US retail sales of oat milk, which have been driving most of the growth in plant-based milk in the past couple of years, started to show year-over-year declines in the latest quarter, according to new data from SPINS shared with AgFunderNews.

While market leader almond milk has experienced declines in unit sales due to inflation, oat milk has been on an explosive growth trajectory. Barely registering in the US plant-based milk category a few years ago, oat milk now occupies the #2 spot in the retail market ahead of soy, which at its peak generated $1 billion+ in annual retail sales, but has since declined to just $203 million.

However, new point-of-sale data from SPINS shows that in the refrigerated set, which accounts for the bulk of category sales, dollar sales of oat milk fell -4.6% year-over-year to $135.4 million in the 12 weeks to July 16, while units fell -5.3%. In the smaller shelf-stable set, dollar sales of oat milk were also down, falling -3.8% to $15.1 million, while units fell -3.9%.

The only major subsegment delivering growth in units sales over the 12-week period was shelf-stable coconut milk (+28.9%).

For context, unit sales of dairy milk—which have been on a declining trajectory for years despite a brief blip during the pandemic—fell -2.5% in the 12-week period and drooped -2.3% in the trailing 12 months.

Califia Farms CEO: ‘We have seen unit softness in the plant-based milk category that began with price increases taken as a result of inflation’

Dave Ritterbush, CEO at plant-based dairy co Califia Farms, told AgFunderNews: “We have seen unit softness in the category that began with price increases taken as a result of inflation. The pricing increases began around the beginning of 2022, with a second round of price increases in late 2022. As we begin to lap the price increases you are seeing some level of dollar sales softness as unit consumption has not fully returned.”

But he added: “All of our research would suggest that this condition is temporary as the new category pricing is fully absorbed by consumers. We still see that plant-based milks have a strong consumer appeal given both the strong health benefits and taste. Additionally, they continue to increase in share as a total percentage of the dairy category.”

AgFunderNews has reached out to Danone (Silk) and HP Hood (Planet Oat) for comment.

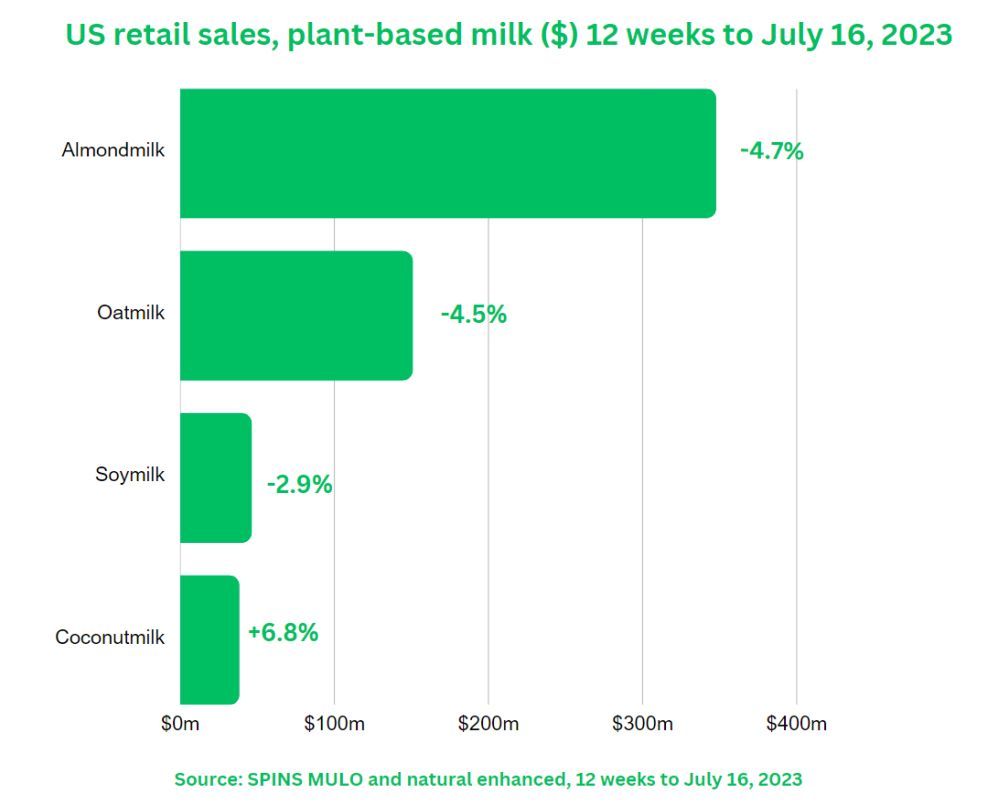

US retail sales, 12 weeks to July 16, 2023 (% year-over-year growth/decline):

- Dairy milk: Dollar sales -3.6% to $3.248 billion, unit sales -2.5%

- Plant-based milk: Dollar sales -3.9% to $643.9 million, unit sales -4.5%

- Refrigerated: Dollar sales -4.6% to $568.3 million, unit sales -5.8%

- Shelf-stable: Dollar sales +1.8% to $75.6 million, unit sales +4.4%

- #1 – Almond milk: -4.7% to $347.5 million

- #2 – Oat milk: –4.5% to $150.5 million

- #3 – Soy milk: -2.9% to $46 million

- #4 – Coconut milk: +6.8% to $38.3 million

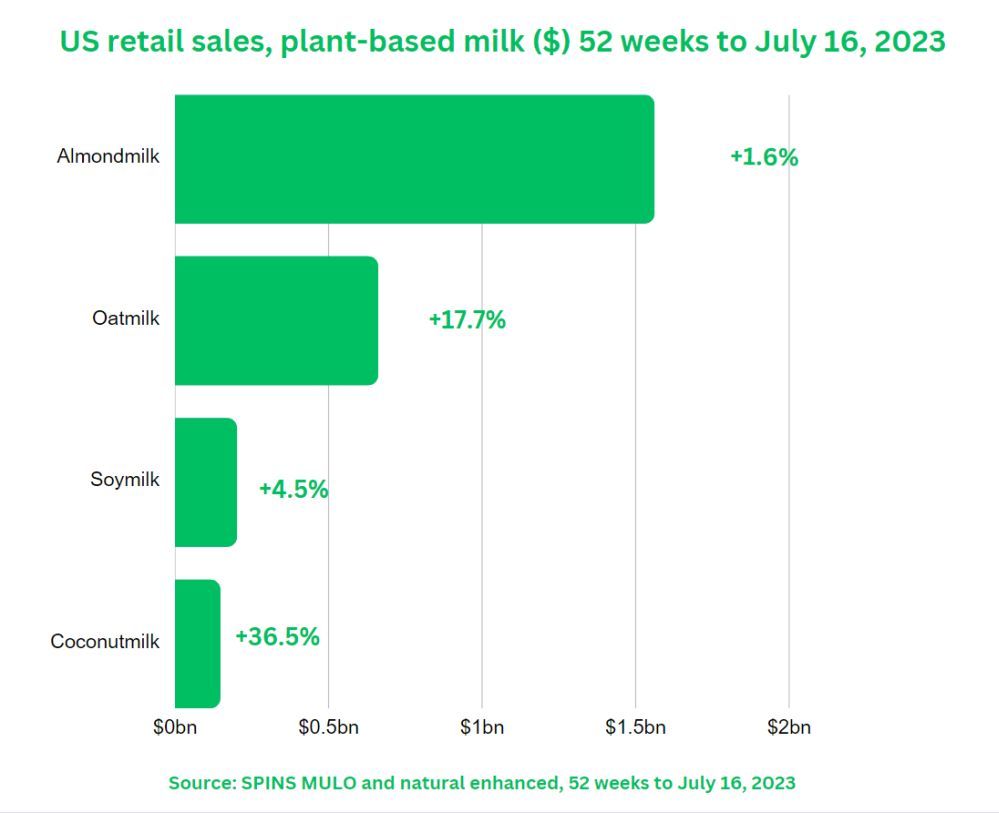

US retail sales, 52 weeks to July 16, 2023 (% year-over-year growth/decline):

- Dairy milk: Dollar sales +4.6% to $14.74 billion, unit sales -2.3%

- Plant-based milk: Dollar sales +7% to $2.84 billion, unit sales -5.4%

- Refrigerated: Dollar sales +6.4% to $2.5 billion, unit sales -6.7%

- Shelf-stable: Dollar sales +12.3% to $320 million, unit sales +3.5%

- #1 – Almond milk: +1.6% to $1.56 billion

- #2 – Oat milk: +17.7% to $660.5 million

- #3 – Soy milk: +4.5% to $202.7 million

- #4 – Coconut milk: +36.5% to $146.5 million

Source: The US retail figures above combine SPINS multi-outlet (MULO) channel data powered by Circana covering food, drug and mass stores; and SPINS natural enhanced channel data, which includes co-ops, associations, independents, and large regional chains, but excludes some key players such as Whole Foods & Trader Joe’s. They do not cover convenience stores or foodservice sales, which are becoming increasingly important for plant-based milk.

Source: The US retail figures above combine SPINS multi-outlet (MULO) channel data powered by Circana covering food, drug and mass stores; and SPINS natural enhanced channel data, which includes co-ops, associations, independents, and large regional chains, but excludes some key players such as Whole Foods & Trader Joe’s. They do not cover convenience stores or foodservice sales, which are becoming increasingly important for plant-based milk.

Further reading:

NotCo exits refrigerated plant-based milk segment in US, switches focus to shelf-stable