Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder. Click here for more research from AgFunder and sign up to our newsletter to receive alerts about new research reports.

Data mentioned in this article are adjusted using a model of how they will appear 12 months into the future based on historical trends, to take predicted reporting lags into account. As such, they may differ from earlier published versions of the same data.

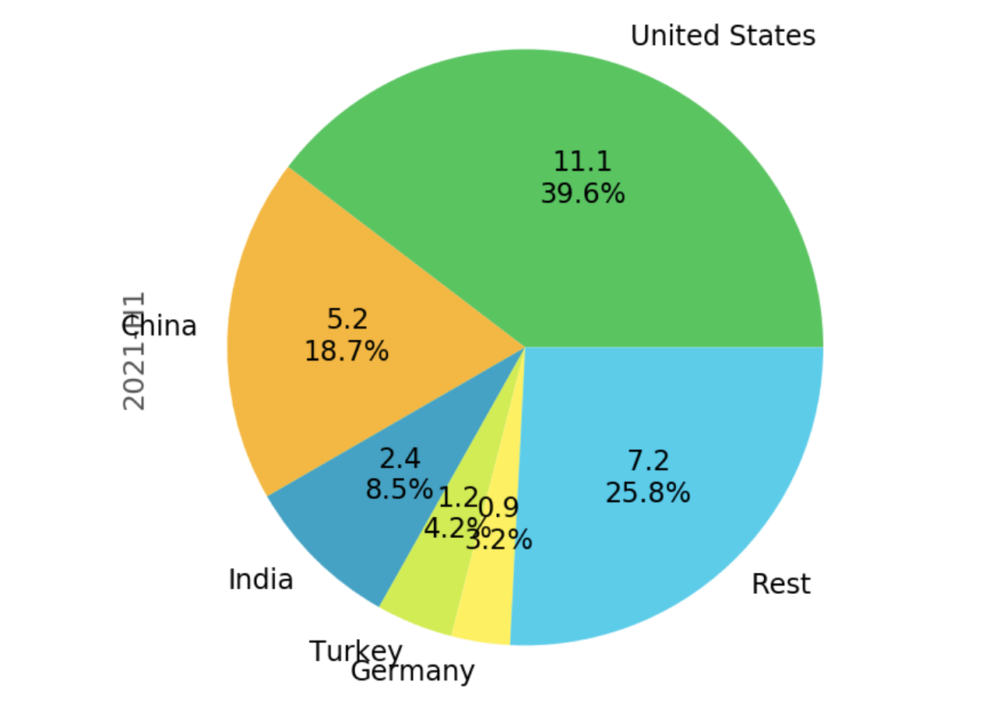

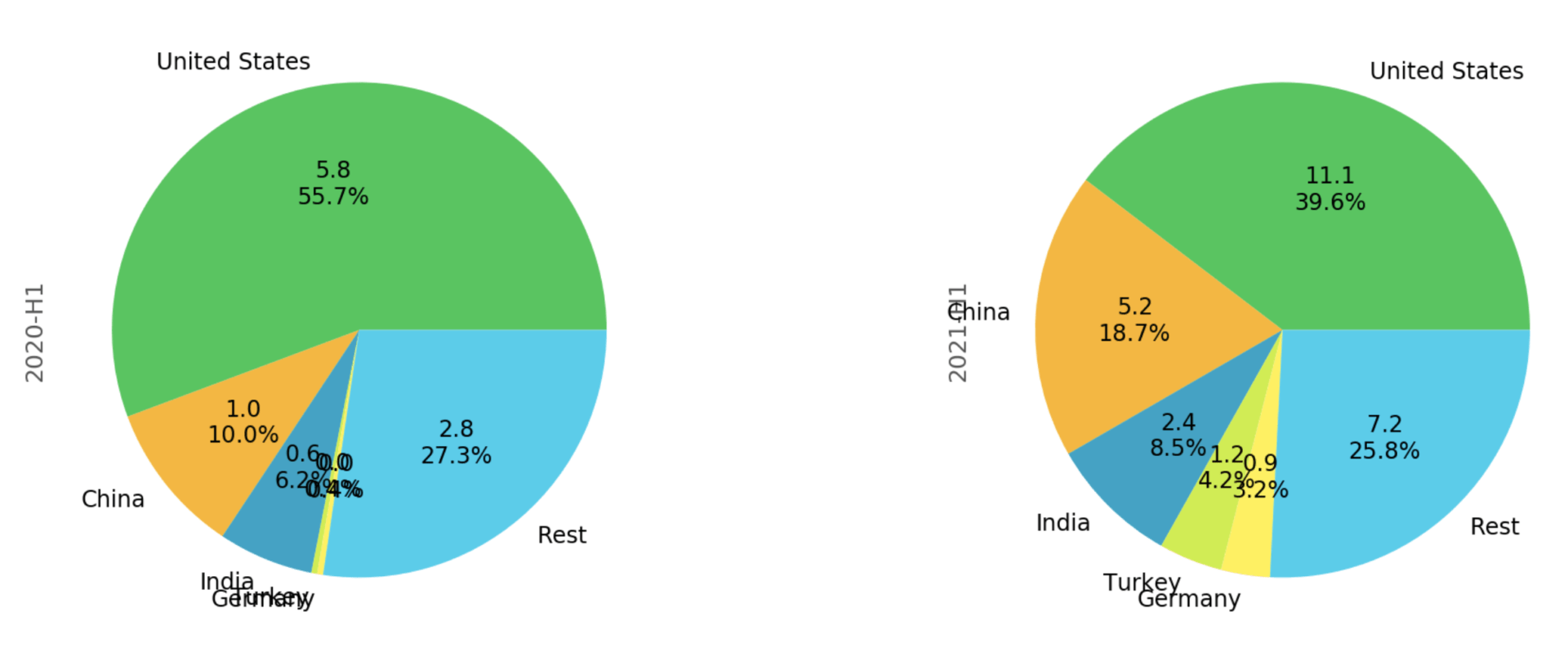

While funding to US agrifoodtech ventures in dollar terms almost doubled between H1 2020 and H1 2021, the country’s share of the global total decreased by close to a third, according to AgFunder data – with much of it surrendered to China and India.

Private agrifoodtech companies in the US raised a total of $11.1 billion in H1 2021, having raised $5.8 billion during the first six months of 2020.

However, their share of global total funding stood at 39.6% – when a year earlier, it had been 55.7%.

Taking up much of the slack was China, where agrifoodtech ventures raised $5.2 billion in H1 2021 compared to just $1 billion during the first six months of last year. The country’s share of the worldwide total leapt from 10% in H1 2020 to 18.7% in H1 2021.

India also increased its share of the global funding pie; going from 6.2% in H1 2020 to 8.5% in H1 2021 (Indian agrifoodtech’s dollar total grew from $600 million to $2.4 billion over the same timeframe.)

There was also a noteworthy year-on-year growth in market share for Turkey (0% to 4.2%) and Germany (0.4% to 3.2%.)

Share of total dollars invested ($bn/%), H1 2020 v H1 2021

All is not as it first seems…

Clearly, the Asia-Pacific region’s two largest markets — both of which are key food producers as well as consumers — are growing in prominence when it comes to agrifoodtech. It doesn’t seem too surprising to learn that they are taking funding market share from the US.

However, their rise — at the apparent expense of the US — is not as dramatic as it might appear at first glance.

As mentioned above, the US saw total dollars invested almost double between H1 2020 and H1 2021 – the biggest year-on-year leap on record since AgFunder began collecting data back in 2013.

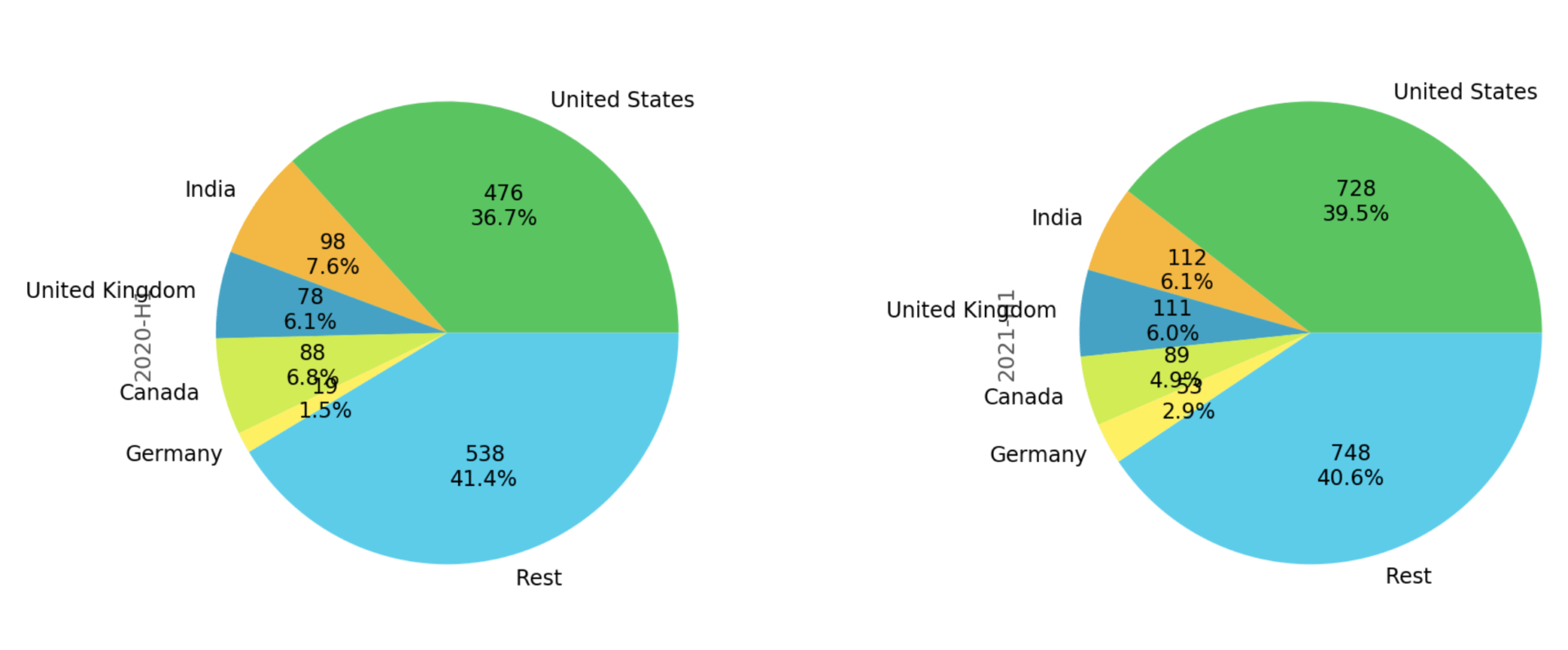

Moreover, looking at a different metric — deal count — we see that the US is the far-and-away leader with 728 investments made in H1; India is a distant second with 112 deals, while China’s count is so small it doesn’t even feature.

Share of total deals (#/%), H1 2020 v H1 2021

Outliers skew the data

What this points to is the role of large outlier funding rounds which boosted China’s share of global agrifoodtech funding dollars in the first half of the year.

In particular, three eGrocery platforms — Dingdong Maicai, Nice Tuan, and Furong Xingsheng — scored multiple investments adding up to billions of dollars between them (Xingsheng alone raised $2 billion from investors including Sequoia Capital China, Tencent, KKR, and Temasek.)

In India, it was Restaurant Marketplaces which were responsible for the outliers – namely, meal delivery archrivals Swiggy and Zomato, which closed rounds of $800 million and $250 million, respectively, during H1.