- Online ugly produce retailer Misfits Market has agreed to acquire its chief competitor, Imperfect Foods. Both companies are based in the US and primarily serve the Lower 48 states.

- The financial terms of the deal were not disclosed but it was structured as an all-stock transaction whereby Imperfect Foods shareholders would receive stock in Misfit Markets, as opposed to cash for the acquisition.

- The deal gives Misfits access to Imperfect’s large delivery fleet and is expected to help the companies increase scale.

- Misfits CEO Abhi Ramesh told Bloomberg that an IPO is the ‘most likely’ path for the combined companies.

Why it matters:

At last check, Misfits was valued at $2 billion and Imperfect at $700 million.

Misfits Market told Forbes that the combined entity should reach nearly $1 billion in revenue later this year and double the scale of Misfit Market’s business. The CEO told Bloomberg that this would give it a valuation of more than the sum of the two combined businesses.

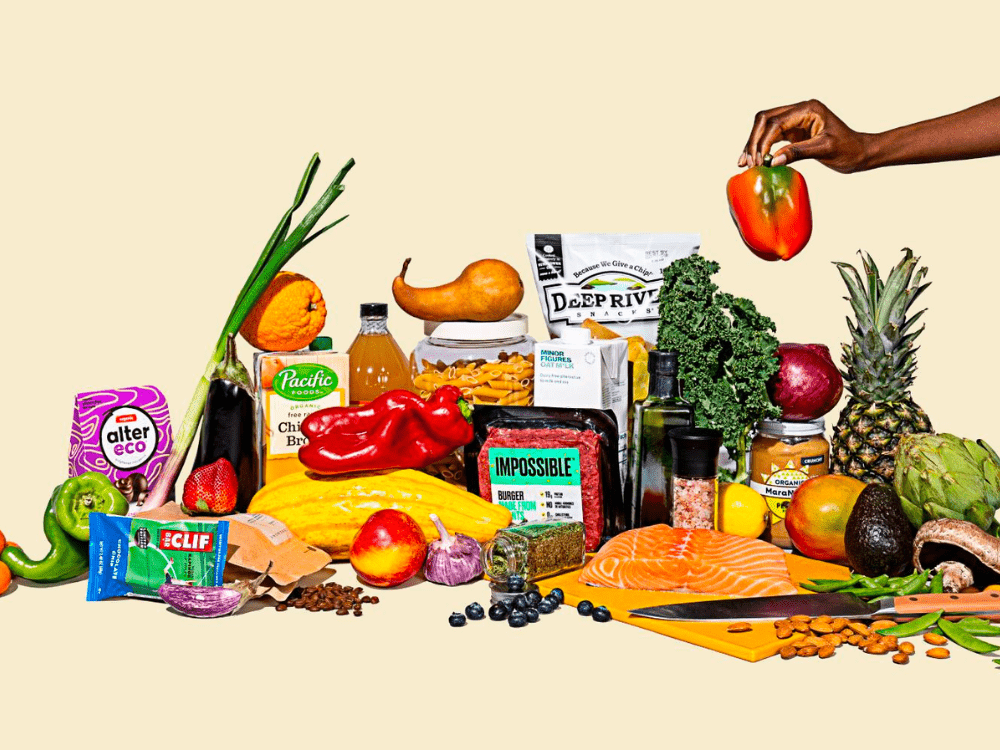

Both companies have built a business on rescuing surplus and ‘ugly’ foods that would otherwise end up in landfills, selling these items at discounted prices to consumers, in addition to other grocery products. The stated goal is to reduce food waste in the US while simultaneously offering shoppers lower prices on their groceries. Misfits Market, for example, says it offers items for ‘up to 40% off traditional grocery store prices.’

Imperfect Foods’ CEO Dan Park said in a statement that the two companies have collectively rescued nearly half a million pounds of food in the US that would have otherwise gone to waste. ‘The combined experience and expertise of this newly-merged team will exponentially increase our ability to take on established players in the traditional grocery space,’ he added.

With the acquisition, Misfits gets access to Imperfect’s delivery network, its private-label brand, as well as its foothold in more urban parts of the US. Customers of both services can also expect even lower prices — a timely benefit, considering the inflationary state of the country right now.

Ramesh noted to Bloomberg that thanks to the deal, Misfits ‘might not need to raise money again,’ and that an IPO ‘is the more likely path’ for the company.

In the short term, the two companies will continue to operate separately, though Ramesh will serve as CEO of both. Executives from Imperfect will join the Misfits leadership team.