Data Snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

The Asia-Pacific region agrifoodtech investments saw grew tremendously in 2021, surpassing $15 billion according to AgFunder’s Asia-Pacific AgriFoodTech Investment Report 2022.

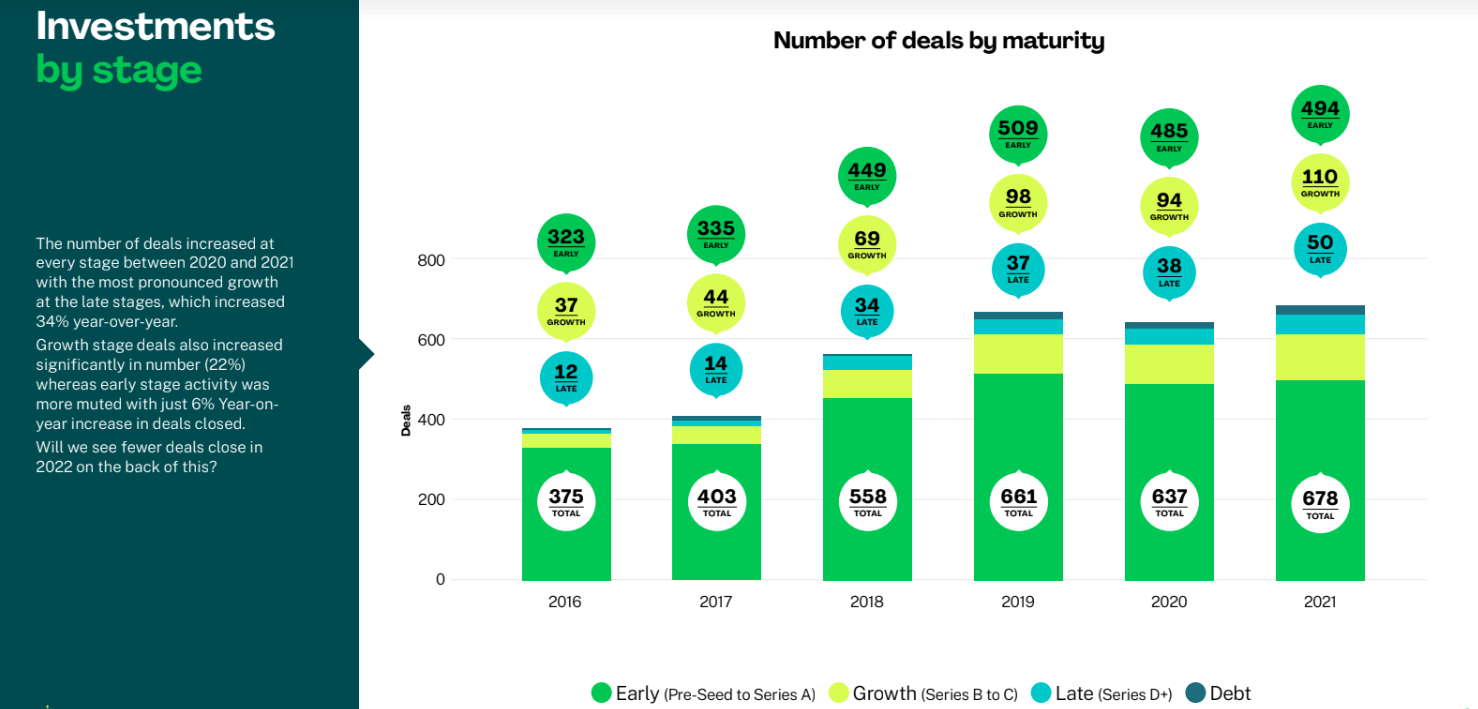

The number of deals across all stages increased for a total of 363 overall. Asia-Pacific agrifoodtech is similar to Africa in that early-stage funding dominates deals.

However, late-stage Asia-Pacific deals significantly grew in number by more 30% in 2021, compared to the early and growth stages.

While growth-stage deals did increase (22%), early stage activity was more muted with just a 6% year-on-year increase in deals closed. The median size of deals also went up, a factor which also caused an increase in overall investments in 2021 for the region.

Asia-Pacific late-stage deals by the numbers

The number of late-stage deals in 2021 increased 42% to $65 million, up from $45.7 million in 2020. Early-stage deals, on the other hand, barely saw an increase: $1.59 million in 2021 compared to $1.4 million in 2020.

In 2022, late stage is losing some of its dominance. For the first time in three years, the median size of late-stage deals has dropped — to $56.2 million in H1 2022.

This is likely due to a slump in agrifoodtech investment in China, whose companies were leading in all funding stages except seed. Investments in the country had shot up due to eGrocery investments. The category is now struggling to stay afloat.

Take Series D 2021 investments, for instance:

Chinese eGrocery app Dingdong Maicai secured $70o million from Chinese boutique investment bank Cygnus Equity. The following month, it raised another $330 million in Series D funding, this time led by SoftBank‘s Vision Fund.

Grocery app Xingsheng Youxuan, raised $2 billion in a round led by led by Sequoia Capital China.

Nice Tuan landed $750 million in a round co-led by tech giant Alibaba and internet investment firm DST Global. Nice Tuan has since cut down its operations in some of its poorly performing regions and laid off around 80% of its staff.