Beyond Meat has “recognized the existential threat facing the business and is taking steps to preserve cash and stabilize sales,” say analysts at TD Cowen in a note initiating coverage on the plant-based meat company.

“However, in our view, the fragility of its financial situation and the weak consumption patterns in the meat alternatives category present too much risk.”

The core problem, according to the investment bank, “is the product… Beyond Meat is losing market share in a declining refrigerated plant-based meat alternatives category. Management tried lowering prices to attract more consumers, but sales continued to fall.”

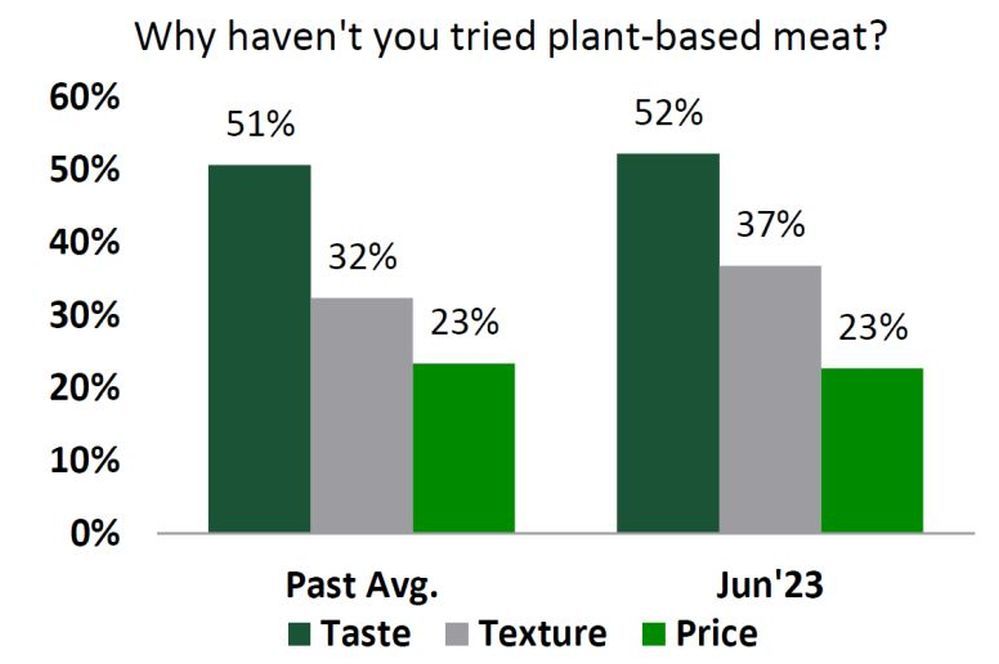

Beyond is now focused on improving consumer perceptions of the health and environmental benefits of the plant-based category, noted TD Cowen. “However, our proprietary consumer survey finds that consumers cite taste, aroma and texture of meat alternatives relative to the real thing, not price or health benefits, as their primary concerns.

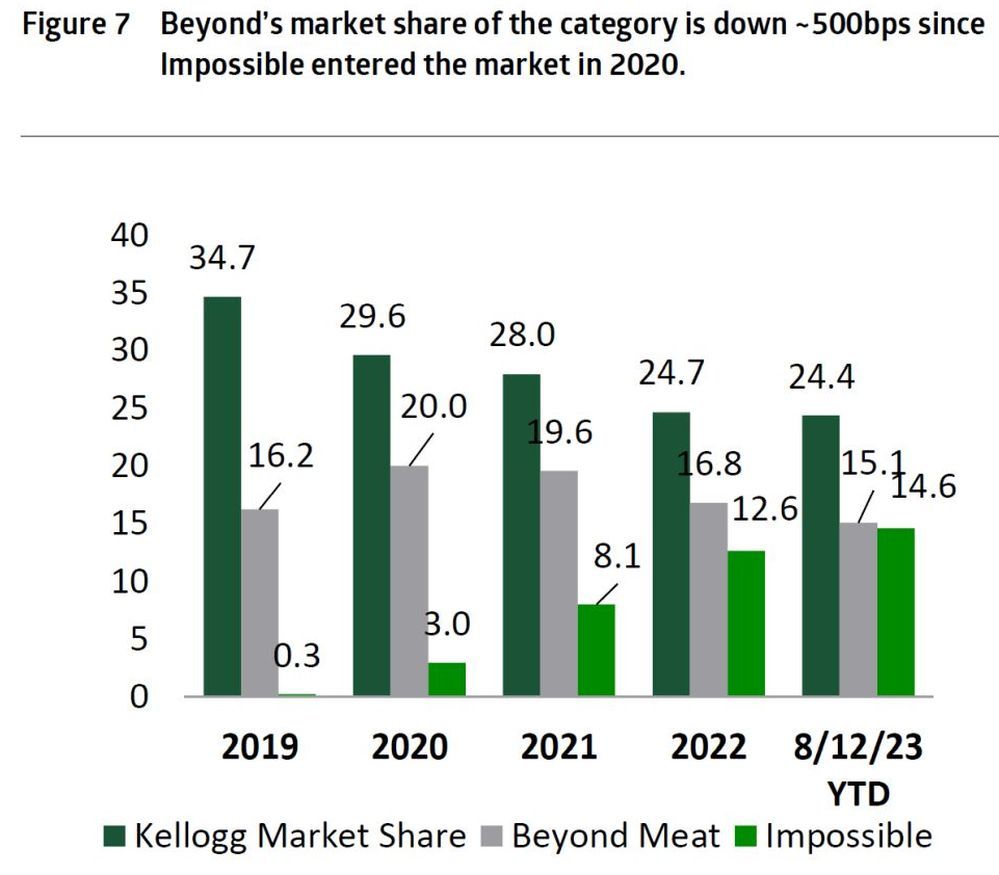

“Our recent tracking data indicates that Beyond’s struggles continue within US retail, with sales down 23% year over year in the year-to-date (volumes -18%) compared to a category decline of 11%. What’s more, the Beyond brand’s 500 bps market share decline over the past three years relative to Impossible Foods’ 1,100 bps gain suggests that consumers view Impossible as the better product.”

“Management believes that they can regain consumers’ attention by addressing their health and wellness misperceptions through marketing and health claims. Our view is that these efforts will have trouble cutting through the already confusing clutter of health claims in the food industry. We believe that negative perceptions of taste remain the primary obstacle for trial. Our proprietary consumer survey confirms the declining interest in the category and consumers’ negative perception of taste.” TD Cowen September 2023

‘Consumers view Impossible as the better product’

Beyond Meat—which went public in 2019—will likely need to raise more capital in the equity markets by the end of the year through an ‘at-the-market’ facility established in May, predicts TD Cowen, which gave the company an ‘underperform’ rating. “This is likely to weigh on investor sentiment.”

While bosses have prioritized cash flow and cost cutting, they failed to hit their target for positive cash flow generation in the second half, noted Cowen, which also expects Beyond Meat to revise (down) its topline guidance again when it issues its third quarter results.

“Our tracking data indicates that US retail sales are still declining at a 20% rate. As a result, we forecast an 18% sales decline for the year… With annual sales of only about $330 million and operating expenses still at around $200-240 million run-rate, it’s very difficult to see the path to sustainability.”

‘We wouldn’t be surprised if the company shifts more of its focus to Europe longer-term’

Stepping back to look at the category’s recent history, the pandemic initially provided an enormous sales boost due to an increase in trial and at-home food consumption, noted TD Cowen. “However, sales slipped into negative territory in [late] 2021 when consumers shifted back to cheaper conventional meat.

“Impossible [Foods] exacerbated Beyond’s problems by entering the grocery channel at significantly lower price points. Beyond was forced to reduce price to match Impossible, but consumers seemed to prefer Impossible’s taste and texture.”

Beyond’s entry into the jerky market then “stalled out early and burdened the P&L with significant cost overruns.”

In the foodservice sector, meanwhile, Dunkin’ Donuts removed Beyond Sausage patties from its menu, while KFC and Taco Bell elected not to move forward after conducting tests, said TD Cowen.

“Most importantly, the McPlant test by McDonald’s in the US using Beyond Meat did not generate sufficient consumer interest to merit broader expansion. Beyond had hoped that the product would attract a subset of McDonald’s consumers seeking an occasional plant-based option for health or environmental reasons, and perhaps even bring some ex-patrons back to the chain. However, McDonald’s determined that its consumers simply weren’t ready for it.”

On the plus side, Beyond Meat seems to be resonating more in some European markets “because consumers operate with higher awareness of environmental issues and are more keen on trying/incorporating plant-based products in their diets,” said TD Cowen.

“We wouldn’t be surprised if the company shifts more of its focus to Europe longer-term.”

Beyond Meat Q2, 2023 by the numbers:

- Net revenue: Down 30.5% year over year (YoY)to $102.1 million, but +11% vs previous quarter

- Net loss: $53.5 million

- US retail revenues: Down 38.5% YoY to $48.5 million

- US foodservice revenues: Down 45.4% YoY to $12.8 million

- International retail: Down 15.6% YoY to $20 million

- International foodservice: Down 0.9% YoY to $20.9 million

- Full year 2023 outlook: $360-380 million (in Q1, it had predicted $375-$415 million)

- Balance sheet: As of July 1, Beyond Meat’s cash and cash equivalents balance was $225.9 million and total outstanding debt was $1.1 billion. Read more HERE.