A recent report from the Western Growers Association highlighted the ongoing labor shortages, rising costs, and climate change impacts facing farmers today among other challenges. While the report focuses more specifically on the need to automate harvest activities, the challenges ring true during other times in the crop production cycle too.

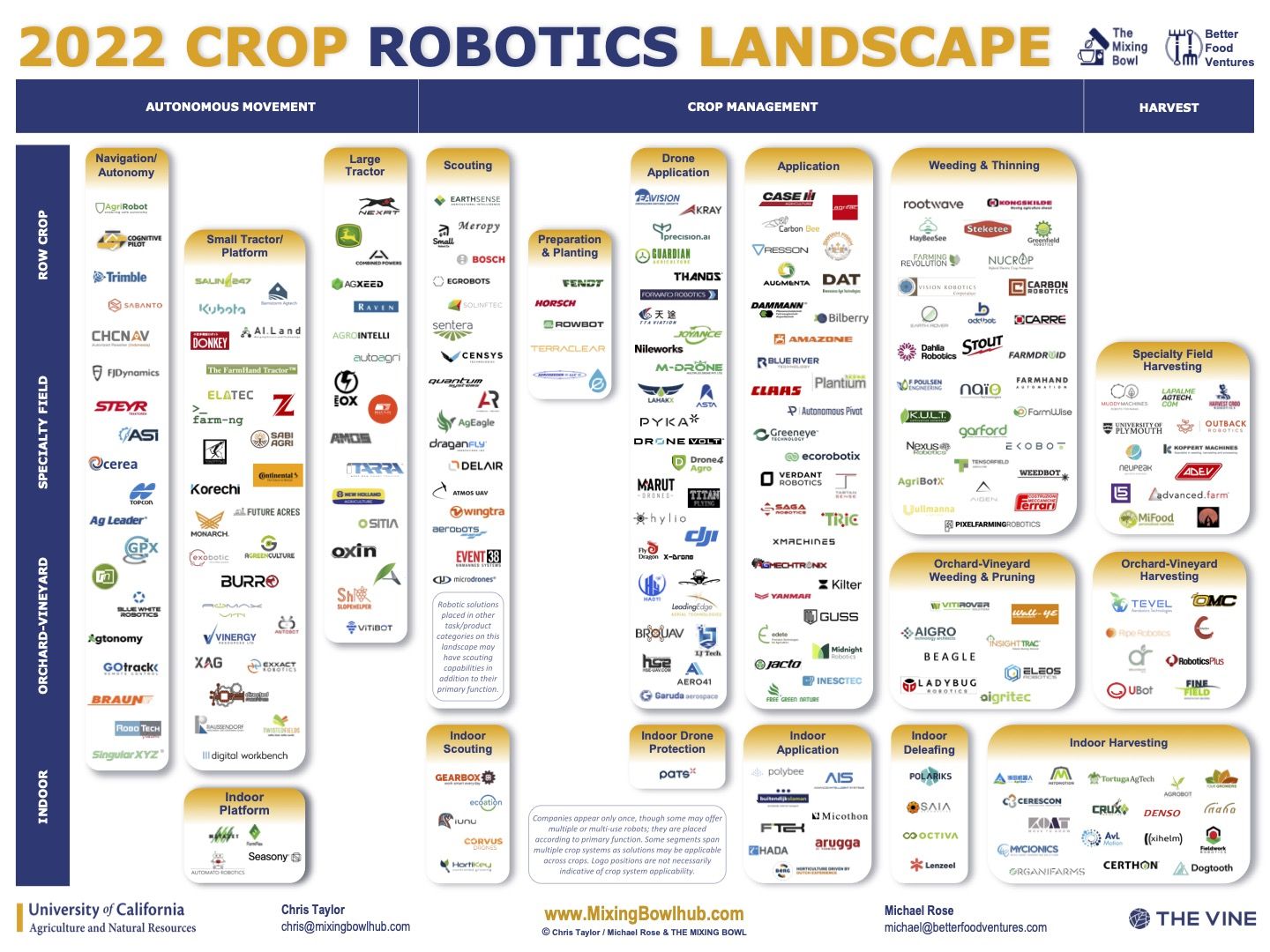

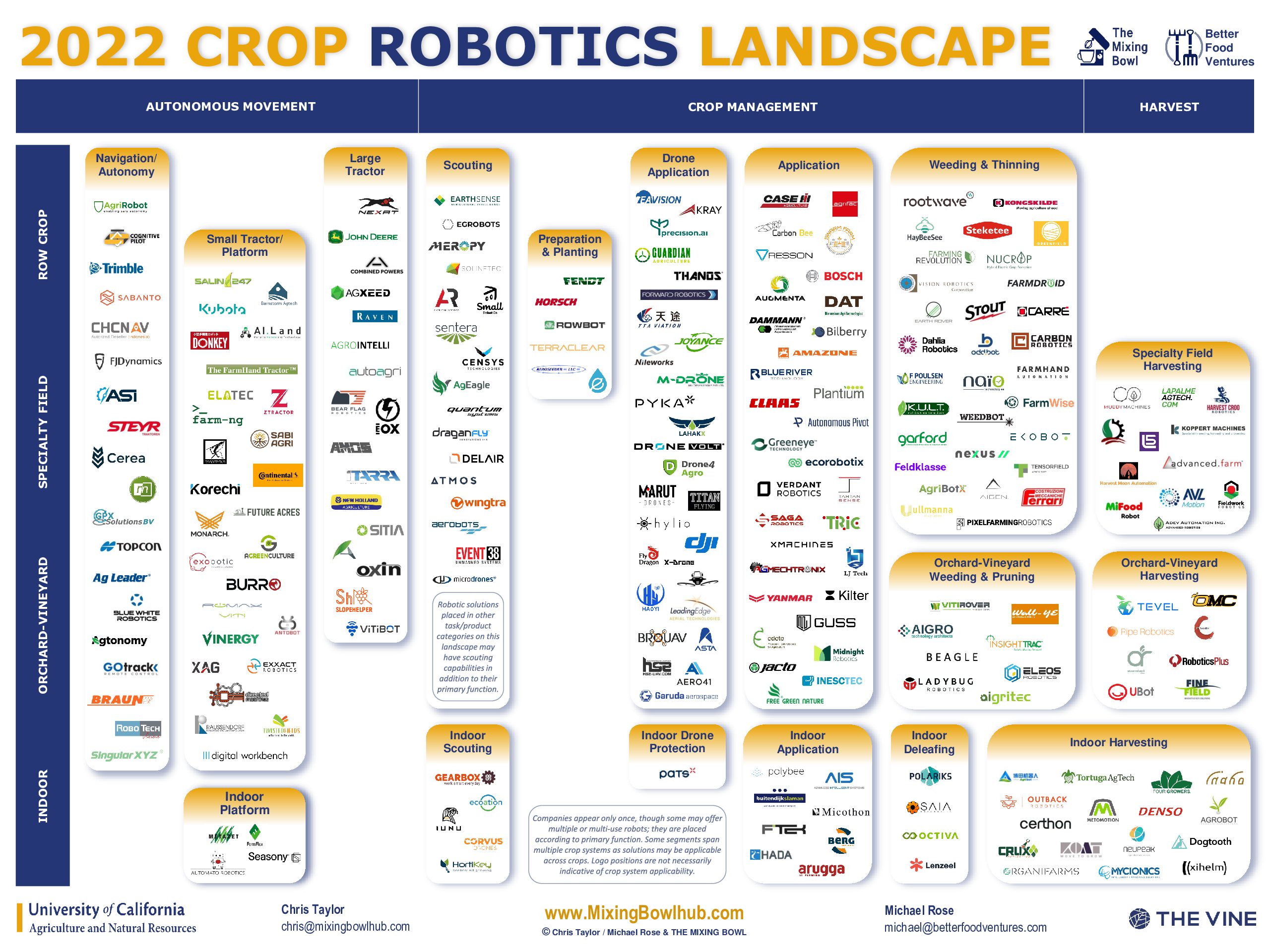

Inspired by the report’s takeaways and a growing number of farm robotics startups working to meet these challenges, The Mixing Bowl and Better Food Ventures have put together a market map detailing nearly 250 farm robotics startups automating various crop farming activities both indoors and outdoors. The map was a collaboration with the University of California Agriculture and Natural Resources and The Vine.

We caught up with The Mixing Bowl’s Chris Taylor, Michael Rose, and Rob Trice to find out more about the map and how the crop robotics segment is developing.

How did you decide how to split out the farm robotics companies on the map?

Before we could decide to split out the companies on the map, we first had to decide “What is a crop robot?”. To be honest, there was not much consensus on a definition amongst the folks we interviewed for the landscape, but there seemed to be two themes. First, machines needing to act autonomously and, second, to be labor-saving for a farming operation. But we had some interesting discussions amongst ourselves about what to include on the map. For instance, if a machine is only sensing or gathering data should it be considered a robot? Or if a machine does not have a fully autonomous mobility system to move around—– perhaps just an implement pulled by a standard tractor—is it a robot?

Eventually, for the purposes of this robotic landscape analysis, we focused on machines that use hardware and software to perceive surroundings, analyze data and take real-time action on information related to an agricultural crop-related function without human intervention. In general, the systems included in the landscape need to offer autonomous navigation or vision-aided precision, or a combination. The solutions must also be commercial offerings and be utilized in the production of food crops specifically.

As for how to split out the companies on the map, we decided it would be useful to readers to segment by production system (broadacre row, specialty field, orchard-vineyard and indoor) as well as by task areas (autonomous mobility, crop management, and harvest). We segmented further by subtasks, like scouting and weeding, within those functional areas. Some of these, like indoor harvesting, are crop system-specific, whereas others, like autonomous tractors, work across crop system boundaries. It’s a diverse set of solutions.

How has this landscape changed in the past two years? Why have you decided to focus so closely on farm robotics now?

We’ve always been watching the sector and had included a few robotic companies in both our earlier Farmtech and Indoor Agtech Landscapes, but this is the first time we have done a landscape for agricultural robotics specifically. In the past, it seemed like more of the activity in the space was research or concept-oriented rather than true commercial undertakings. Of the commercial undertakings, there were numerous false starts and the sector had failed to gain market adoption.

But we felt there was a shift occurring. To be honest, we’ve assessed robotics plays in the past as investors at Better Food Ventures and we have been pretty bearish. We’ve seen many companies needing to raise big rounds of capital just to bring a product to market and also seen many die in the “Valley of Death”, falling short of achieving scale and profitability. Moreover, we have not had many successful exits in ag robotics based on profitability, though we have seen some acquired for having unique technology.

In spite of all of that, we just felt like it was a shift that needed to be analyzed. More great talent and more investment dollars were flowing into the space, and there was increased activity with regard to both the production systems and tasks being pursued commercially. Even in our internal investment discussions regarding robotics startups, we were sensing our bearishness was receding. In fact, we have now invested in two crop robotics companies at Better Food Ventures: Four Growers and Farm-ng. Part of what we liked about these newer startups is that they could get to a product/market fit and get to revenues on a modest level of investment.

The key takeaway from our analysis is that due to significant technological progress, and other reasons we discuss in our landscape analysis, the Valley of Death appears to be neither as wide nor as ominous as it has been in the past for crop robotics startups. One phrase we heard more than once in our interviews with robotic solution providers was, “[What we are doing today] would not have been possible a decade ago”, and we agree.

Which segment of farm robotics is the most challenging and why?

Given the realities of the dynamic, unstructured, and unforgiving environments in agriculture, all of the segments are a hard challenge. However, the most complex is generally acknowledged as harvesting, specifically picking specialty crops in fields, orchards, vineyards, and indoors. Harvesting stresses all of a robot’s capabilities: autonomous motion, vision, decision-making, dexterity, reliability, and speed. We are seeing robotic solutions perform some tasks on par with a human—a comparable performance for a comparable cost—yet it has been difficult for robots to reach the speed and accuracy performance of a human fruit or vegetable picker at a comparable cost—until now, perhaps.

What excites you most in farm robotics?

The dynamic nature of the sector and the diversity of solutions being developed, even in the sometimes slow-to-evolve agricultural arena, make crop robotics exciting. We evaluated more than 600 companies and included nearly 250 crop robotics solution providers on the landscape. Because the Valley of Death is easier to cross now, in the coming years we expect to see more of these startups succeed, solve more challenges and unlock new and unimagined opportunities for farmers. The rate of technology development, including the maturity of common and open technology platforms, will only accelerate their rate of success in the next few years.

Agriculture is certainly one of the most challenging industries for robotic development. Although crop robotics developers are leveraging technical developments from other robotic applications like autonomous vehicles and warehouses, the complexity of the tasks and the rough environments crop robotic solutions providers must solve for are pushing the boundaries of what robots can do. In this regard, agriculture is a technology leader in the overall robotics space. That is exciting.

Sponsored

International Fresh Produce Association launches year 3 of its produce accelerator