Data Snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Ag biotech was one of the few investment categories in 2022 that saw a slight increase in funding despite a decrease in VC spending for agrifoodtech overall. Overall funding in ag biotech rose 8.5% from $2.51 billion in 2021 to $2.73 billion in 2022, according to AgFunder’s Global AgriFoodTech Investment Report 2023.

Ag biotech is an AgFunder-defined category that includes on-farm inputs for crop and animal agriculture including genetics, microbiome, breeding and animal health.

In recent years, food security and sustainability concerns have driven growth in the category, as many at ag biotech tools improve crop protection and health along with animal health and ultimately promise improved yields.

Investment by region

The Americas and Asia tied as regions with the most ag biotech funding in 2022, with each raising $1.3 billion. These regions’ dominance is largely thanks to mega-rounds from China, India and the US. As last year’s top deals illustrate (below), much of the global ag biotech industry is still dominated by North America.

European ag biotech startups raised about half as much as the Americas, with $533 million. Of that number, $200 million went to one startup, France’s DNA Script.

In Oceana, ag biotech is still in its very early stages; startups in the region raised just $19 million in 2022.

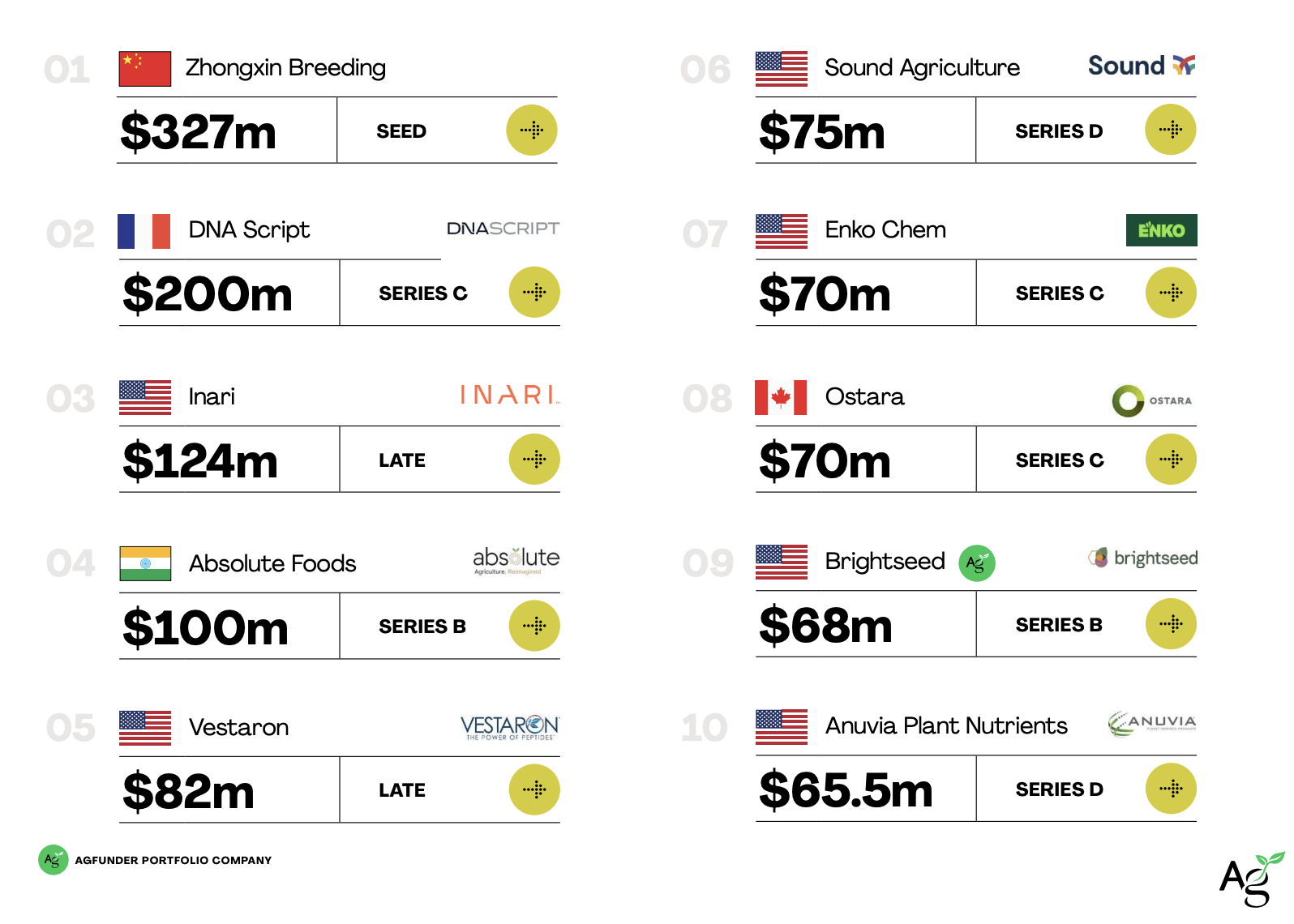

Top deals for ag biotech startups

Chinese pig breeder Zhongxin Breeding, which deploys genomic selection, somatic cell cloning and other technologies to develop new breeding lines, had the largest funding round — a whopping $327 million seed round. This is the first upstream deal to top China’s agrifoodtech funding, and illustrates the Chinese government’s goals for improving self-sufficiency in seeds and genetics.

All other top rounds for ag biotech were Series B or higher, including plant gene-editing startup Inari, synthetic biology startup Vestaron, which makes peptide-based crop protection products, and India-based bio-inputs company Absolute Foods.

Outside of top rounds, two new players to watch in this space are US-based Traitology and French startup Neoplants, which both raised seed funding in 2022. Traitology develops traits in row crops such as soybeans to improve yields, extend growing seasons, and increase resilience to climate change and disease; while Neoplants genetically engineers houseplants to absorb pollutants in the air.