Editor’s note: Michael Campos is an associate at Prime Impact Fund in Cambridge, Massachusetts, US. This article reflects the views of the guest author and not necessarily those of AFN.

Over the last ten years, we’ve seen an unprecedented rush of venture capital into agtech. Drawing from AgFunder’s 2019 AgriFoodTech Investing Report, funding to agtech startups increased by 900% between 2013 to 2019, rising from $2.2 billion to $19.8 billion. A strong quarter used to mean a hundred investments got done; the first quarter of 2018 hit 600. And more companies are reaching maturity – while 57 companies raised Series C or later rounds in 2014, 256 did in 2019.

At Prime Impact Fund, we invest in companies with the potential to mitigate greenhouse gas (GHG) emissions at the gigaton scale, focusing on the pre-seed to Series A stages. We’ve come to the world of agtech as outsiders, and with the explicit goal of wringing out emissions that are unlikely to be addressed by today’s class of startups. When you view the world through climate wedges, agriculture stands out like a sore thumb, accounting for about 9 gigatons of carbon dioxide each year, or 26% of total global emissions. Policy levers are unlikely to directly reduce these emissions in the near term because agriculture has largely been exempted from carbon pricing. So it’s going to come down to technology. In developing our investment thesis for technologies in this field, we ask three questions:

- What emissions reductions are happening already?

- What emissions reductions aren’t yet happening?

- How do we unleash startups in neglected categories?

The answers might surprise you.

In software and biotech, there’s more happening than you might think

Agtech to date has been undersold from an emissions perspective. Like in other verticals, most VC dollars in agtech go to software and biotech companies, and this sense of business-as-usual is leading to substantial emissions reductions already.

Plant-based meats offer 90% emissions reductions and are increasingly becoming mainstream, with Impossible Foods and Beyond Meat leading the way. If they reach 10% market share, they would reduce GHGs by about 500 million metric tons of carbon dioxide each year. Cultured meat could have an even larger impact.

Precision fertilizer application based on drone imagery and advanced analytics saves both money and emissions associated with nitrogen fertilizers. Using these tools to increase fertilizer uptake by crops from 42% to 68% could save north of 300 million metric tons of carbon dioxide per year, according to default estimates using Prime’s CRANE tool for projecting the future emissions-reduction potential of new technologies.

Emerging leaders in this category include Farmer’s Edge, CropX, and Ceres Imaging. Microbial fertilizers are the other side of the coin, fixing nitrogen from the air so that plants need less fertilizer. Cost savings and emissions reductions are aligned here as well; Indigo Ag and Pivot Bio have made headway.

Outside of software and biotech, there’s less happening than you might think

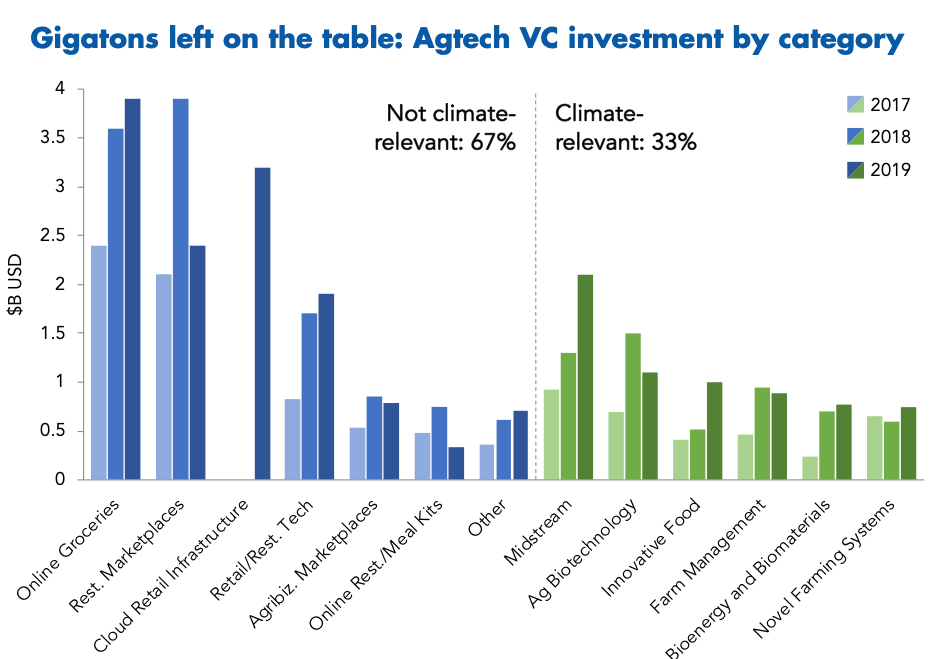

If the good news is that business-as-usual is making a difference, the bad news is that it’s missing much larger opportunities. Only about one-third of venture capital going into agtech is invested in categories with any significant GHG implications. A smaller fraction goes to explicitly GHG-reducing companies. Moreover, generalist VCs may be moving away from the category: 2019 was the first year since 2013 that agtech VC investment declined.

So what are we missing? A few technologies at front of mind for us include soil carbon sequestration, biomass burial as biochar, algae aquaculture, and zero-carbon fertilizer production. Again, through default analysis in CRANE, any of these could reduce emissions by more than 500 million metric tons of carbon dioxide per year, and in the highest case – biochar — nearly 5 gigatons per year.

These are just a few ideas we’ve come across opportunistically – there are no doubt many more. Unfortunately, they all have one thing in common: barriers to traditional VC funding. In hardware-heavy cases like biochar production, it’s difficult to demonstrate meaningful proof points without expensive industrial equipment deployed at scale. In cases like renewable fertilizer, changes to farmer buying habits and workflows are needed to gain wide acceptance. In total paradigm shifts, like ocean farming, you get the worst of both worlds in the near-term.

The ‘Tesla of agtech’ lies ahead

Where does all this leave us? In the near term, it’s safe to say that agtech and climate tech funds will pave the way. For our part, we recently made our first agtech investment into Clean Crop Technologies, a midstream company protecting crops to reduce food waste. But what changes on the horizon could unleash the potential of agtech in climate change mitigation?

Let’s start with the elephant in the room: The rewiring of global ag supply chains. Covid-19 has exposed deep flaws in today’s globalized food system and sparked renewed interest in local, sustainable production. However, in the short term, we’re seeing signs of further consolidation and globalization. This will not last. In the medium term, look out for national trade policies and consumer choice to oxygenate the market.

As regions recover from Covid-induced shortages, some governments will double down on supporting domestic producers. On top of this, increasingly cheap distributed renewable energy could unlock new agricultural lands. This combination will give regional companies the economic cover and the infrastructure necessary to gain a foothold in a fiercely competitive industry.

Consumer preferences could also play a surprisingly large role. Upscale food and ag products, long considered niche, actually represent a $100 billion market doubling every 10 years. For startups, this means that “’niche’ markets will become increasingly credible stepping stones to commodity markets. The Tesla of agtech still lies ahead, but the secret master plan – -entering at the high end and driving down costs on the road mass adoption — is right under our noses.

We’re believers that there’s no comprehensive solution to climate change without major changes to the agricultural system. There will be multiple unicorn-level outcomes as companies begin reshaping the $7 trillion food industry while removing gigatons of carbon from the atmosphere. For those startups and investors fortunate enough to remain standing now, the ag industry just got a lot riper for disruption.