Avrio Capital, one of the first investment firms to focus specifically on food and agriculture, has re-branded into a new investment firm called Rio Investment Partners, raising $77.5 million in the first close of a $150 million fund.

Rio will invest in growth stage businesses across the agrifood supply chain and counts Farm Credit Canada, a core investor in Avrio, as one of its cornerstone investors.

Rio has been cofounded by Aki Georgacacos, an executive from Avrio, and Jean Francois Huc, an experienced biotech entrepreneur. Other existing Avrio team members Steven Leakos, managing director, and Jonathan Goodkey, principal, are also part of the Rio team.

Avrio cofounder Jim Taylor will not join Rio, instead focusing on sub-debt, according to sources. Michael McGee, another partner in Avrio, is also not transitioning over, but his plans are unknown.

Why the re-brand?

“The agrifood investing space is changing and evolving, and as we always like to say to our portfolio companies, if you’re not growing, you’re shrinking,” Aki Georgacacos, partner at Rio, told AgFunderNews. “So, when we thought about the future of the firm, we realized we wanted to build a platform that could invest in a very comprehensive way across the entire agrifood tech continuum. And as we mapped that out and started to think about the kind of professionals we’d want involved, we felt it made sense to signal to the marketplace our new approach with a new name, while maintaining the heritage of Avrio.”

Avrio has an impressive heritage: the firm has deployed three funds totaling over $250 million, producing returns of at least two times their investments. One of its most successful exits was Manitoba Harvest Hemp Foods, in which it invested $6.05 million and returned $52 million, a 8.67x return and 48.24% IRR (internal rate of return). Private equity firm Compass Diversified Holdings acquired Manitoba in 2016, recently selling it onto Tilray, the famous publicly-listed cannabis group.

On the technology side, Avrio exited precision ag software group Farmers Edge to Canadian billionaire Prem Watsa’s Fairfax Financial for a just under 5x return. It also exited Wolf Trax, a fertilizer and seed treatment startup that was acquired by Compass Minerals for nearly $40 million in 2014. That yielded a 15.4x return for Rio’s $2.5 million investment, and a 138% IRR.

Why food & ag?

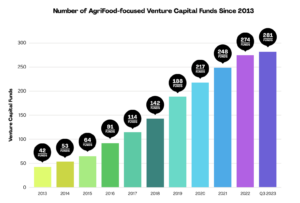

“A convergence of positive trends has created a unique opportunity for agri-food investing over the next decade,” Huc told AgFunderNews. “There is a strong, global imperative for innovation across the value chain – we need to feed more and more people with finite resources. In recent years, we have seen a rapid growth in agri-food investment, which has stimulated a thriving ecosystem, particularly in North America. Within this global ecosystem, Canada has a large and robust agri-food sector that is critical to the economy. This is the backdrop for a global push to make agriculture and food more sustainable, healthy and efficient.”

“Unlike many sectors of the economy, agriculture and food have been slow to adopt technologies that can improve productivity, reduce environmental impact, increase efficiency, decrease waste and improve health and safety,” added Georgacacos. “Today, there are hundreds of companies in the ag-tech and food-tech sector that did not exist 5 years ago. The use of technology in this sector remains embryonic, and there is a tremendous opportunity to leverage emerging technologies and capabilities to create value across the entire agri-food value chain, from inputs and production practices through processing and transformation to consumer-packaged goods promoting health and wellness. There has never been a better time to invest in the agri-food sector.”

What will Rio invest in?

The firm is looking to invest at the intersection of enabling technologies, different capabilities, and the agrifood value chain. It will invest at growth stage where the value proposition “is clearly understood, the unit economics look positive and the product market fit is established,” said Georgacacos. “With all of those elements checked off, our strategy is geared towards scaling businesses and taking on execution risk.”

Huc elaborated that the firm is looking at gene editing (CRISPR), gene sequencing and computational design technologies to improve seeds, enhance microbial production and produce alternative proteins; cellular agriculture and industrial biotechnology to produce food/pesticides/fertilizers/feed; remote sensing and predictive modelling to increase productivity in the field; data collection and management to enable precision agronomic farming; robotics to automate production, harvesting, processing and distribution; artificial intelligence to enable machine learning and reduce labor intensity; the internet of things to maximize connectivity and leverage data collection, AI and robotics; and blockchain to bring transparency and traceability to the food chain and facilitate transactions.

“We will also invest in companies possessing unique capabilities, such as privileged sourcing of value-added inputs, differentiated logistics networks that offer better cost structures and/or service levels, advanced manufacturing methods, e-commerce platforms that provide differentiated access to markets, management teams possessing unique experience, relationships and networks, and emerging brands that connect with consumers,” added Huc.

What types of food and agriculture technologies excite you the most?

“We are excited by opportunities in animal health, food technologies that deliver nutrition, wellness, cleaner labels and convenience to consumers, technologies that can reduce waste and spoilage across the value chain, the use of biotechnology to enable more sustainable and economical production, and digital solutions that save producers money and make them more efficient.”

Where will Rio invest?

Initially, Rio will focus on North America, predominantly its home country of Canada. But the firm intends to invest in the U.S. as well and eventually build out its investment platform to eventually invest overseas with an international franchise and brand. For now, Rio is operating from two offices; one in Calgary, Alberta and one in Montreal, Quebec.

What is this platform approach?

“Too often VC funds are reliant on one or two individuals to run their investments, articulate the strategy and execute; that makes it hard to scale and stake the sector more comprehensively,” said Georgacacos. “We want to create a team with a broad set of capabilities; we want to bring in young people and develop them through the firm, creating a private equity firm that’s about the horse and not the jockey. In 10 years, we want to have a dynamic group of partners, senior investors and junior staff who have been recruited and retained at RIO, have developed their skills and expertise in Agri-Food investing, have fostered and flourished a unique network of industry contacts and have been promoted from within. This motivated team of professionals will be managing several RIO funds and generating industry leading returns for its limited partners. This is the platform we are committed to building, one where RIO eclipses the sum of its parts.”

What’s in the name?

“Rio means river in Spanish: it flows, evolves, changes. It needs to change as it goes forward to stay alive and relevant, and it brings life and growth to everything it touches, all of which resonated with our firm. Totally coincidental that it’s part of the Avrio name.”

The existing Avrio equity and sub-debt funds will continue to operate under the Avrio name.

Sponsored

International Fresh Produce Association launches year 3 of its produce accelerator