Disclosure: AgFunder is the parent company of AgFunderNews.

There’s no denying 2023 has been a gloomy year so far for agrifoodtech financing in Africa — as is the case in most other markets around the world.

Africa’s food and agriculture technology ecosystem has rapidly grown in the last decade, with investors pumping some $1.8 billion of funding into startups since 2014.

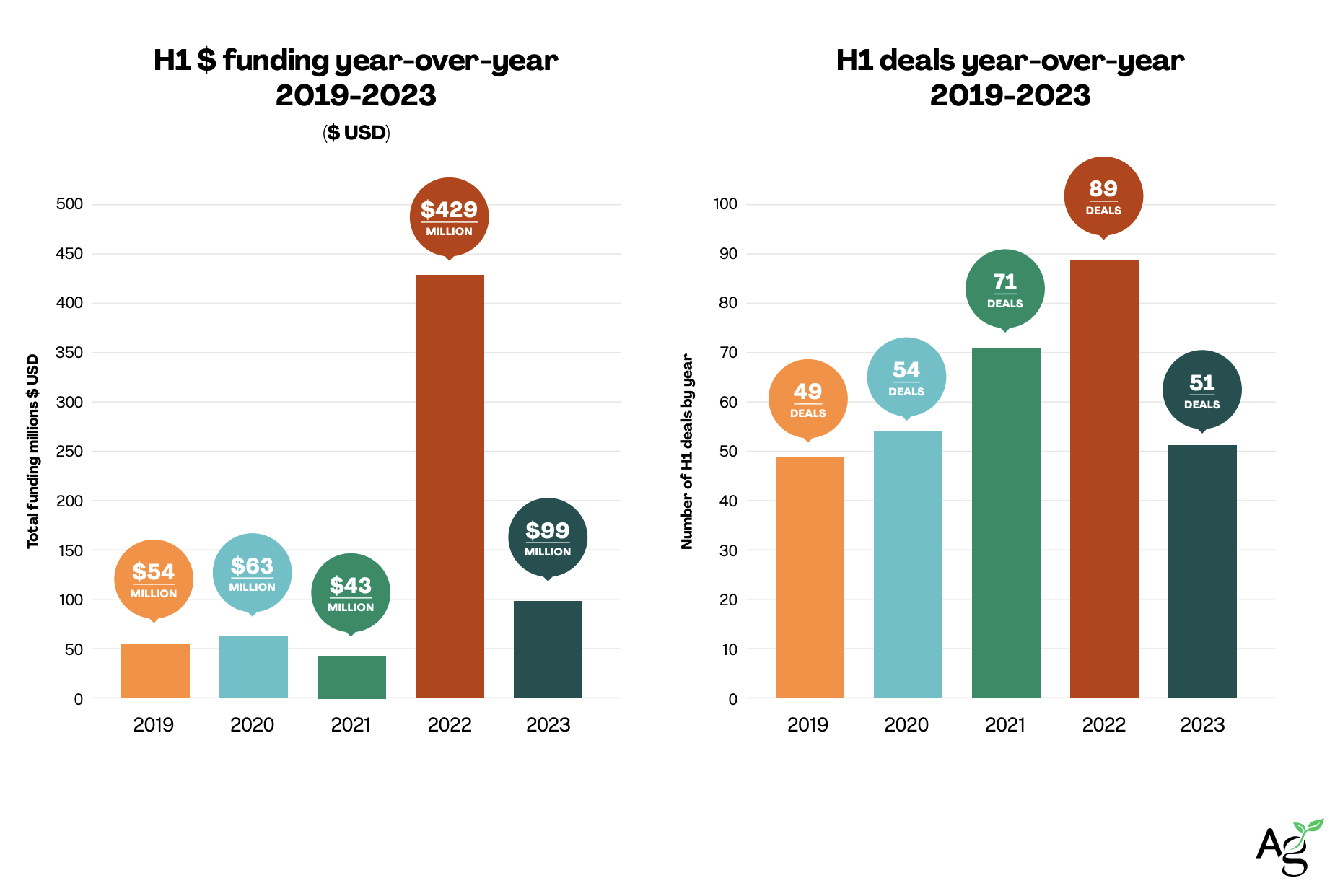

That growth led to record-breaking levels of investment in 2022, when funding reached $636 million — a 25% year-over-year increase despite the macro headwinds that saw most venture capital markets plunge globally.

Global macroeconomic conditions in 2023 — among them rising interest rates, currency volatilities, and inflationary pressures — have curtailed this growth trajectory.

Africa agrifoodtech investment reached just $99 million in the first half of 2023 (H1 2023), a 77% year-on-year decline, according to a new report from AgFunder produced in collaboration with the Bill & Melinda Gates Foundation, FMO Ventures Program, and Mercy Corps Ventures.

Easing global macroeconomic upheaval could be an incentive for investors to slowly turn the tap back on for startups. In Africa, the conscious decision by many nations to elevate climate change in talks about agricultural transition could also positively influence investors.

The key challenge will be identifying the startups with credible, impactful solutions.

The big four

For years, Kenya, Nigeria, Egypt and South Africa have been known as Africa’s top startup markets. Here, the levels of economic upheaval have been especially elevated in 2023.

Local currency depreciation and ballooning debt in Kenya, skyrocketing cost of living and cash shortages in Nigeria, runaway inflation and a foreign reserves crisis in Egypt, and growth slowdown due to prolonged load shedding (aka blackouts) in South Africa have generated anxiety among investors. Many have responded by turning off the funding tap.

In 2022, the big four markets recorded a 21.2% decline in funding, a trend that has continued after they cumulatively attracted $94.7 million during the first half of this year. Even so, these markets still accounted for roughly 86% of all African agrifoodtech financing in 2022.

Kenya’s Wasoko, Apollo Agriculture and MarketForce; Nigeria’s ThriveAgric; and Egypt’s MaxAB, are among the startups demonstrating resilience. In 2022, they cumulatively attracted $300 million.

The size and importance of a market is not necessarily an indicator of its agrifoodtech prowess, however. For example, Ethiopia’s agricultural sector is critical to the country’s economy, accounting for close to 40% of gross domestic product, 80% of exports, and an estimated 75% of the workforce. But ag innovation remains scarce, explaining why the country does not feature among the 10 countries that have attracted funding over the past decade.

Shifting capital

Resilience among most of the continent’s well-established companies is having a critical influence on venture capitalists’ investment decisions for Africa’s agrifoodtech financing.

As the report shows, capital allocation has moved from early-stage startups to maturing and mature firms seeking scale-up and geographical expansion financing.

In 2022, startups at the series B and C stages attracted $266 million in funding, up from $170 million in 2021. Firms with sound financial bases attracted $118 million in debt financing in 2022 compared to $97 million the previous year.

As well, there’s been a shift around where investors are putting capital.

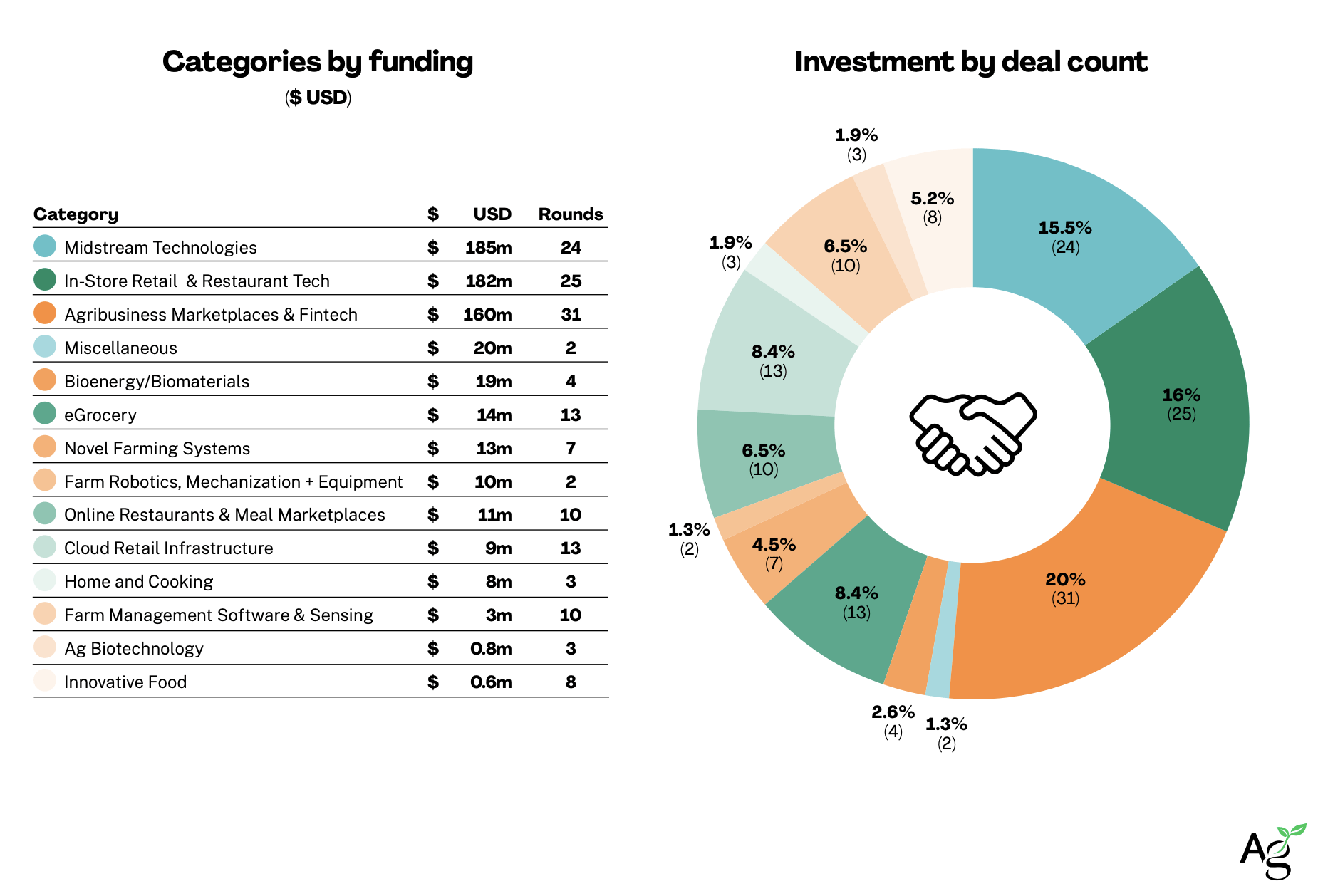

Funding in the In-Store Retail & Restaurant Tech category increased to $182 million in 2022, from $26.5 million in 2021; while Midstream Technologies funding slowed to $185 million in 2022 from $293.7 million in 2021.

The change is substantial, considering that over the past five years, firms operating in the middle of the supply chain have attracted the bulk of the financing. In 2022, it was a near level allocation of funds between downstream, midstream and upstream.

Reality check

While Africa’s agrifoodtech industry continues to project dynamism, some negative factors remain stubbornly constant. Agrifoodtech in Africa continues to be a male-dominated sector, with only 34 firms having female founders, cofounders, or CEOs. Only two companies have female-only leadership teams.

And while Africa’s agricultural systems are in dire need of technological innovations and mechanization, only a handful of startups have ventured into areas like Novel Farming Systems, Farm Management Software & Sensing IoT, Farm Robotics, Mechanization & Equipment and even Ag Biotechnology.

In 2022, startups in these categories attracted a mere $26.8 million in funding.

There is also the constant failure by a majority of the continent’s countries to create conducive environments for agrifoodtech innovations to thrive, leaving just four countries to dominate in funding and deals.

Nonetheless, some investors remain confident in the continent’s agrifoodtech future.

“Despite the recent ‘funding winter’ in Africa, long-term fundamentals of technology uptake, population growth and the immediacy of risks and opportunities posed by climate change position agrifoodtech strongly,” Danny Smith, regional director of Katapult Africa, noted in the report.

And Africa’s particular vulnerabilities around climate change and food security may well force the hands of startups, investors and governments alike.

As the United Nations noted this year, “[African] countries will need to invest in agriculture and related sectors, as well as in water, health, and in education services to reduce vulnerabilities and build capacities to withstand shocks from climate change and conflicts, as well as economic downturns and slowdowns.”

Echoing that, Tekedia Capital chairman Ndubuisi Ekekwe spoke of the opportunity this “funding winter” may bring in the future.

“This reality has the potential to open opportunities for local producers. This means that firms that deploy the use technology can seize the moment and improve productivity.”