Data Snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

It’s no secret that the world’s food supply chains are fragmented but few more so than those on the African continent.

It comes as no surprise, therefore, that entrepreneurs in the agrifood sector are focusing on making improvements in what’s frequently dubbed the “messy middle.”

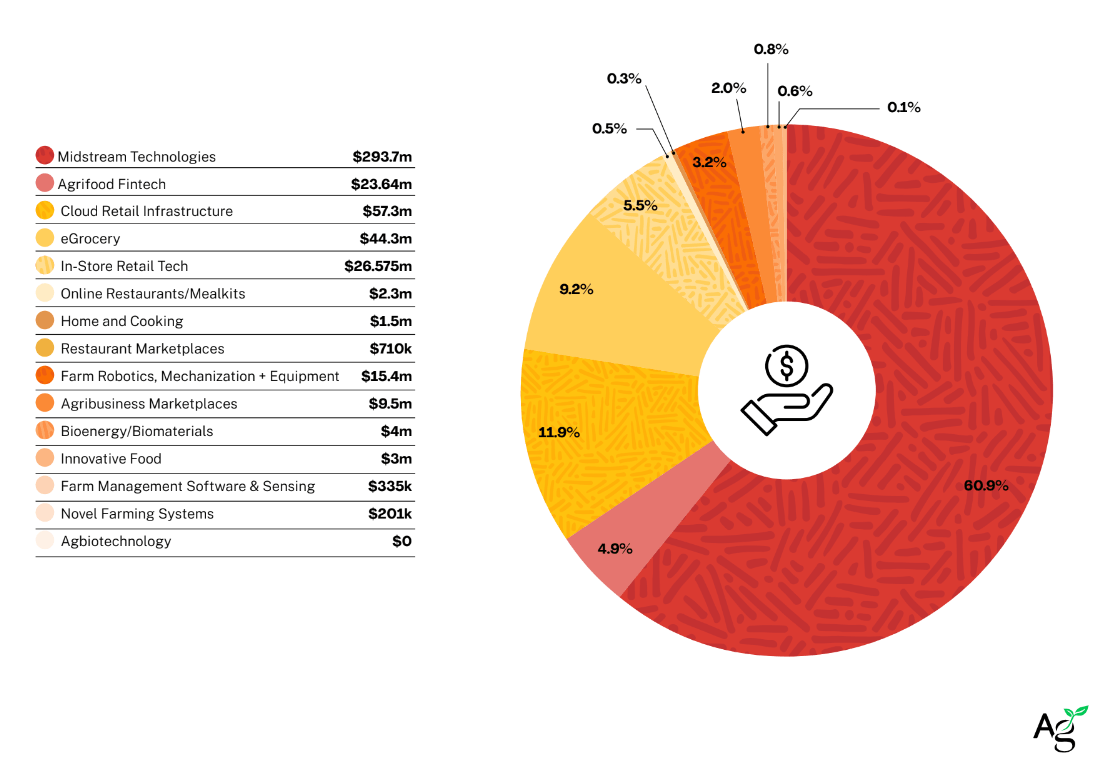

In 2021, over 60% of venture capital funding for agrifoodtech went to Midstream Technologies, totaling $293.7 million, according to the recent 2022 AgFunder AgriFoodtech Investment Report.

AgFunder defines Midstream Technologies as startups connecting farmers and food producers to retailers, agro-processors and other clients. These are startups that solve inefficiencies in the ‘middle of the agricultural value chain’ and are providing solutions in food procurement, logistics, food traceability and overall specialize in supply chain digitization.

Most agrifood entrepreneurs focused on the midstream have revealed that a lack of direct access to markets often leaves farmers dealing with middlemen who provide linkages but often shortchange them. They also have a lack of adequate financing which affects the quality of inputs — such as seeds and pesticides — they can access and use on their farms, negatively impacting their yields. On the other hand, retailers and food processors grapple with inefficient procurement channels, translating to inconsistencies in the quality and quantity of produce that they receive.

Recent global events like the Covid-19 pandemic and the Russia-Ukraine war, which have further disrupted food supply chains, have also had a hand in turning investor attention to Midstream Technologies, which has been a buoyant category on the global stage too.

Top deals in midstream technologies

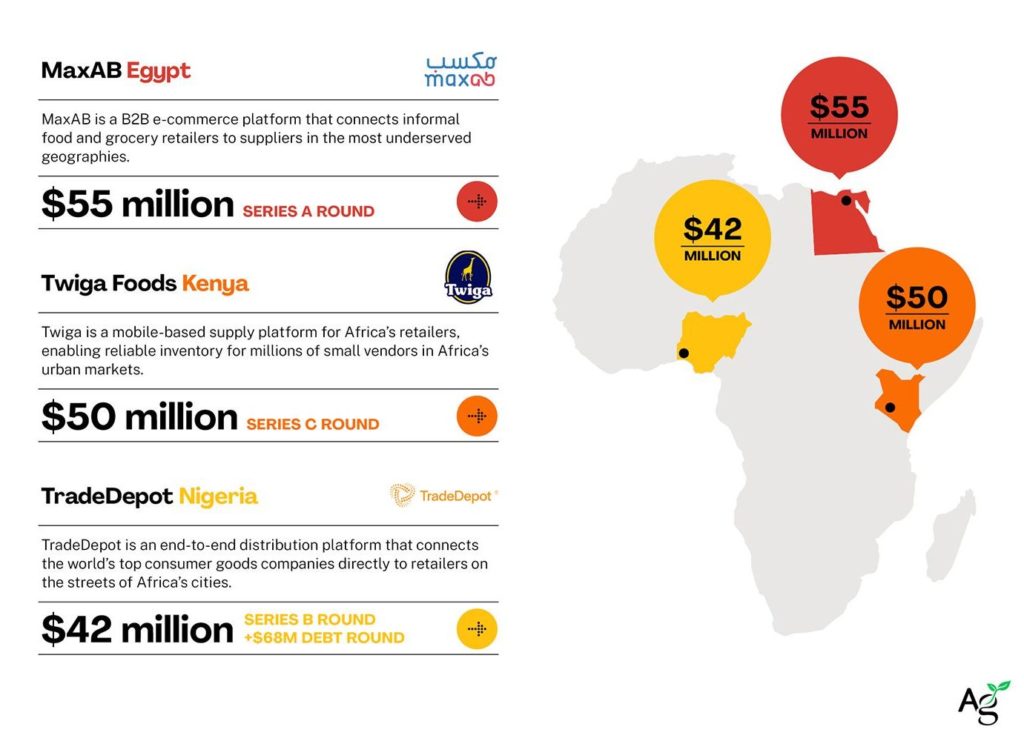

MaxAB

Egypt’s MaxAB helped push Egypt to one of the top-funded countries in 2021. It is a B2B e-commerce platform connecting traditional food retailers to suppliers by providing end-to-end supply chain services, onboarding data analytics and fintech to its services portfolio.

Founded in 2018, it closed an extended Series A at $55 million in September 2021 after a first close of $40 million the month prior. Investors backing the round included global development finance institution the International Finance Corporation (IFC) and Rise Capital, the San Francisco-headquartered firm founded by long-time emerging markets investor Nazar Yasin. Yasin formerly worked at major multi-billion dollar fund manager Tiger Global, as well as leading investment bank Goldman Sachs and he was also the former CEO of Latvian social networks provider Forticom. The Catalyst fund of the entrepreneurial community Endeavour also invested alongside a mixture of other EM funds and impact investors.

The financing came with MaxAB’s acquisition of the Moroccan YC-backed WaystoCap, a step further towards dominating the North African e-commerce scene.

Twiga Foods & Trade Depot

Twiga Foods, a Kenyan B2B marketplace that supplies urban retailers with produce sourced directly from farmers, secured $50 million in a Series C round in 2021 led by Creadev.

This year, the 2013-founded Twiga announced that it would be venturing into producing domestic horticultural food items. With this, Twiga committed $10 million to the launch of this new commercial farming subsidiary.

Another startup in midstream technologies to score big was Nigeria’s TradeDepot which secured $42 million in a Series B round. At the same time, TradeDepot also secured $68 million debt round led by Arcadia Funds.

The Series B round was led by the International Finance Corporation (IFC) with participation from Novastar Ventures, Sahel Capital, British International Investment (formerly CDC Group), Endeavor Catalyst along with existing investors, Partech and MSA Capital.

TradeDepot operates as a B2B e-commerce platform that connects retailers to food, beverage and personal care brands. It offers a microloan service for retailers along with a ‘buy-now-pay-later’ financing option.

Even in 2022, the Midstream Technologies category has already seen venture capital coming thick and fast with like Vendease, Nile, Thrive Agric, Wasoko, Marketforce and ProXalys raising new rounds, just to name a few.