Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Companies in the Online Restaurant & Mealkit category raised $326 million in H1 2021, according to AgFunder data.

In keeping with a longer-term trend that has been unfolding for the last couple of years, the sector itself has continued to evolve in terms of its sheer variety of business models. In other words, the definitions for ‘mealkit’ and ‘online restaurant’ are rather fluid these days.

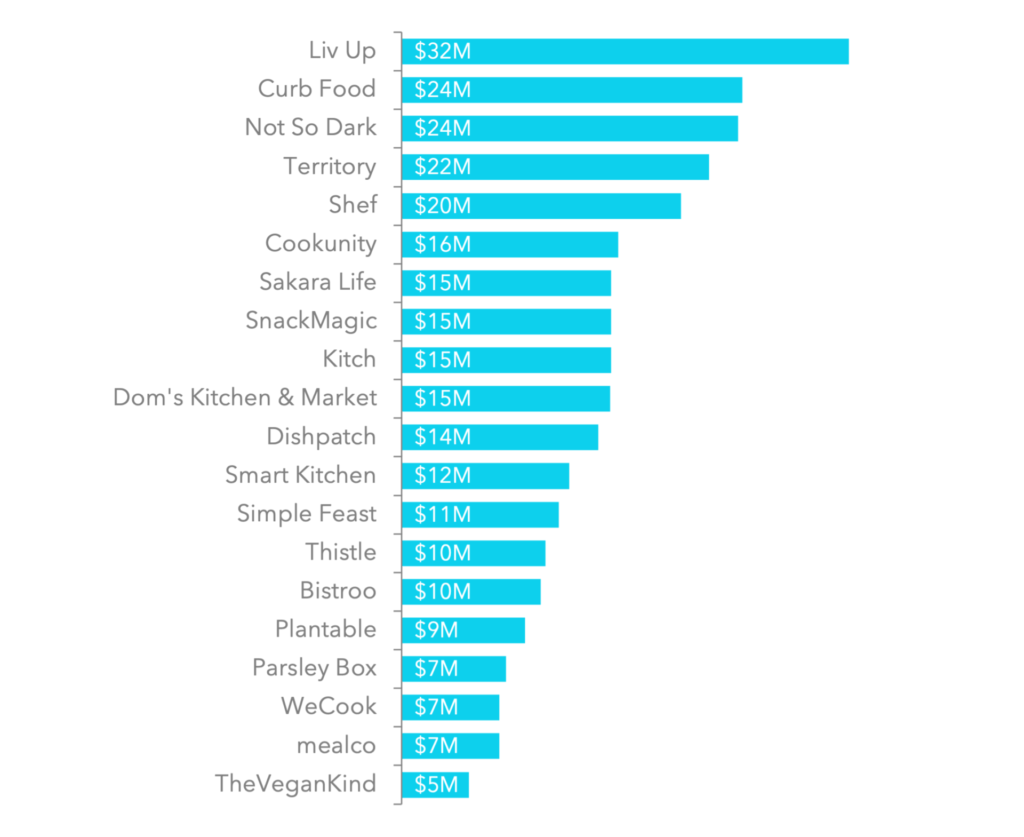

Top Online Restaurant & Mealkit deals in H1 2021

Brazilian meal delivery service Liv Up scored the top deal of H1 with its $32 million Series D round of funding led by Lofoten Capital. It specializes primarily in direct-to-consumer frozen meals made with ingredients from the 40 or so small producers it has partnered with.

The next-highest H1 investments went to dark kitchen operations, with Sweden’s Curb Food and France’s Not So Dark each nabbing $24 million. Both companies operate kitchens that serve delivery-only meals from virtual brands conceptualized and prepared in-house, as opposed to through a partnership with a restaurant.

Further down the list, healthy and plant-based food services such as the US’s Sakara Life ($15 million), Denmark’s Simple Feast ($11 million), and Thistle ($10 million), also in the US, took most of the investment dollars. The presence of these services reflects the continued growth of the alt-protein sector as more companies affix the “plant-based” label to their wares.

A smaller but still noticeable area of this category is that of homemade delivery meals, where consumers order digitally from at-home chefs preparing meals in their own kitchens. Andreessen Horowitz-backed Shef raised a $20 million Series A round for its network of chefs selling home-cooked meals to local communities in the US. Cookunity raised $15 million for a similar business that services the New York area.

Why the variety pack?

For years, the phrase ‘mealkit’ typically described the business model pioneered by Blue Apron and similar companies, whereby customers order subscription boxes containing pre-portioned ingredients and step-by-step cooking instructions. Historically, the sector seemingly struggled to deliver on its promise of a faster, more convenient way to get dinner on the table. By 2020, many startups in the space had gone the way of the foodtech graveyard.

The Covid-19 pandemic changed this trajectory. With restaurants closed and more consumers stuck at home, the category not only came back in vogue – it also began to evolve in terms of its scope. As the top deals of H1 highlight, ‘mealkit’ can now mean anything from a cook-at-home subscription box to a pre-made frozen meal or an order of shelf-stable groceries. Liv Up, for example, specializes in fresh, frozen meals, but in the last couple of years has also added grocery items such as meat, produce, and dairy to its offerings.

The proliferation of apps and other digital ordering tools enables companies to more easily get their concepts into the hands of consumers, suggesting we’ll see even more variety in the future for this category.