Data Snapshot is a regular AgFunderNews feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Agrifoodtech investment in Latin America varies greatly from one country to the next, with some spanning the entire supply chain and others more narrowly focused on just a couple categories.

Overall, the region’s agrifoodtech startups raised $1.7 billion in 2022. While this accounts for just 5% of global agrifoodtech investment, the numbers are creeping up, according to AgFunder‘s inaugural Latin America AgriFoodTech Investment report produced in partnership with SP Ventures, Alianza Team, BASF and Cibersons.

As more capital flows to the region’s startups — the vast majority of which are still at early and growth stages — we may start to see greater variety across countries as more startups tackle various points of the supply chain.

Brazil accounts for half of all marketshare

Brazil is still far and away the largest market for agrifoodtech in Latin America, with its startups commanding about half the region’s marketshare.

The country is home to a diverse set of startups that run the gamut when it comes to the supply chain. Illustrating that, many of 2022’s top agrifoodtech deals in Latin America went to Brazilian startups, from agrifintech platform Agrolend to eGrocery services Evino and Trela and climate tech startup Re.green.

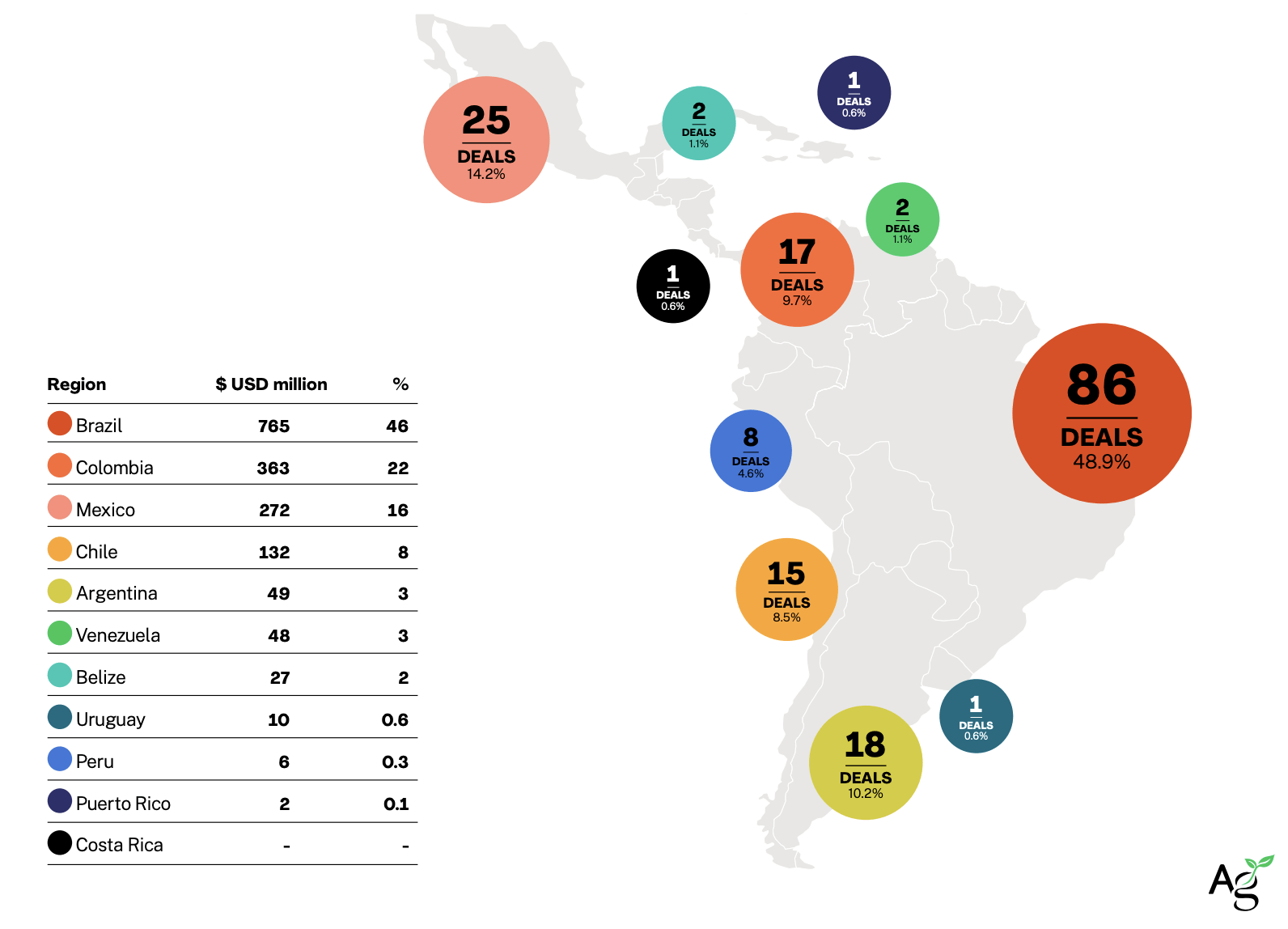

Overall, Brazilian startups raised $785 million across 86 deals.

Colombia still a downstream market, Mexico branching out

Colombia’s agrifoodtech investment focus remains less diverse than Brazil for the moment. Most of the $363 million startups in the country raised went to eGrocery services and Cloud Retail Infrastructure (aka food delivery). Colombia is especially strong in the latter category. Rappi is the region’s leading food delivery app and raised $100 million in 2022.

Mexico is also strong in downstream categories such as eGrocery and Cloud Retail — as evidenced by Jüsto‘s $152 million round last year. [Disclosure: AgFunderNews’ parent company AgFunder is an investor in Jüsto.]

However, Mexico, which closed 25 deals last year, is also beginning to branch out in terms of agrifoodtech innovation and investment, particularly where bio-energy is concerned. As overall agrifoodtech investment swims back upstream, we may see more deals from Mexico for companies closer to the farm or lab.

Ones to watch

Argentina is known for exporting its founders to other parts of the world and rapidly expanding its companies beyond the country’s borders so some Argentina-founded companies may not appear in the dataset as a result. Chile is probably best known in agrifoodtech investment as being the home of alt-protein startup NotCo, which has expanded beyond its own borders in recent years to other Latin American countries and the US. Chile is also one of the strongest markets in Latin America for biotech, with some interesting companies such as seed treatment provider Andes.

And finally, smaller but up-and-coming markets in Latin America include Venezuela and Belize: Yummy’s $47 million round and Dimitra’s $26.5 million, respectively – brought those markets into the top 10 in 2022.