- The lack of fermentation facilities to meet demand is creating a significant backlog of innovations, according to a new report released today by Synonym Bio.

- The first-of-its-kind report—The State of Global Fermentation Capacity—documents available global microbial fermentation capacity based on data from Capacitor bio, a free online database developed by Synonym Bio with Blue Horizon, the Good Food Institute, and the Material Innovation Initiative.

- The database—a ‘Yelp for biomanufacturing’—documents 150+ facilities in 30+ countries with available bench-scale, pilot-scale, and commercial-scale fermentation capacity for everything from enzymes to nutraceuticals.

- The report was released today as US stakeholders urged the Biden Administration for support to address a biomanufacturing ‘choke point.’

Billions of dollars have flowed to precision fermentation and biomass fermentation companies in recent years, says Synonym Bio, a startup helping firms develop and finance commercial-scale biomanufacturing facilities.

“But achieving commercial adoption requires a network of large-scale infrastructure, which as shown in the Capacitor data, does not yet exist,” reads the report.

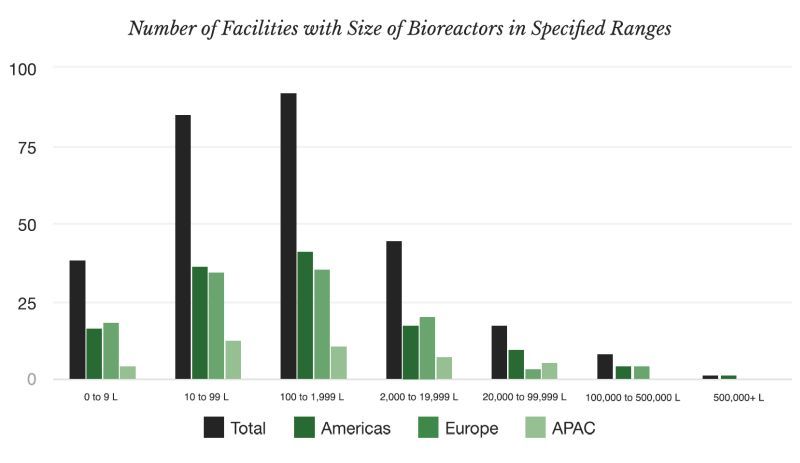

Most available facilities are bench scale (29%) or pilot scale (41%), with providers ranging from contract manufacturing organizations and academic research facilities; to well-known players such as Corbion and Phyton Biotech; to new players such as nth Bio and Motif Foodworks, According to the Capacitor data.

There are far fewer demo-scale (15%) and commercial-scale (16%) facilities: “The majority of users are looking for commercial-scale or demo-scale facilities that simply don’t exist to meet current, let alone future, demand,” it reads.

As for regional availability: “There is less capacity in APAC [vs Europe and the Americas] that has been uploaded but we expect this figure to grow as biomanufacturing becomes more mature and more CDMOs (contract development and manufacturing organizations) such as ADM’s ScaleUp Bio are established in the region.”

Data on Asian capacity is “harder to discern,” says Synonym Bio. “But we do know that China is making building biomanufacturing infrastructure a strategic priority.”

Capacitor users are seeking technical specifications that don’t match available capacity

Based on search filter data, many Capacitor users are also seeking technical specifications that don’t match available capacity, with many seeking reactors of over 20,000-liters, or looking for facilities offering anaerobic fermentation and spray drying, where available capacity is lacking, for example, says the report.

Alex Jaffe, product manager at Synonym Bio, told AFN: “When you start drilling down into some of the more specific sub-technologies in downstream processing — that’s where we don’t see as much alignment [between what users are searching for and what’s available].”

The top three products users filter for are proteins, enzymes, and recombinant proteins.

Conagen: ‘The lack of sufficient US manufacturing capacity is causing a backlog of promising innovations that cannot be commercialized’

The report was released shortly after the deadline passed for stakeholders to comment on steps the Biden Administration should take to “ensure we have the right research ecosystem, workforce, data, domestic biomanufacturing capacity… to support a strong bioeconomy” as part of its National Biotechnology and Biomanufacturing Initiative.

Industry stakeholders are putting pressure on the US government to take steps from offering government-backed, low-interest loans, tax rebates, non-dilutive investments, or direct subsidies to funding scholarships for synthetic biology and bioprocess engineering majors.

Conagen—a synthetic biology company producing high-value ingredients using precision fermentation—urged the government to fund four regional, publicly accessible pilot facilities allowing companies to test innovations and make products in compliance with regulatory requirements.

It added: “The government should also provide resources for constructing commercial-grade precision fermentation facilities to ease the manufacturing choke-point. Ensuring that these resources are efficiently used means such a program should favor sites that utilize old infrastructure, such as aging ethanol plants.

“It is likely that this infrastructure exists in communities where deindustrialization means revitalization opportunities exist through investment in new industries.”

The government could also “act as an off-taker to purchase bio-manufactured products, “sending a strong signal to investors that an infrastructure project will be durable and successful, increasing its bankability,” according to Synonym Bio.

Lawmakers could also add tweak the Internal Revenue Code to enable facilities to utilize tax-exempt private activity bonds to fund their construction, something that has been used in the biofuels and carbon capture space, claims Synonym.

“As has historically been the case for nascent industries, the federal government may need to help

catalyze and incentivize demand so markets can eventually become self-sustaining.” – Synonym Bio

“China is providing vast resources to firms in biomanufacturing”

While the US is currently the global leader in biomanufacturing and biotechnology, this lead cannot be taken for granted, added Conagen. “China is providing vast resources to firms in these industries through direct subsidies, acquisition of foreign companies in these industries, utilization and backing of state-owned entities, and technology transfer agreements.

“The lack of sufficient US manufacturing capacity is causing a backlog of promising innovations that cannot be commercialized.”

As AFN has recently highlighted in articles about Remilk and Superbrewed Food, however, investors are reluctant to provide the capital to fund large-scale microbial fermentation facilities for new products until they see some market validation, despite the clear mismatch between supply and demand.

Blue Horizon: “Pretty much everyone we run into is facing some difficulty in terms of scale-up”

Nate Crosser, principal at Blue Horizon—an investor in Synonym Bio, which has also backed a series of companies in the fermentation space including Geltor, Change Foods, and The EVERY Co—told AFN: “Having some successful hero companies is definitely going to increase the bankability of projects.”

In the meantime, he said, “Capacity is a major issue for the entire bioeconomy space.

“Pretty much everyone we run into is facing some difficulty in terms of scale-up. Some of that is inevitable. If you’re commercializing a novel bio product with no existing market, there’s a significant risk there that neither co-manufacturers nor bankers are necessarily comfortable financing,” said Crosser.

“We’ve definitely seen a little bit of pullback of really broad plans for companies to build their own large-scale production facilities, although some are still happening, so for example Change Foods is building a really big [precision fermentation] facility [for animal-free dairy proteins in Abu Dhabi]. But others are pulling back for the time being such as Remilk and Superbrewed Food, so it’s a mixed bag.”

“Regardless, co-manufacturers are going to be more important than ever,” added Crosser, who said the location of facilities is also mission-critical, both in terms of access to cheap or renewable energy sources, which can account for up to a third or cost of goods (or through using an adjacent facility’s heat or steam to power your operation), and feedstock availability.

Smart financing approaches

As fermentation facilities can easily cost tens to hundreds of millions of dollars, smart financing approaches will be vital, he said.

One approach developed by Synonym Bio draws inspiration from commercial real estate and data centers, wherein a specialized project developer and financier with pre-existing standardized designs and capital relationships develops and builds large-scale capacity for companies and then provides dedicated access to the facility through a long-term triple-net lease.

This structure mitigates risk for project investors by allowing investment into a portfolio of projects while minimizing the time, talent, and capital required for companies to construct their own facilities directly, he claimed.

Continuous production processes, more efficient material capture

But it’s not just about funding bioreactors, he said. Investors are also looking for companies that can increase production efficiency, whether it’s through continuous production processes (eg. Pow Bio) or higher downstream recovery rates. Having high titers is not much use if you’re not capturing all of the precious product at the end, or it costs a fortune to get it, for example.

Startups looking to scale up their process can also benefit from partnering with someone who has done it before, he said, highlighting deals between ADM and animal-free dairy precision fermentation co New Culture; Cargill and biomass fermentation co Enough; and AB InBev and animal-free egg protein co The EVERY Co.