAccel. Here he lays out the nuances within 245 ag biotech startups and how TechAccel thinks about investments in this fundamental agrifood tech category.

Ag Biotech (agriculture biotechnology) applies to all technologies used on the farm involving biological or chemical processes. It is a broad category involving many types of technology and science, including breeding, genetics, microbiome research, and animal health and nutrition. Ag biotech is a central component of the agrifood tech investing landscape with startups raising $262 million in the first half of this year alone — 23% of farm technology fundraising figures — as noted by AgFunder.

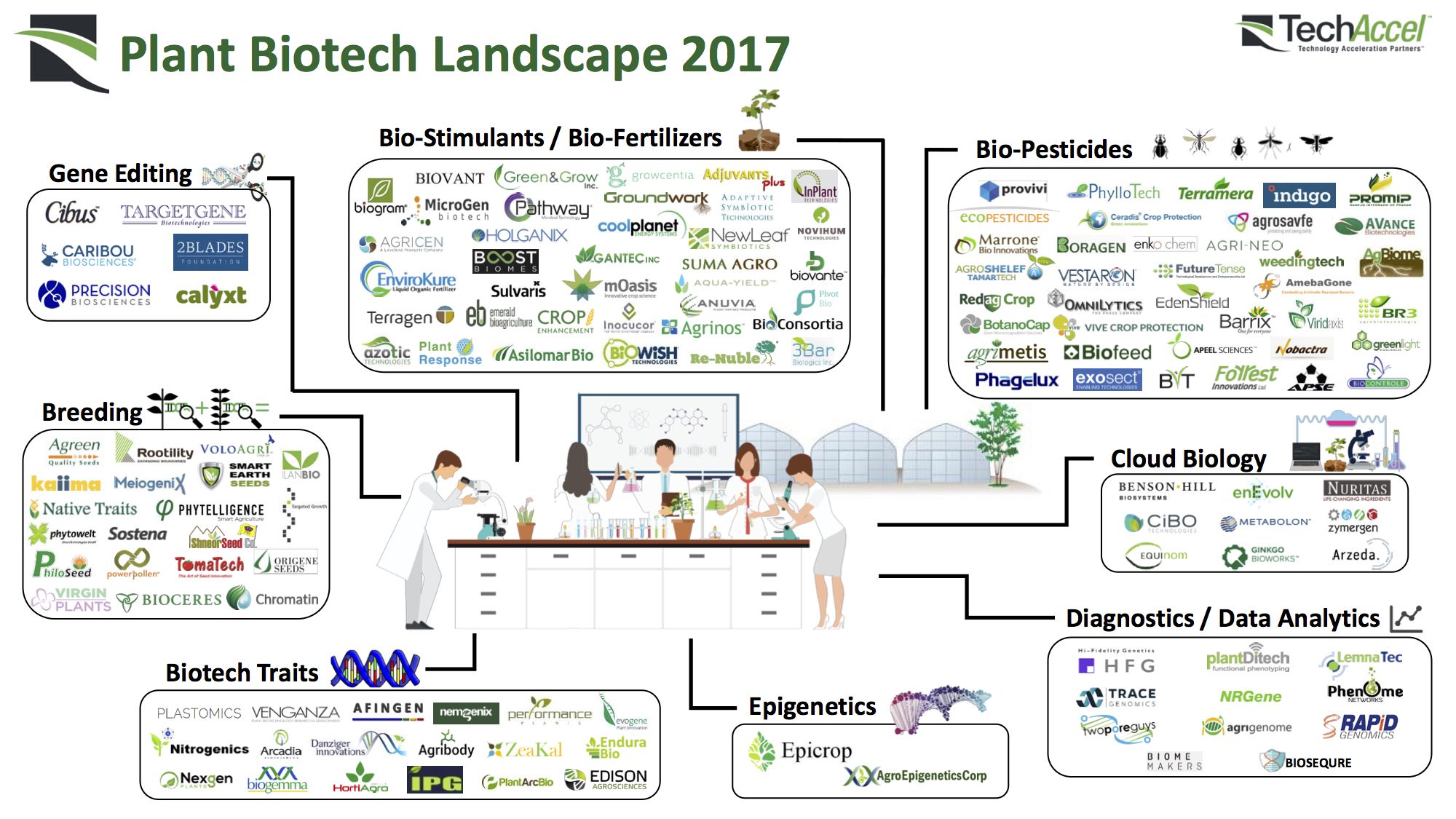

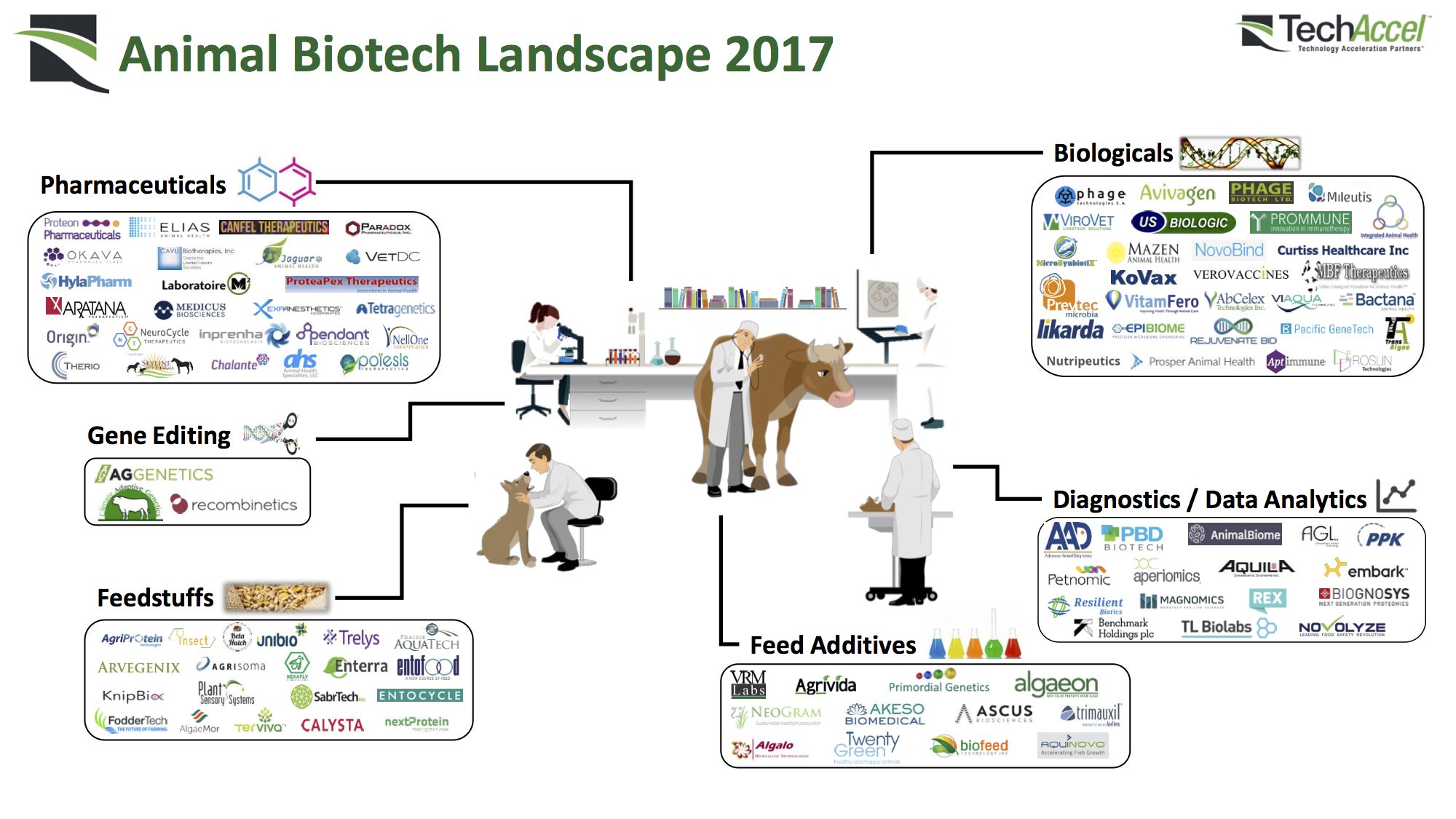

To better evaluate and visualize the ag biotech market landscape, we at TechAccel started to create market maps as an internal project. Over time, we realized it could be a valuable resource to share amongst peers and industry outsiders, given the venture community’s tendency to focus more on digital agtech companies.

There are 245 companies illustrated in the maps. According to our research, they have raised approximately $3.4 billion in total funding since they were founded: $500 million in animal biotech and $2.9 billion in plant biotech.

Below is a summary of our ag biotech category definitions and some commentary around a few areas we find the most compelling for investment.

Gene Editing

Gene Editing is an ag biotech tool used to precisely insert, edit, or delete the DNA of an organism. In agriculture and animal health, breeders could utilize one of several approaches including CRISPR-Cas9, TALENs, and Zinc Fingers to create disease-resistant genes, improve health and nutrition, or enhance performance at a fraction of the traditional time and cost [compared with genetic modification or traditional breeding]. Today, we believe there are excellent investment opportunities to utilize gene-editing in higher value-niche crops that are closer to the consumer such as fruits, vegetables, and nuts. These crops have higher margins compared to row crops and less competition from major agriculture conglomerates, yet still represent large addressable markets.

Breeding & Trait Technologies

Breeding is the science of changing plant traits to produce desired characteristics using methods such as conventional breeding, tissue culture and propagation, molecular breeding, and marker-assisted breeding. Biotech Traits transfer useful characteristics into a plant by inserting genes from another organism. There are a few startups developing innovative breeding and/or genetic technologies that avoid the regulatory burden of a genetically modified organism. Three examples are Epicrop Technologies, a startup using epigenetics to improve yield, stress tolerance, and vigor in several crops, Kaiima Bio Agritech, a company using mutagenesis and other technologies to improve crop performance, and Phytelligence, a startup using proprietary tissue culturing technology and protocols to produce cheaper, faster, and superior rootstocks.

Epigenetics, the key to Epicrop’s technology platform, is a process that influences the way genes are expressed without changing the gene sequence to improve crop performance.

Cloud Biology

We believe investing at the intersection of ground-truthing biology and intelligent data is one of the keys to solving the global food crisis. Cloud Biology, which combines advances in genomics, cloud-computing, artificial intelligence, and high throughput automation, speeds up development timelines, lowers costs, and produces optimized crops. Less than $50 million has been invested in this category thus far when excluding outliers like Zymergen, Ginkgo Bioworks, and Metabolon, which all operate in other industries in addition to agriculture. Benson Hill Biosystems is a leader in this category and is focused exclusively on agriculture.

Orally Available Vaccines

In animal agriculture, orally available vaccines, medicated feed, and other novelties like bacteriophage cocktails, provide an effective solution to the spread of global disease and the rise of antibiotic-resistant bacteria. They also help counter decreases in feed efficiency and animal growth rates as producers reduce the use of sub-therapeutic antibiotics. In addition to animal health benefits, these technologies can have a profound impact on food safety. Integrating health benefits directly into feed or drinking water significantly reduces the cost of goods, improves the ease of manufacturing, and decreases the odds of additional dosing. Most of these technologies will fall under Biologicals, which are products derived from living organisms and biological processes used to prevent, diagnose, or treat animal disease, and function through an immunological process. These products are regulated by the USDA’s Center for Veterinary Biologics.

Adjacent to this category is that of Pharmaceuticals, or products typically developed through chemical synthesis, that are used to diagnose, cure, treat, or prevent animal disease. Example products include anti-parasitic drugs, anti-inflammatory medications, anesthetics, pain medications, antibiotics, and specialized products for managing reproductive, cardiovascular, or metabolic conditions. They are regulated by the FDA’s Center for Veterinary Medicine.

Animal Health & Nutrition

We believe animal health and nutrition (in general) is an under-appreciated ag biotech sector in terms of venture funding. Most life science investors focus on the human space due to the larger market, while some dedicated agtech VC funds are restricted by their Limited Partners from investing in animal health altogether. The industry also requires specific expertise that most generalist investors do not possess. TechAccel believes there are niche opportunities to leverage the application of human health technologies in animals. If the investment structure is clearly defined up-front, investors can obtain synergies from the data collected, and use a shorter, less costly animal health opportunity to generate liquidity.

Two categories make up most of the animal nutrition segment in ag biotech: Feed Additives, supplements that improve the quality of animal feed, animal performance, and/or animal health, and Feedstuffs, novel animal feeds that serve as the primary or secondary food source. The former includes growth promotion additives, prebiotics and probiotics, feed enzymes, and feed preservatives, while the latter includes insect proteins, cellular agriculture, single-cell proteins, and by-products. One fast-growing niche that touches both animal health and nutrition is aquaculture feed and vaccines.

Biologicals & Microbiome

There is a large opportunity in microbiome research and biologicals on the plant side as companies move away from traditional ag chemistry. Lower costs, lower regulatory hurdles, and reduced environmental concerns all play a role. That being said, it’s a very competitive space in ag biotech and difficult to differentiate between companies all claiming the same value-add. We believe strong risk-adjusted returns for investors can be achieved by securing intellectual property and further de-risking the technology, focusing on innovative delivery systems, or by investing in proprietary data plays. Controlling the rights to a novel biological technology or investing in a delivery vehicle that can be applied industry-wide may be a better bet than obtaining a minority equity position in one of many startups from a risk/reward perspective. Additionally, companies that are collecting microbiome-related data and creating predictive analytics may be an early acquisition target for a large seed/fertilizer/chemical company or venture-backed startup looking to enhance internal product development.

Agricultural inputs in this category include Bio-Pesticides, naturally occurring substances or microorganisms applied to seeds, plant surfaces, of soil that control pests and diseases by non-toxic means, and Bio-Stimulants / Bio-fertilizers, naturally occurring substances or microorganisms that enhance plant growth, health, and productivity, or increase the availability of nutrients.

Companies that offer Diagnostics / Data Analytics as a service look to provide unique biological insights outside of precision agriculture, and can touch both plant and animal biotech.

AG BIOTECH LANDSCAPE GUIDELINES:

- Innovative startup or small publicly traded companies focused exclusively on biotech and biotech applications in agriculture and animal health

- All companies were founded after the year 1995

- Funding ranges from grants and angel investment to publicly traded microcap companies

- Some companies have been financed by revenue only

- Most companies fit into multiple categories but were placed into one primary focus area for visualization purposes

- Ignored traditional ag chemistry companies

- Ignored industrial biotech, food biotech, and cannabis companies as they could each populate their own landscape

- Ignored companies that were acquired

- Not an exhaustive list by any means and feedback and/or suggestions are welcome

- Living document that will be continuously updated with new information