With Beyond Meat mulling a restructure of its operations in China due to lackluster demand, what is the market opportunity in China for meat and dairy alternatives?

When it comes to plant-based meat, Matilda Ho, managing director at Chinese VC firm Bits x Bites, pulled few punches during a panel debate in Singapore last week to launch AgFunder’s Asia Pacific agrifoodtech investment report: “In 2019 around the time of the Beyond Meat IPO there was so much FOMO (fear of missing out) that alternative protein companies didn’t even need to send samples and they got money in the bank,” she observed.

“And so a lot of very mediocre products got a lot of funding and several startups [in this space] have exited China since 2022. Beyond Meat only has one full time employee right now in China basically working as a sales rep selling to five-star hotels for overseas travelers [Beyond Meat, which opened a factory near Shanghai in spring 2021, has not responded to requests for comment on product availability or staffing in China].”

She added: “The biggest enemy has always been tofu, which China invented more than 2,000 years ago, and it’s very cheap, very tasty, is soy-based and clean-label. The only problem is the [short] shelf-life. To really solve the protein security challenge, we need a better tofu, not a cheaper [plant-based or cultivated] hamburger patty.

“However, dairy alternatives are growing quite rapidly. Not because of sustainability, but more due to diversity [of options]. Chinese people grew up having a soy grinder at home and making our own soy milk so it’s very familiar. So now it’s just about creating a lot of diverse products from coconut milk to all the different plant-based milks to really give consumers additional options.

“When it comes to density of coffee shops per capita, Shanghai is the number one in the world, so that really creates a lot of opportunities for all the different plant-based milks.”

Dao Foods International,* which has invested in multiple startups in the alt protein arena in China including leading domestic player Starfield, was equally enthusiastic about plant-based dairy, and more positive than Ho about plant-based meat, although cofounder Tao Zhang acknowledged the challenges facing startups in the space.

AgFunderNews caught up with him at the Asia-Pacific Agri-Foods Innovation Summit in Singapore last week:

We discussed:

- How would you characterize the market for plant-based meat in China right now? Which players are driving this market?

- What kind of infrastructure is there to support plant-based meat in China (extrusion, fermentation)?

- What messaging resonates with Chinese consumers for plant-based meat?

- What kinds of companies is Dao Foods investing in?

- How supportive is the Chinese government when it comes to alternative proteins?

- Are there many startups in cultivated meat in China and is there a clearly-defined regulatory pathway to enable these products to get to market?

- In the US, the media narrative around alt proteins has changed noticeably over the past 12 months as sales in alt meat have fallen back, Beyond Meat keeps losing money and it has become increasingly clear that cultivated meat is not going to make a dent in the mainstream meat industry any time soon. How are things looking in China?

- How challenging is it for Chinese startups in alt proteins to raise money right now? And what support do they need in addition to money?

According to Zhang:

The market: “The plant-based meat market for China as far as the next generation of products is concerned is still nascent. It still needs a lot of nurturing and ecosystem building work to take off.

“China has a long history with plant-based foods, which sounds like a good thing for alternative proteins, but it’s actually a challenge because the traditional mock-meat products have been considered not that healthful or tasty and they do not have very positive perceptions with mainstream consumers. We want to work with entrepreneurs that can overcome these negative consumer perceptions with convincing and appealing products.”

Consumer messaging: “Taste, price and convenience are still the top purchasing factors that drive mainstream consumers to purchase food products on a regular basis. But health and nutrition are also starting to play an increasingly dominant role in purchase decisions.

“As far as I can tell, mainstream Chinese consumers aren’t easily swayed by moral considerations for now, although that could change especially with the younger generation. So this requires people like us to not just do investment, but also to do ecosystem building work to raise consumer awareness of such novelty products, and also the benefits they could bring not just to consumers, but also to the planet.”

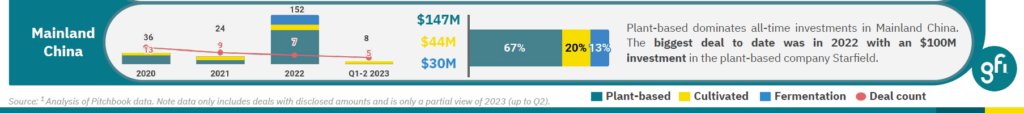

Infrastructure: “Starfield, the first plant-based meat company we invested in in China, has raised enough funding to build out its own factory so it is well-positioned. Some other less well financed plant-based meat companies still need to outsource the manufacturing part of what they do for now.

“But I would say China definitely has a competitive advantage as far as fermentation capacity is concerned. For some of the international companies in biomass or precision fermentation, my advice is, take advantage of what China can offer so you can lower costs, achieve price parity, and make products that are more interesting to mainstream consumers.”

Dao’s investment strategy: “We support and invest in all sorts of alternative protein companies in plant-based, fermentation, and cell-based. So our companies do plant-based yogurt, plant-based milk, plant-based snack food, and plant based meat and seafood. We are a patient capital provider, we are impact investors, so we usually get in at a very early stage, because we intend to play a catalytic role.”

Chinese government support: “The Chinese government on the macro level is quite supportive of new proteins actually. The Chinese president made some remarks last year, which sent a good signal to the whole industry.”

[In a speech to the Chinese People’s Political Consultative Conference last year, President Xi Jinping said: “It is necessary to expand from traditional crops and livestock and poultry resources to more abundant biological resources, develop biotechnology and bio-industry, and seek energy and protein from plants, animals, and micro-organisms.”]

“And as far as food security is concerned, a large part of this is protein security. So what we do is very much aligned with what the Chinese government cares about and is looking for from a strategic perspective.”

Cultivated meat in China: “There’s existing pathways for government approval of novelty products and ingredients. But as far as cell-based meat is concerned, I wouldn’t say there’s a very clearly defined pathway for approving and getting products to market. We published an article on the legal pathway for cultivated meat products in China on our website [cultivated meat is included in China’s agricultural five-year plan, as well as in the National Development and Reform Commission’s five-year plan].”

Investor attitudes: “As far as the investment community is concerned, there’s been some momentum for plant-based venture investments over the past two years. But I wouldn’t say that the mainstream investment community knows enough about plant-based or alternative proteins to make more informed decisions.

“But that could change and that’s why at Dao Foods we not only do investment work but also ecosystem building work by raising more awareness with consumers, but also with the mainstream investors and government stakeholders.”

Funding: “Entrepreneurs are facing an uphill battle in terms of fundraising because of the economic downturn. As with any nascent sector, entrepreneurs need to be mentally prepared for ups and downs, so aside from our funding we also help entrepreneurs refine their narrative [to attract investors], refine their business model and provide mentorship and customized incubation services so they will be better positioned to raise more funding when the time is right.”

Portfolio companies to watch: “I can give you three examples. The first investment we did in China is in Starfield, probably China’s fastest-growing and also best-financed next generation plant-based meat company. They have entered close to 60,000 restaurants and retail outlets, so you can find them in chains such as 7-Eleven, KFC, Sam’s Club, Family Mart, and Luckin Coffee – China’s equivalent of Starbucks, so they are doing pretty well selling plant-based to beef, chicken and tuna products.

The second company, which is based out of Shanghai, is called New Nai Tea (PlantNow), and makes plant-based milk tea products. They have recently entered over 500 convenience stores in Qingdao, a new tier one city on China’s East Coast and they are ready to enter close to 10,000 convenience stores and university campuses.

“The third company is called 70/30, which is using fermentation to develop mycelium-based meat analogs and pre-packaged meals. Since starting in Shanghai they have sold over half a million of their meals and in their network they have 100 different foodservice companies that they engage with, with the ambition to include more from all over China.”

* Dao Foods International is an investment firm established to build alternative proteins in China. It was founded by Tao Zhang from Dao Ventures and Albert Tseng from Moonspire Social Ventures in collaboration with New Crop Capital.