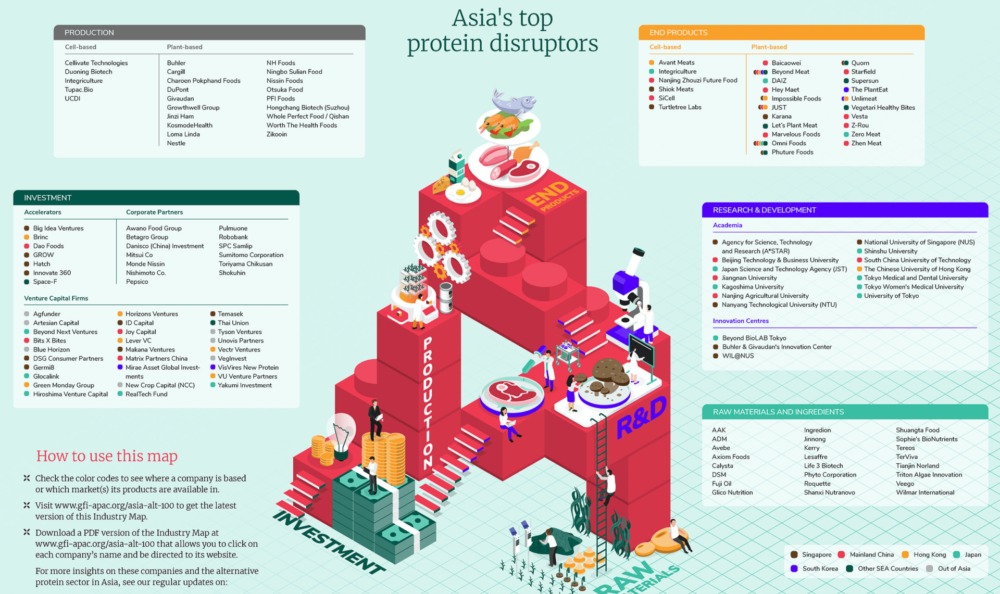

The Good Food Institute (GFI) Asia Pacific has released the 2020 Asia Alt 100 – its list of the 100 startups, corporates, and research organizations shaping the region’s growing industry around meat, dairy, and egg substitutes.

These 100 players have been selected from five categories from across the alt-protein production cycle: raw materials and ingredients, research and development, food production, corporate partnerships, and end products.

Corporates dominate the Asia Alt 100, making up 57%, while startups represent 29%. Research institutions including universities and state labs make up the remaining 14%.

GFI has also highlighted who it believes to be the top 35 alt-protein investors in the region, including VC firms and accelerators.

Most major Asia-Pacific markets are covered, among them China, Hong Kong, Japan, Singapore, and South Korea. India is not included, however.

To be eligible for inclusion in the Asia Alt 100, organizations either have to be incorporated in Asia, or otherwise have built a local presence or “invested significantly” in the region. Companies that don’t meet these criteria can’t make the cut, even if their products are sold in the region via distributors.

Nevertheless, European and North American companies are fairly heavily represented in the list – indicating how reliant the regional sector remains on outside players.

Elaine Siu, managing director at GFI Asia Pacific, said that the region’s alt-protein industry “needs to move beyond importing technologies and brands from Silicon Valley” if analogs are to “truly become a protein solution for Asia.”

“Coming from a background of very vibrant and diversified food cultures, Asian consumers have a discerning palate and demand for a great variety when it comes to food […] We need homegrown players who understand and can cater to the local markets’ taste,” she said in a statement.

Decoupling from Silicon Valley

GFI suggests that the key to shifting more of the industry and investment ‘Eastwards’ may lie in playing to the region’s potential for hosting upstream technologies. China and Indonesia are among the world’s top 15 growers of soybeans — one of the main raw ingredients for plant-based meat alternatives — based on UN Food & Agriculture Organization data, with almost half of the world’s supply of soy protein processed in China according to GFI.

Just 58% of the raw material and ingredient players listed in the 2020 Asia Alt 100 originate from Asia Pacific. Increasing regional representation in that segment would contribute to bringing down production costs and make alt-protein products more viable in Asian consumer markets.

“More and more Asian companies will enter the industry as the local players start to realize the competitive advantage they have in growing raw materials, processing ingredients, local distribution network, supply chain infrastructure, and of course, in creating products that are tailored to the variety of Asian palate and culture,” Siu said.

GFI used internal datapoints to put together its list. Without providing further details on its methodology, it said in a statement that its Hong Kong-based Asia-Pacific team “is in a unique position [with its] finger to the pulse of the industry” and is “privy to, and trusted with, invaluable information” as a result of the free-of-charge consulting work it does for companies, investors, entrepreneurs, and policymakers.

You can download a visual industry map, including the Asia Alt 100 and the sector’s top 35 investors, here.

Got a news tip? Email me at [email protected]

Sponsored

International Fresh Produce Association launches year 3 of its produce accelerator