London-based fintech startup Stable has launched a platform to help buyers and sellers of food mitigate price volatility. The platform is backed by $6 million in seed funding from fintech investor Anthemis, Syngenta Ventures, Swiss insurer Baloise, and Bermuda-based Ascot Underwriting.

Price volatility is a major risk for producers, buyers, and insurers of agricultural products. Prices can swing by as much as 20% or 30% per year, making it difficult for farmers to manage and plan their businesses and for commodities investors to gauge investment decisions.

Dairy farmers are a good example of a farmer group impacted by price volatility; record numbers of price-taking family farmers are leaving the industry with AHDB reporting 222 British dairy farmers left the industry in the last four months alone.

Currently, large farmers and traders are able to minimize their risk for common crops, such as corn, wheat, and soy, with futures, which guarantee prices for a period of time. But less than 1% of the world’s farmers work on farms bigger than 250 acres, and most crops are not traded on exchanges.

Stable’s mission is to fill a market gap for midsize farmers of the top 200 crops produced around the world, making it easier for them to insure their businesses against sudden changes in price. The platform acts as a marketplace for farmers to buy affordable volatility insurance for their products. Having access to this type of insurance not only helps farmers secure their income but also helps them de-risk their businesses, making other types of financing, like business loans, more accessible. Commodity buyers, meanwhile, use the platform to make trades in products that aren’t available on the large exchanges.

The platform currently supports farmers and commodity traders in 15 countries, with its top three markets being the UK, Brazil, and Australia. The company is currently managing roughly £2 million ($2.6 million) in premiums, with average insurance contract sizes of about £3,000. Stable’s founder Richard Counsell says the platform is adding about 1,000 contract per month.

With Stable’s seed funding, the company is eying both geographic expansion and launching industrial and energy products.

A farmer understands

Counsell, himself a farmer in southwest England, got the idea for Stable while working for a software company in Chicago. Counsell felt that agricultural commodities markets and financial products for farmers had become entirely too complex.

“I felt like the whole industry had forgotten its real farming roots,” Counsell told AgFunderNews. From the farmers’ standpoint, he felt the language and tools used in financial markets didn’t translate to farmer’s day to day business activities and concerns. “If we forget everything else, and think about what do farmers need, it sure as hell wouldn’t look like a Bloomberg screen.”

On the front end, Stable offers a simple interface for farmers to buy insurance to protect themselves against price swings for the food they produce. Farmers use the platform to get quotes and purchase policies based on the type, volume, and duration for a food commodity they want to protect. Premium levels vary based on the minimum and maximum commodity prices—known as “start” and “stop” prices—for which farmers choose to insure their goods.

On the back end, these policies are underwritten against independent index prices, which reflect the average sales price for a particular good. Stable relies on commodity index prices from the U.K.’s Department for Environment, Food & Rural Affairs (DEFRA) and Agriculture and Horticulture Development Board (AHDB). This type of insurance, known as “index insurance,” is intended to simplify policy and claims management because payouts are triggered automatically based on how commodity prices shift around a baseline index price. Index insurance policyholders can recoup lost costs more quickly and efficiently than most standard policies allow because they do not involve claims evaluators. In exchange, policyholders compromise somewhat on how much they are able to recoup.

In Stable’s case, the payout threshold is capped at 50% of a given commodity price index, known as the “stop price.” If the index price for a ton of wheat, for example, is $100, Stable’s stop price would be $50, meaning the limit of a farmer’s protection would be $50 per ton.

Farmers can choose the point at which they receive a payout, known as the “start price,” and can set that price at up to 90% of the index price. In the same wheat example, a farmer with a $90 start price per ton of wheat would get a payout if the price fell below $90, up to Stable’s stop price of $50 per ton. The lower a farmer’s start price, the lower his insurance premium, because a payout would be less likely.

“Having a stop price of 50% of the current index price limits the theoretical maximum losses for the underwriters, and therefore the premiums payable are more affordable. Stable’s stop-loss policy is designed to provide the maximum level of protection for the most affordable premium,” the company notes on its website.

Niche and diverse

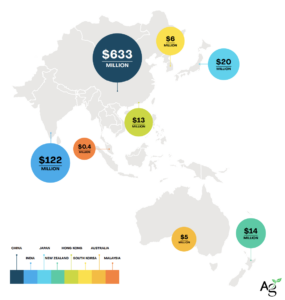

The other way it mitigates risk for underwriters is by spreading their exposure across a wide range of commodities and geographic areas. Counsell compares this approach to the traditional practice of mixed farming, where farms grew a range of crops throughout the year, which helped ensure that no single weather event or crop loss devastated a farmer’s earnings.

“If an underwriter insures 1,000 [units] of Australian barley and the price of barley drops, the underwriter will write down a lot of money,” he explained. “Here, insurers are taking pieces of risk from different geographies and crops. There is no correlation between Argentine beef and Norwegian salmon, and that’s what our platform is built on. We love niche and diverse.”

Counsell says the only reason Stable can disrupt the risk management market this way is because of the advancement of data science and financial technology. The platform’s launch is the result of three years of research and development, partnerships with three universities, in Lisbon, Cambridge, Mass., and Liverpool, England, and a lot of air miles that Counsell racked up traveling to meet with farmers in 15 countries. “Doing something simple is incredibly complicated,” Counsell joked.

Investors backing Stable speak to the company’s novel approach to helping agricultural businesses and capital risk takers quell variability, particularly in the the majority of markets worldwide where protection is not guaranteed, as it is for farmers in the U.S. under the federal government’s crop insurance program.

“Stable is tackling a huge problem for a very crucial market in a way we have not seen before,” said Ruth Foxe Blader, managing director of Stable investor Anthemis. “Sitting at the intersection of agriculture, finance and technology, the team are disrupting a multi-trillion dollar industry to give stability where volatility clouds the market.” Anthemis was an investor in The Climate Corporation, which sold to Monsanto for just under $1 billion in 2013 as agtech’s first digital unicorn.

Contracts bought on the platform are underwritten by global underwriters at Lloyd’s of London (pictured).

Sponsored

International Fresh Produce Association launches year 3 of its produce accelerator