US vertical farming startup Fifth Season has shut down its operations. Pittsburgh Business Times was first to report the news.

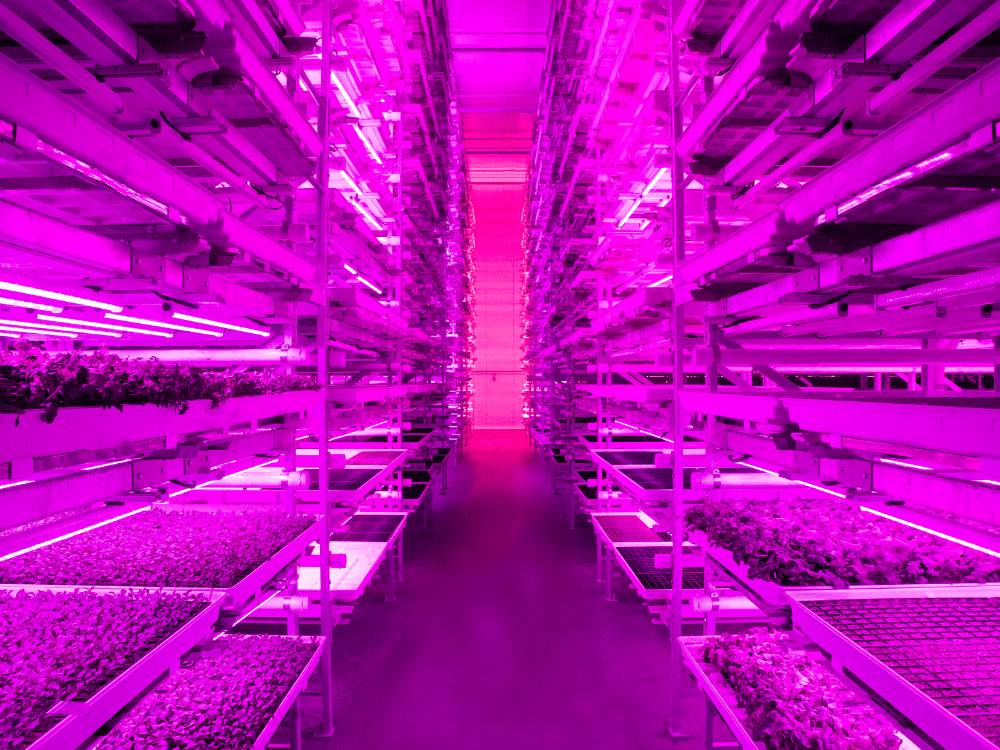

Sources familiar with the matter said Pittsburgh, Pennsylvania-based Fifth Season closed its doors last Friday. The company was known for its vertical farming facilities that used robotics to grow leafy greens indoors.

The shutdown also spells the end of a pricy expansion the company was planning for Columbus, Ohio next year.

At the time of closing, Fifth Season had raised $35 million from Drive Capital, 99 Tartans, Reinforced Ventures, Alumni Ventures and Grit Ventures.

Why it matters:

Fifth Season’s seemingly abrupt closure is likely not the last we’ll see for this sector.

Controlled environment agriculture — and vertical farming in particular — has long been the subject of much hype and promise. But to date, there’s very little public data around what works and what doesn’t in terms of efficiency and return on investment.

Large farming facilities are extremely capital intensive. CNBC recently called out Fifth Season’s Ohio facility that was planned for 2023. The 180,000-square-foot vertical farm would require a $70 million expenditure — or roughly $17 million per acre. And while demand for locally grown, pesticide-free food is growing, it’s sometimes not enough to offset the cost of operating these high-tech operations.

Fifth Season’s closure follows news from earlier this year of French startup Agrocool’s placement into receivership. At the end of 2021, AeroFarms scrapped plans to go public via SPAC. Just this week, Netherlands-based Glowfarms ceased all activity after failure to find sufficient funds.

All this suggests that vertical farming is at, or at least very close to, the “trough of disillusionment” it’s been heading towards for months. This is the point in the Gartner Hype Cycle where, according to the research firm, “Interest wanes as experiments and implementations fail to deliver. Producers of the technology shake out or fail. Investments continue only if the surviving providers improve their products to the satisfaction of early adopters.

As Henry Gordon Smith recently wrote on AFN, “What comes next is a period of depression and correction.”

Recent shutdowns like Fifth Season’s don’t spell the end for vertical farming. Rather, they mark the beginning of a period of honest discussion of what does and doesn’t work and, hopefully, more realistic expectations. The vertical farming industry just might lose several more startups in the process.

What they’re saying:

Perhaps the best indicator of what happened at Fifth Season and whether robotic vertical farming has a future can be gleaned from former employees. Several took to LinkedIn this week to express their thoughts:

- “Sadly, this journey is ending with Fifth Season closing its doors due to this challenging macroeconomic environment,” said one senior food developer.

- A software engineer wrote that, “Unfortunately, sometimes the timing is just wrong and recessions hit companies differently. Fifth Season will be shuttering its doors as of today and my heart is broken for the loss of potential, but I’m excited for my next chapter.”

- Finally, a principle software engineer wrote, “I still believe in our vision. Temporal downturns may have [a]ffected us, but I believe it will be a realized solution at some point in the future.”

Sponsored

International Fresh Produce Association launches year 3 of its produce accelerator