While US retail sales of refrigerated plant-based meat alternatives have continued their precipitous decline, sales of frozen alt meat have started to stabilize, according to new data from Circana.*

In the 52 weeks to Sept 29, 2024, sales of refrigerated and frozen alt meat combined fell 9% year-over-year to $1.1 billion, while volumes dropped 9.9%.

However, there is a clear difference between the two temperature states. Sales of refrigerated alt meat (accounting for 29% of the category) fell 22.8% year-over-year to $22.6 million in September 2024 with volumes down 31.7%. However, sales of frozen products (accounting for 71% of the category), dipped only slightly by 1.3% to $54.3 million with volumes down 1.4% over the same period.

“After three years of double-digit declines, dollars and volume decreases for combined frozen and refrigerated plant-based meat alternatives are starting to level off somewhat,” said Anne-Marie Roerink, president at consultancy 210 Analytics. “This is driven by frozen that experienced single-digit decreases, while declines in refrigerated remained in the double-digits.”

For a time, it looked as if putting refrigerated products in the meat case next to conventional meat would be the key to unlocking growth for meat alternatives by putting them squarely in front of meat eaters. However, sales of refrigerated meat alternatives have been going backwards since Q3, 2021, said Roerink, who notes that retailers have also been reducing the number of items they stock in the segment.

On a volume basis, she said, “Pound sales [of refrigerated meat alternatives] during the latest 52-weeks dropped to 39 million lbs compared to the high of 61.8 million lbs in 2020.”

| Refrigerated alt meat sales | Price per pound (refrig) | Frozen alt meat sales |

Price per pound (frozen)

|

|

| 2019 | $270m | $7.25 | $645m |

$6.06

|

| 2020 | $490m | $7.90 | $886m |

$6.26

|

| 2021 | $496m | $7.99 | $850m |

$6.44

|

| 2022 | $430m | $8.06 | $892m |

$6.94

|

| 2023 | $365m | $7.98 | $781m |

$7.73

|

Source: Circana data crunched by 210 Analytics*

Conventional meat sales

To place this in context, dollar sales of conventional refrigerated meat rose 5.5% year-over-year to $7.9 billion in the four weeks ending Sept 29, 2024, with volumes up 3.3%.

“With September delivering another strong performance, the year-to-date meat department sales reached $76.8 billion, which reflects an increase of 4.4%. Year-to-date pound sales reached 16.5 billion lbs, which is up 2.1% over the same period last year,” said Roerink.

Dollar sales of frozen meat & poultry, meanwhile, rose 8.3% year-over-year in the latest four-week period, with volumes up 6%.

Top five funding rounds in meat alternatives, 2024 (year to date):

- Meati Foods (mycelium) $100m series C

- Infinite Roots (mycelium) $58m series B

- Heura (plant-based) $43m series B

- THIS (plant-based) $25m series C

- MATR (mycelium) $22.2m debt

Source: Preliminary AgFunder data [Disclosure: AgFunder is the parent company of AgFunderNews]

Health key driver for purchases of plant-based foods

The numbers came out as a new report from leading food retailer Kroger, the Plant Based Foods Institute, and data science and analytics firm 84.51° mapping the behavior of plant-based households showed that “shoppers choose plant-based foods mainly for health benefits.”

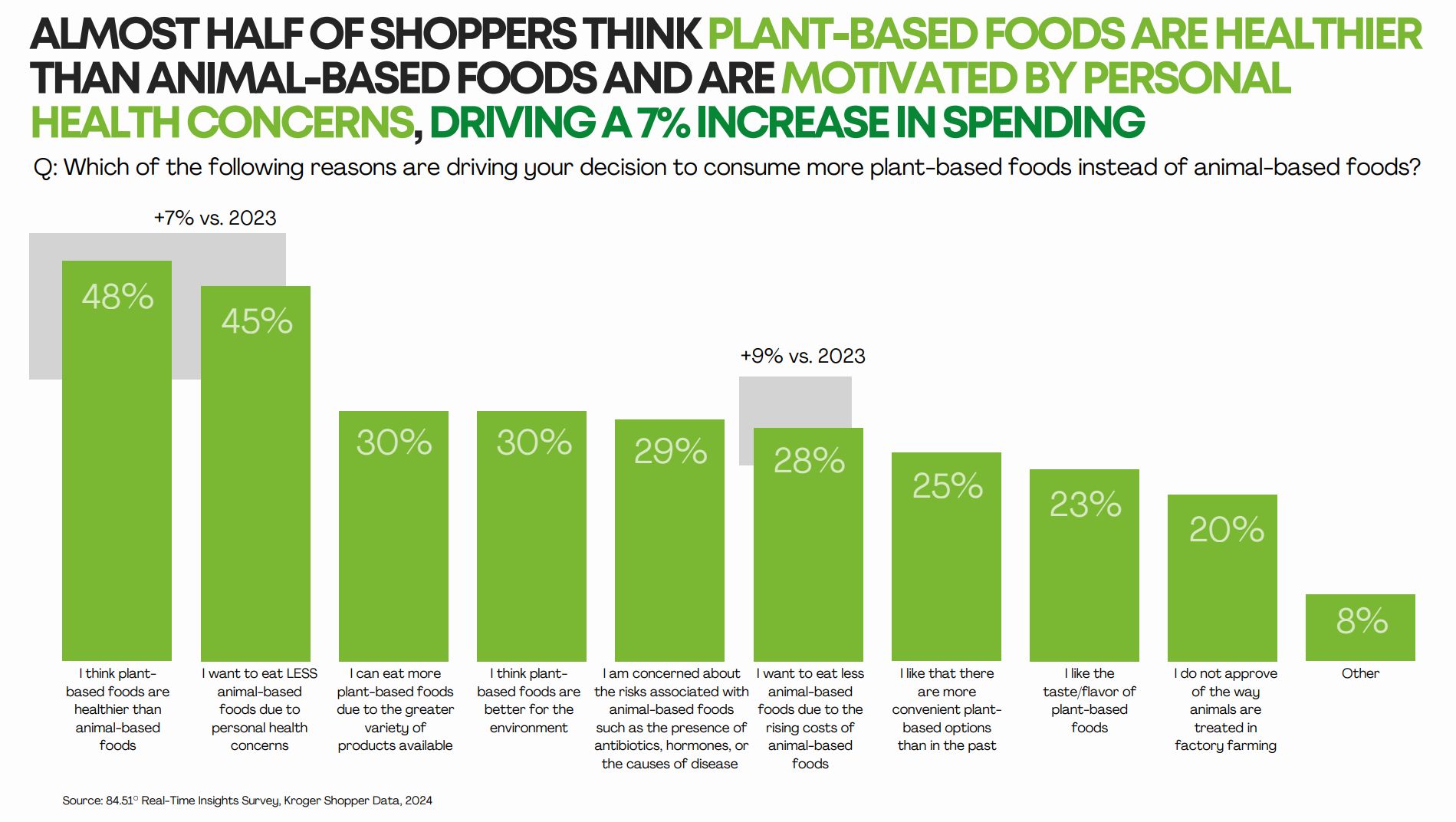

According to the report: “Almost half of households who increased their spend in plant-based foods indicated they are consuming more plant-based foods for personal health concerns, which was a 7% increase over prior year. Rising costs of animal-based foods were cited as the second largest influencer of increased consumption of plant-based foods among these households with a 9% gain over prior year.”

Shoppers increasing their spend in plant-based milk, cheese, and fresh meat are also actively decreasing their spend in corresponding animal-based categories, claims the report.

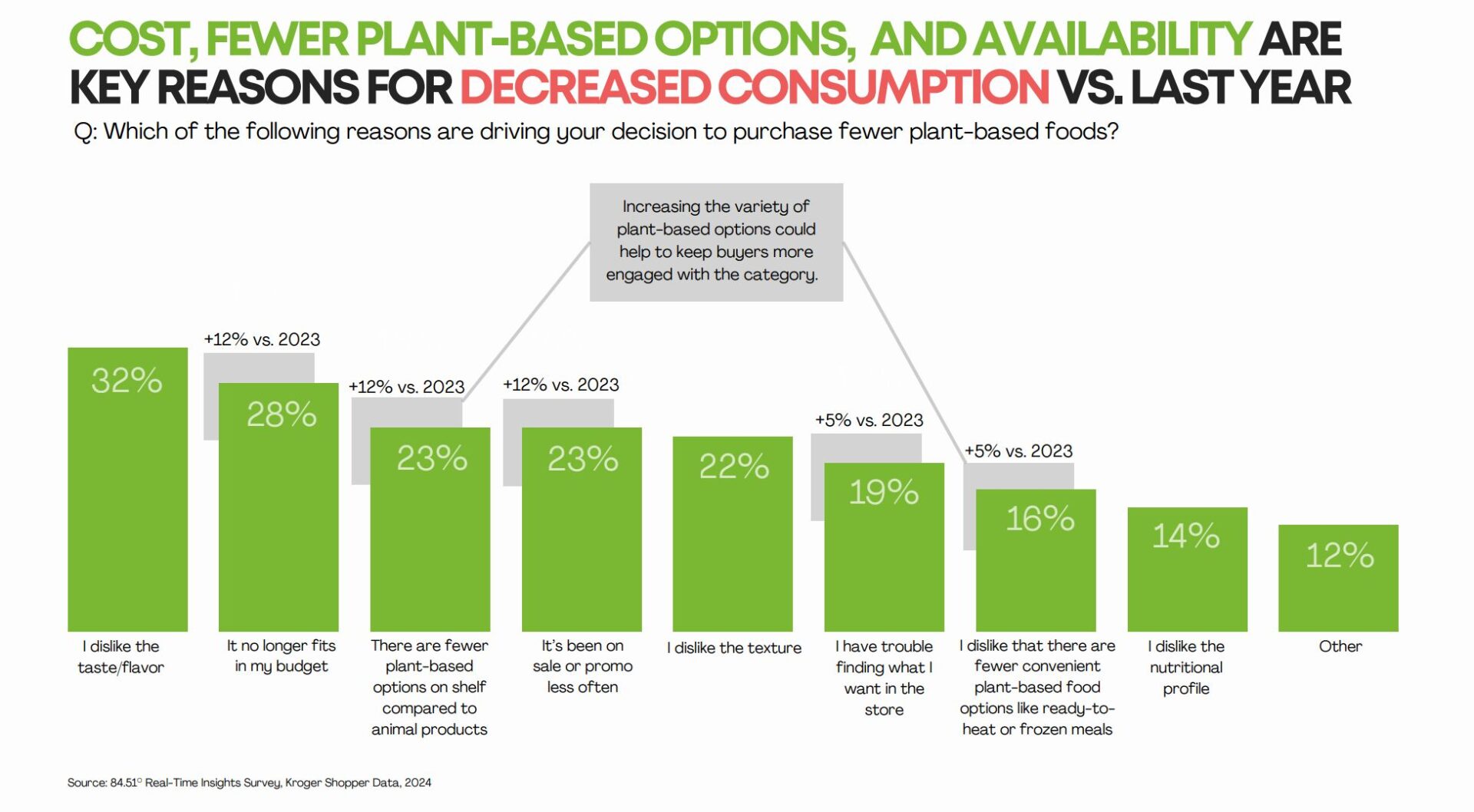

Of the households that decreased their spend in plant-based foods, taste and cost were the primary reasons, while nearly a quarter of households that decreased their spend cited a lack of variety.

PBFA: ‘Some retailers have moved some refrigerated plant-based meat products to the frozen section’

Asked how to square the optimistic tenor of the report with Circana’s lackluster retail sales figures, Linette Kwon, data and consumer insights analyst at the Plant Based Foods Association (PBFA) told AgFunderNews: “Declines in plant-based meat sales in the US are due to a combination of factors including retailers reducing store space and assortment for plant-based meat, rather than being the direct result of shoppers losing interest.”

While you could argue that retailers have reduced assortments because of poor sales/weak demand, Julie Emmett, VP marketplace development at the PBFA, told us: “Plant-based foods are being held to the same velocity thresholds as animal food so “poor sales” is subject to these existing thresholds, which is why in some cases the products are being moved to frozen and/or discontinued.”

Where retailers have reduced duplicative plant-based SKUs, velocities of existing products are “growing significantly,” she claimed.

“As the velocities of existing items continues to grow and brands provide a variety of different types of plant-based meat, and other products in other categories, we expect the build back of distribution and with this type of research and efforts behind it (marketing, expanded space through market tests), plant-based products will build up to the velocities required to maintain in distribution.

“Also a factor is the amount of money the meat and dairy industry spends on marketing and distribution due to their check-off programs, which plant-based foods do not currently have.”

Are plant-based foods displacing animal-based foods?

Kwon added: “Our fourth year of migration analysis research demonstrated that shoppers engaged with plant-based foods have decreased their unit consumption of total animal-based foods, especially of animal-based milk, animal-based refrigerated meat, and animal-based frozen meals. Our analysis also found that once shoppers begin to purchase categories such as plant-based meat, plant-based yogurt, and plant-based cheese, they are likely to repeat their purchase.”

But there is no one-size-fits-all “plant-based consumer,” she noted. “While some may be seeking out plant-based meat products with more whole food ingredients like fava beans, lentils, and mung beans, some may be more driven by environmental concerns, food safety concerns, or simply the desire to try something novel and exciting.”

Overall the industry is “still nascent and evolving,” she claimed. “Even within the past few years, we’ve seen constant innovation across all plant-based categories… As the industry continues to grow, we anticipate all types of consumers to be able to find a plant-based product that matches their needs, preferences and lifestyle.”

Their comments came as nonprofit The Good Food Institute reported more positive figures in some European markets, with sales of meat alternatives in Germany up 6% YoY in 2023, up 18% in France, and up 13% in Italy, with declines in the UK (-6%), Spain (-1.4%), and The Netherlands (-2.5%).

*Circana’s point of sale data covers multi-outlet channels (grocery, mass, supercenter and club), but excludes natural channel retailers such as Whole Foods and convenience stores.