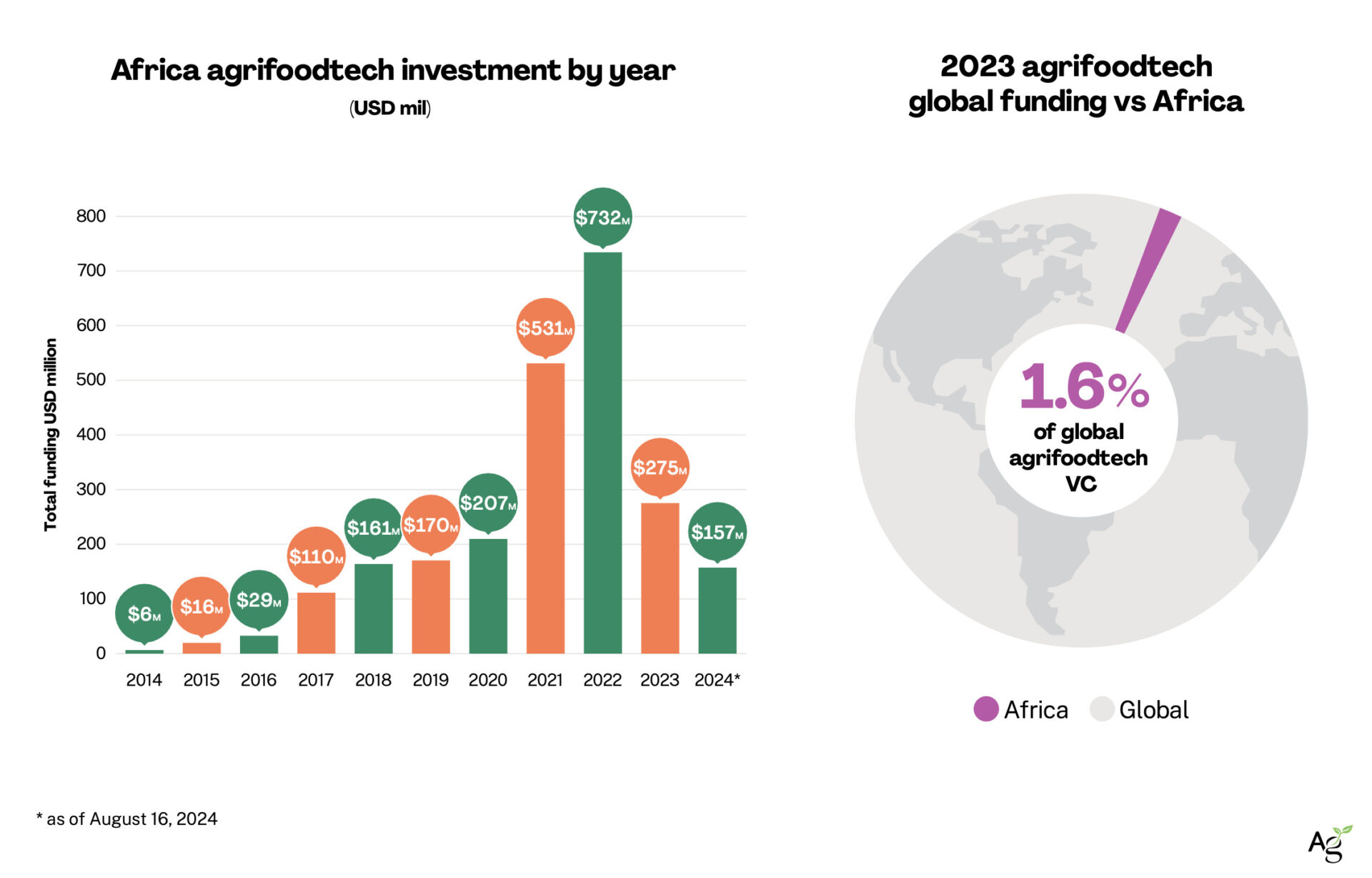

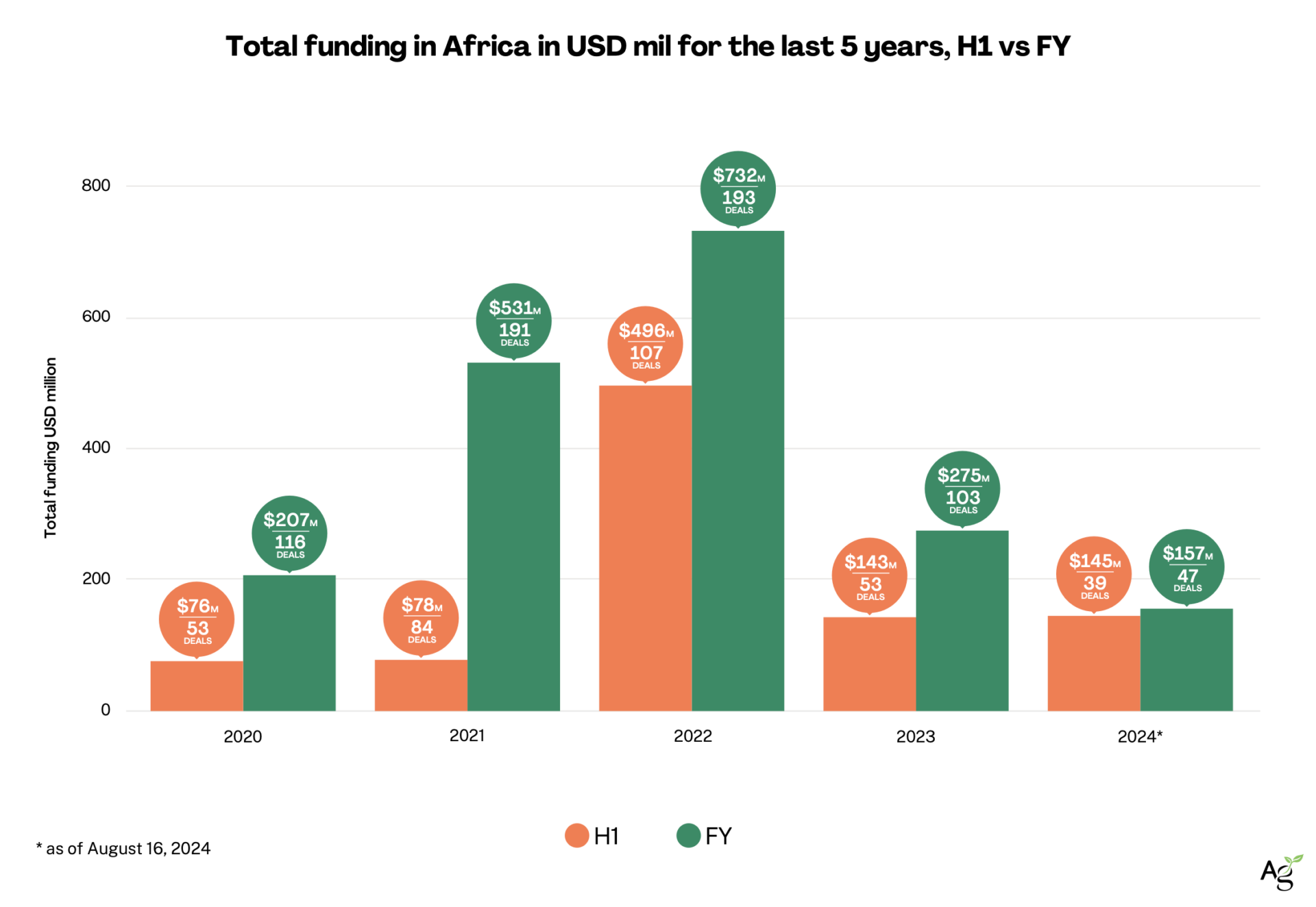

African agrifoodtech funding is showing mild growth and recovery in 2024, with startups in the sector raising $145 million in the first half of 2024, a 1.6% year-over-year increase vs H1, 2023. But Africa still represents a small fraction of global investment, according to AgFunder’s third African AgriFoodTech Investment report, released today.

This comes after a challenging period in 2023 where African agrifoodtech investment declined 62% to reach just $275 million. Africa’s share of the global agrifoodtech funding landscape remains modest at 1.6% in 2023.

Over the past decade, global investors have contributed a total of $2.4 billion to African agrifoodtech ventures, representing slightly more than 1% of worldwide investment in the sector.

The relative increase in African agrifoodtech funding for H1 2024 was accompanied by a 27% decrease in the number of deals. This may indicate risk adversity among investors at the earlier stages but also a preference to pick winners and support them to the later stages.

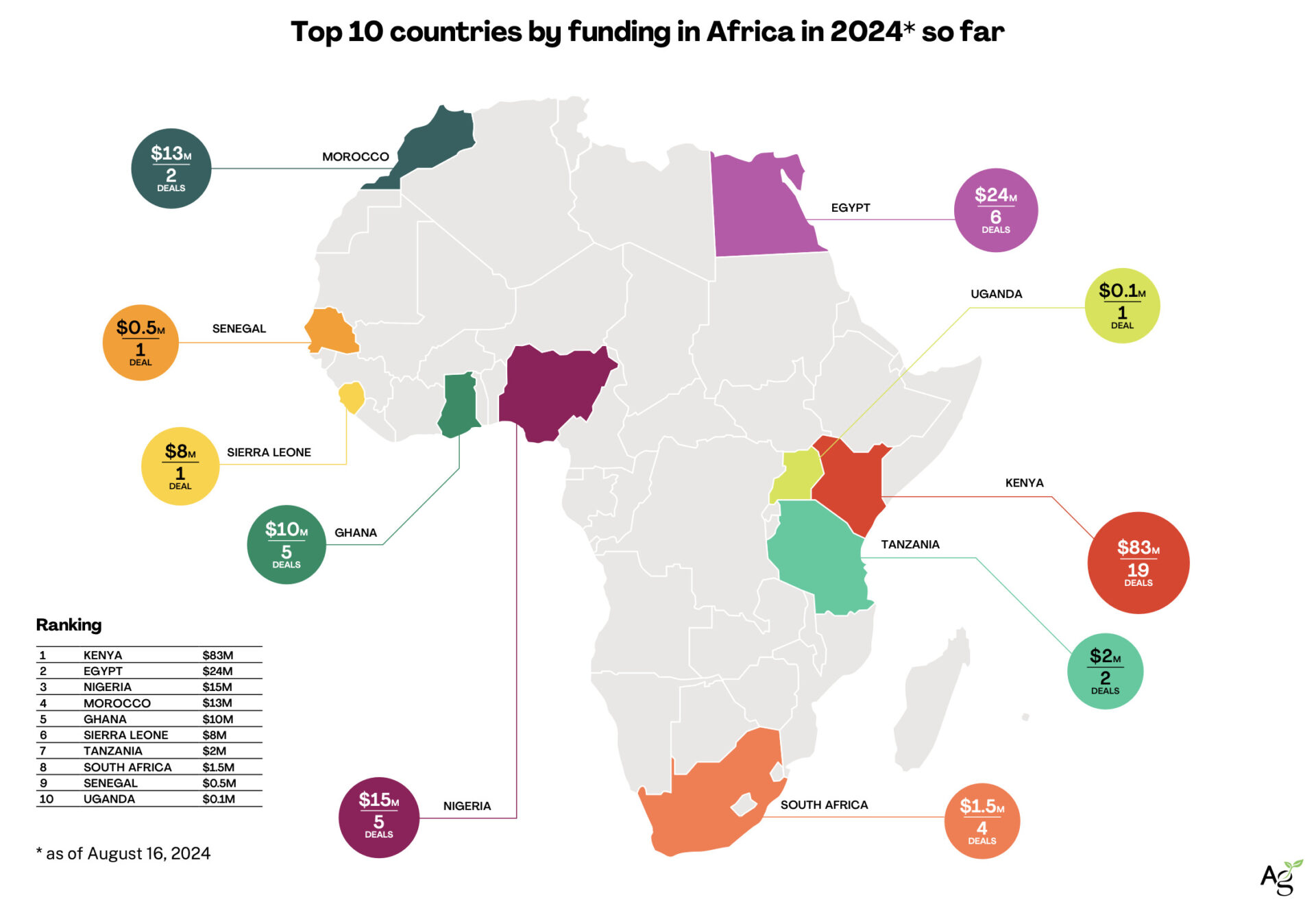

Kenya has re-emerged as the top African hub of agrifoodtech investment in 2024, attracting $83 million across 19 deals—some 53% of the continent’s total. Egypt, was second with 15% of total investment, and Nigeria comes in at third with 10%. Notably, Egypt made a significant leap, climbing three positions from its 2023 ranking, showcasing its growing prominence in the sector.

There’s also been movement in terms of the most popular categories for African agrifoodtech funding. Agribusiness Marketplaces & Fintech has overtaken Midstream Tech and In-Store Retail Tech to be the most popular category in 2023, and so far, in 2024, attracting 41% of all funding dollars and accounting for 36% of deal activity.

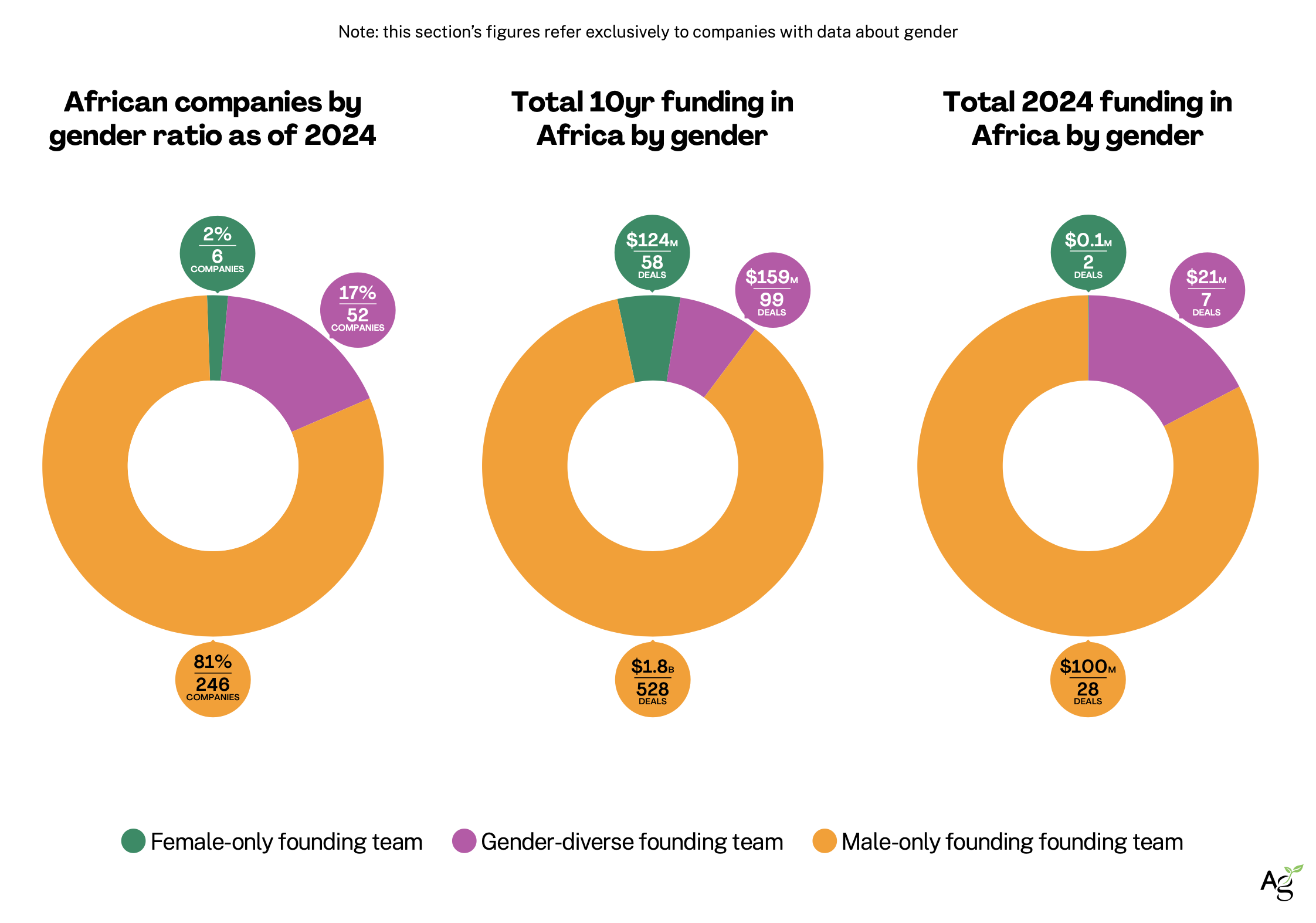

Over the past 10 years, there appear to be signs of increased gender diversity among founding teams; however those with female founders raise disproportionally less than their male-led counterparts.

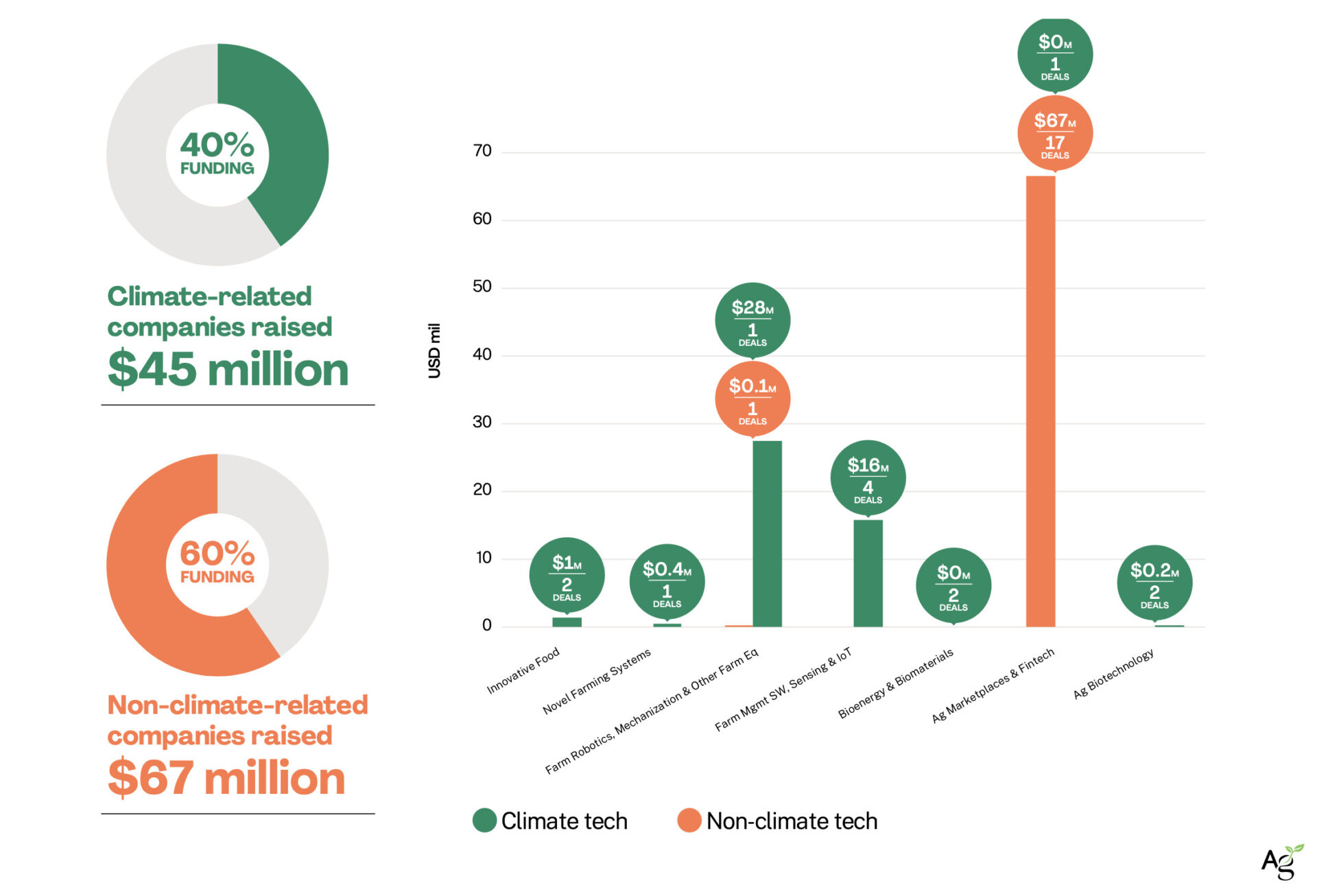

On a positive note, climate tech investments have increased as a portion of overall African agrifoodtech funding so far in 2024, reaching 40% of funding to upstream categories, up from 24% in 2023.

Upstream category Activity in 2024 climate tech

African agrifoodtech funding by the numbers

$275 million: total funding in 2023, a 62% year-over-year decline vs 2022 in a year when globalagrifoodtech funding dropped 50%.

1.6%: Africa’s share of global agrifoodtech funding in 2023.

$2.4 billion: 10-year total investment in African agrifoodtech vs $222 billion globally.

$157 million: funding in 2024 so far.

27%: the decline in the number of deals closed in H1 2024 (39) compared to H1, 2023.

$83 million: the amount raised by Kenyan agrifoodtech startups across 19 deals, accounting for 53% of the region’s total and putting Kenya back in pole position.

51%: the share of investment taken by just two categories in 2023: Ag Marketplaces & Fintech and Farm Robotics, Mechanization and Equipment.

$65 million: investment in Ag Marketplaces & Fintech so far in 2024, across 17 deals and 41% of total funding.

6: the number of companies with female-only founding teams that raised funding in 2024.

40.5%: the portion of upstream funding taken by climate-tech startups in 2024, with $45 million across 13 deals.

75: the number of seed-stage deals in 2023, amounting to $60 million. In 2024 so far, 29 seed stage deals have closed, raising just under $18 million.