Data Snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

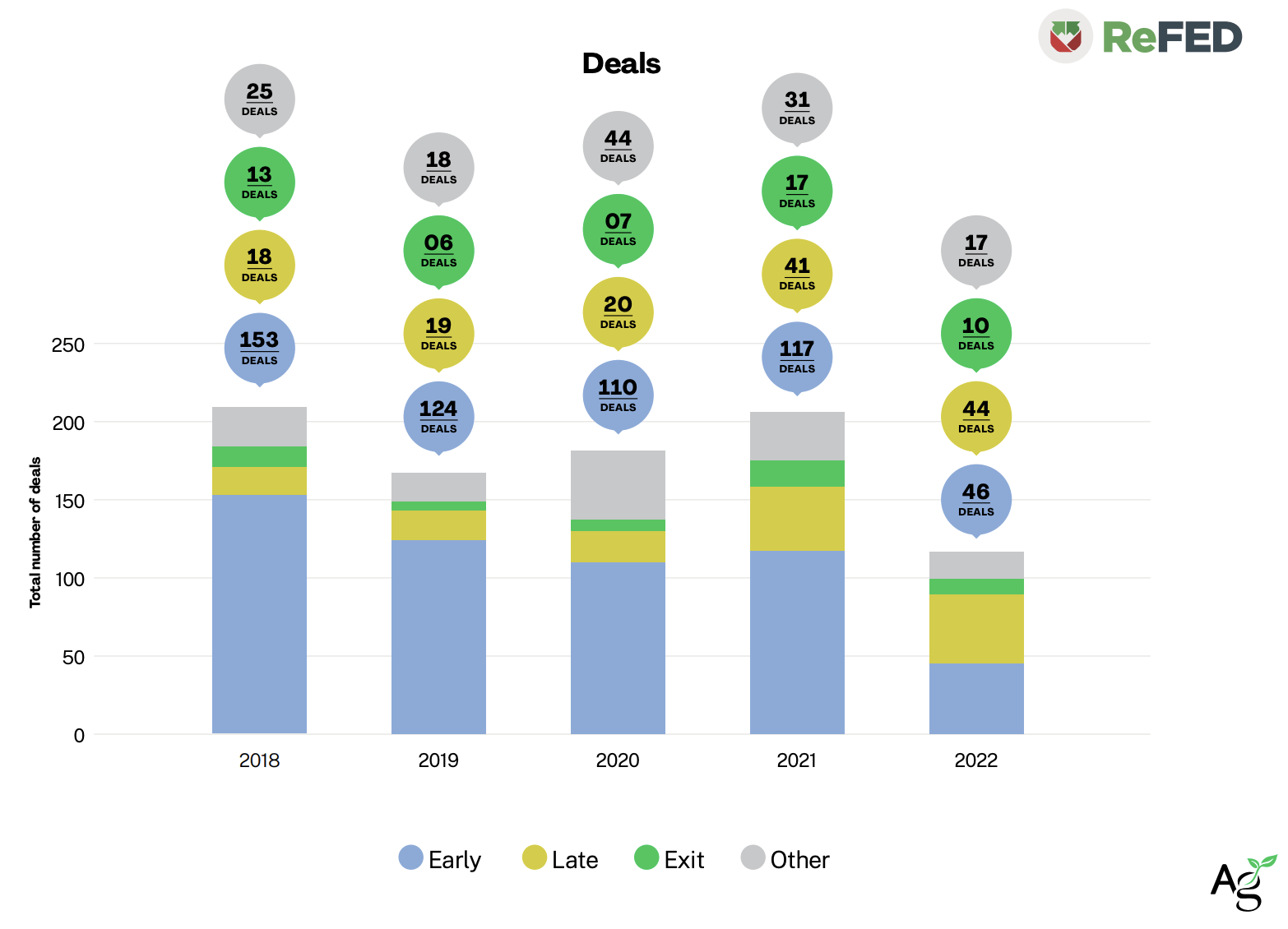

Later-stage deals for food waste mitigation startups in the US remained robust in 2022, despite the general cooldown across agrifoodtech investment. Within the food waste category, the late stage was the only stage to grow by number of deals, according to AgFunder’s Global Agrifoodtech Investment Report 2023 with analysis from ReFED.

Larger platforms are starting to acquire smaller solution providers, too, which is a positive sign for the entire food waste sector.

Later-stage deals (Series B and above) increased to 44 deals in 2022 from 41 in 2021 and just 20 in 2020. This is a sign that companies are starting to scale as businesses recognize the impact food waste mitigation can have on sustainability and ESG goals, not to mention return on investment.

Top later-stage deals for food waste startups

US-based startup Afresh raised one of the top deals in 2022 with its $115 million Series B led by Spark Capital. Afresh’s inventory management system is geared towards food retailers’ efforts to reduce in-store waste.

Mori, which makes a shelf-life extension coating for food, raked in a notable $52 million Series B1 raise.

Other notable rounds include those for supply chain insights platform Crisp and RipeLocker, another shelf-life extension startup.

M&A activity in 2022

Larger platforms are starting to acquire smaller solution providers, which is a positive sign for current and future funders, as there are now more examples of exits in the space. Certain business models benefit from scale, leading operators to consolidate.

Last year, BlackRock Real Assets acquired organics-to-renewable energy company Vanguard Renewables for $700 million, making it the largest M&A deal for food waste.

Elsewhere, private equity firm Paine Schwartz scooped up AgroFresh, which offers both pre- and post-harvest food waste solutions, for $158 million.

Another notable exit of last year was Misfits Market‘s acquisition of its chief competitor, Imperfect Foods. Both companies sell so-called “ugly” produce at discounted prices online in addition to some regular grocery items. The terms of that deal were not disclosed.