Singaporean agrifoodtech startups may have secured the most funding overall last year, as highlighted by AgFunder’s recently released ASEAN Agrifoodtech Investment Report. But take one large outlier in the city-state — retail tech provider Trax’s $100 million Series D round — out of the equation, and Indonesian agrifoodtech startups raised more, with $165 million invested across 26 deals.

Despite its position as Southeast Asia’s largest economy, Indonesia is also among the bloc’s less wealthy members. Millions of its people are employed, often informally, in low-income smallholder farming and micro-merchant retail. Bringing greater efficiency to this agrifood value chain is the focus for several of the top-funded agrifoodtech startups in the country last year.

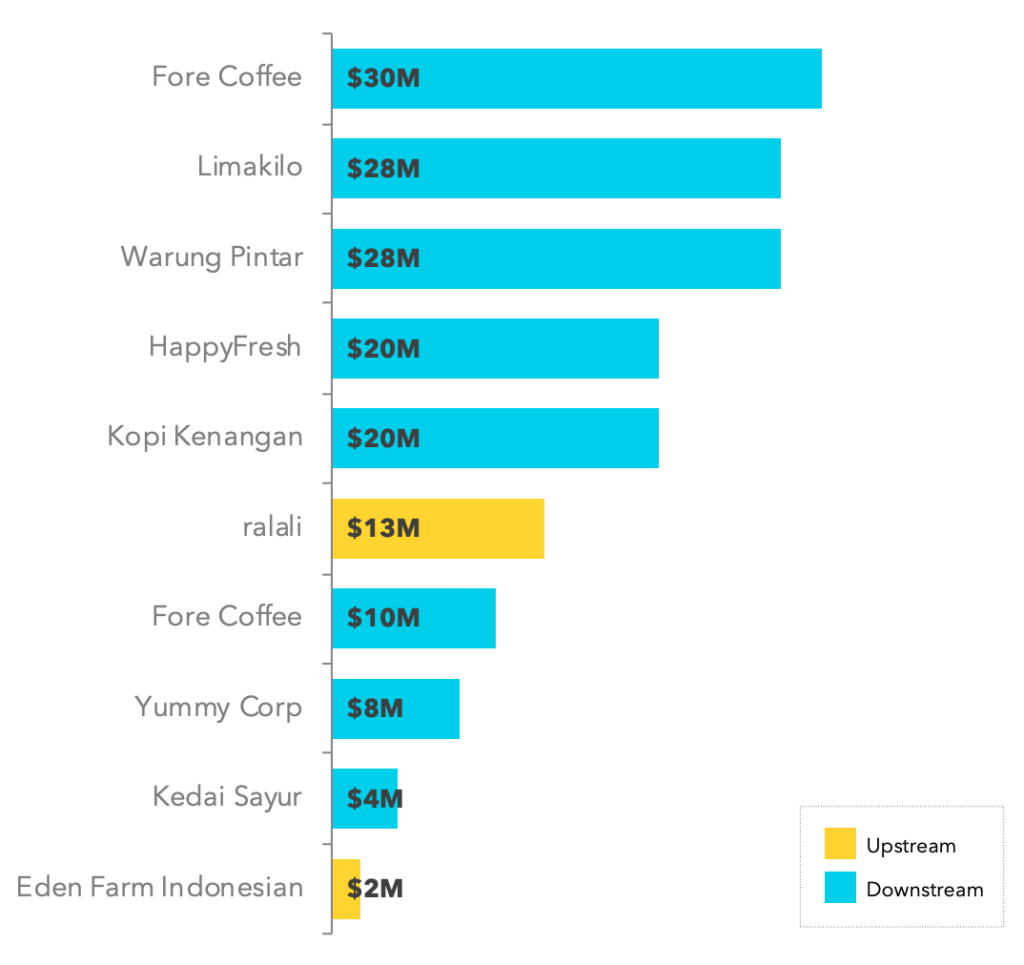

Warung Pintar – which means ‘smart kiosk’ in Indonesian – got funding for its prefabricated, tech-enabled roadside stall, designed to help the archipelago’s ‘mom and pop’ stores benefit from fintech and other innovations.

Kedai Sayur, Ralali, and Limakilo (which was later acquired by Warung Pintar) are all online marketplaces connecting farmers and other suppliers to merchants, or directly to consumers.

By contrast, Indonesia also plays host to a young, growing urban middle class with an increasing amount of disposable income in its pockets. Many of those consumers want to spend that money on products and technologies that offer enhanced convenience, or the satisfaction of a ‘premium’ brand.

This is reflected in the emergence of ‘new retail’ concept coffee chains in Indonesia such as Fore Coffee and Kopi Kenangan. Taking their cue from a model first seen in China with brands such as ill-fated Luckin Coffee, these ‘digital first’ coffee joints offer a hybrid online-offline experience, allowing users to sign up as members and order via a mobile app.

East Ventures was the second most active agrifoodtech investor in ASEAN last year according to AgFunder data, participating in seven deals (US-based 500 Startups closed 10 deals in the region.) AgFunder recently spoke to Melisa Irene, partner at the Jakarta-based VC firm, to find out how the Indonesian agrifoodtech scene grew in 2019.

The interview with her is included in the full version of the report — which you can download here — and is reproduced below for AFN readers.

AgFunder: How would you characterize the Indonesian agrifoodtech ecosystem in 2020?

Irene: Its vitality has been made clearer during the Covid-19 period. Food is the sector that is not allowed to fail, because everyone has to eat to survive. Agrifoodtech sectors received a positive impact during Covid-19 and pushed teams to innovate.

This was seen all across our group’s investments in this space, such as Warung Pintar, Kedai Sayur, SayurBox, Aruna, and Greenly.

The ‘farm to fork’ model has experienced accelerated adoption and it will be a door opener for more tech innovation that promotes food, agriculture, and the sustainability of farmers’ livelihoods.

What are the main challenges and opportunities for agrifoodtech startups in Indonesia?

Infrastructure, crop cultivation, and logistics and distribution are the major challenges for Indonesia’s agrifood sectors.

The nature of our food production capabilities is that different parts of Indonesia will produce different types of crops depending on local conditions. These need to be distributed domestically in an efficient way, which is a challenge given that Indonesia is a large archipelago. It is also the same case for fisheries.

On the farming side, Indonesia’s farmers are mostly smallholders. This poses both a challenge and an opportunity in terms of yield consistency. Crops also take time to harvest; thus, working capital becomes another area for innovation.

Which deal in 2019 really stood out for you, and why?

Aruna raised seed funding from East Ventures and SMDV in October 2019: It opens another perspective on agrifoodtech, through the introduction of ‘shared economy’ principles to aquaculture and its fair-trading platform for fishermen and buyers.

Got a news tip? Email me at [email protected]