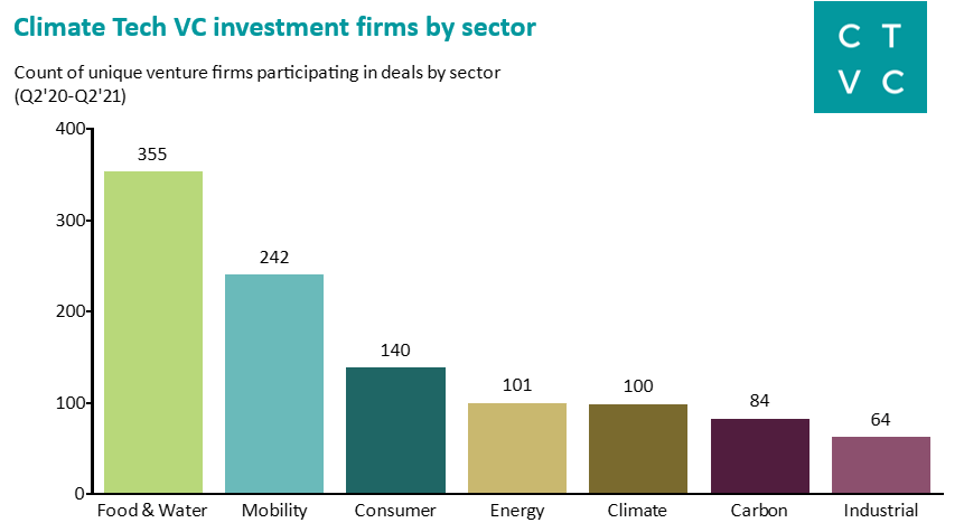

Investors looking to tackle the climate crisis through clean technology over the past year were most interested in startups dealing with food and water, according to industry newsletter Climate Tech VC‘s mid-year review of venture capital funding.

The authors, who are investors themselves, tracked deals made across seven sectors — carbon, industrial, consumer, climate, energy, food and water, and mobility — between Q2 2020 and Q2 2021 and found food and water attracted the largest number of unique investors by far.

The ubiquity of food and water in everyday life and the global Covid-19 crisis are two likely factors that prompted this heightened interest, says Sophie Purdom, co-founder of Climate Tech VC and an active investor in early-stage climate technology businesses.

Food and water “are the most visceral and the most tangible of all of those climate investing categories,” she told AFN.

“Keep in mind this time period we’re tracking is also squarely during pandemic times, when maybe for the first time in a while everyone’s at home and thinking about what food they put in their body, what they’re stocking in their fridge, and engaging with the world around them and their lifestyle in a way that they hadn’t before.”

“Investors are people too, and we’re all biased in our decision making by our lifestyles, and so I have to think in some ways that the pandemic influenced investors wanting to participate at that obvious intersection of climate and food,” Purdom added.

These categories also attract investors who are “dipping their toes into ESG for the first time,” she said, referring to the environmental, social, and governance issues that investors are increasingly paying attention to.

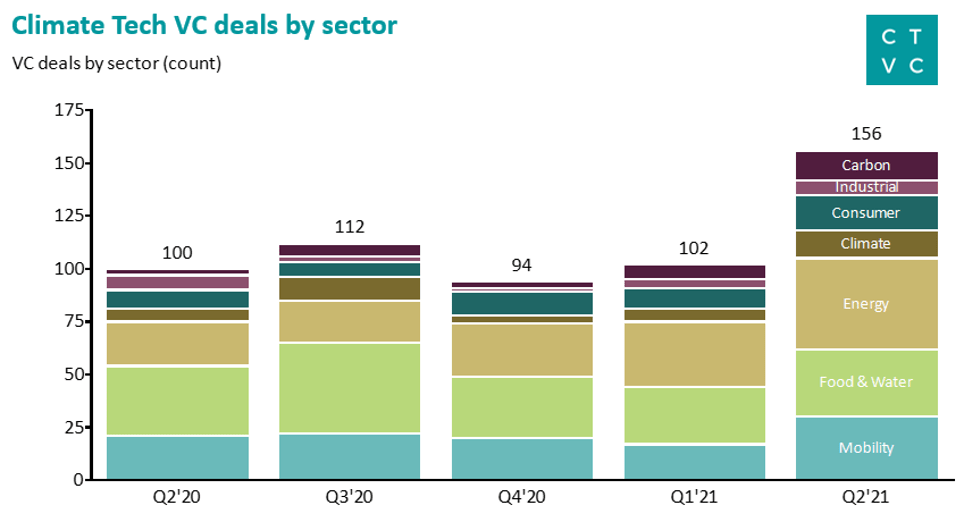

Climate tech investment as a whole is heating up, with startups raising about $16 billion across some 250 deals in the first half of 2021 – equivalent to total deals funded in the whole of 2020.

Energy, the more traditional sector for cleantech investors, is still attracting a large number of deals. But they pale in comparison to food and water — as well as mobility — in terms of actual dollar amount invested.

Purdom said her team breaks down the food and water sector into five sub-categories: agtech, alternative protein, vertical farming, food waste, and climate solutions related to water and ocean health.

Of these, agtech — which is defined as innovations around improving agricultural sustainability and reducing emissions — saw the most activity “by quite a large margin,” both in terms of the number of investors and the dollar amount invested, followed by alt-protein, she said.

Agtech companies also tend to be longer-established businesses with strong products that had been building for at least three to five years prior to the onset of the Covid-19 pandemic. As such, many needed growth capital – while alt-protein startups were younger, either still in the lab or going through seed or Series A funding, Purdom added.

The findings are consistent with the latest data from AgFunder, AFN’s parent company. The agrifoodtech-focused VC firm found that 2021 is set to break a new record for investment across the food and ag value chain, which has already raised $24 billion so far in the first half of the year. The record-breaking haul for the whole of 2020 was $30 billion.

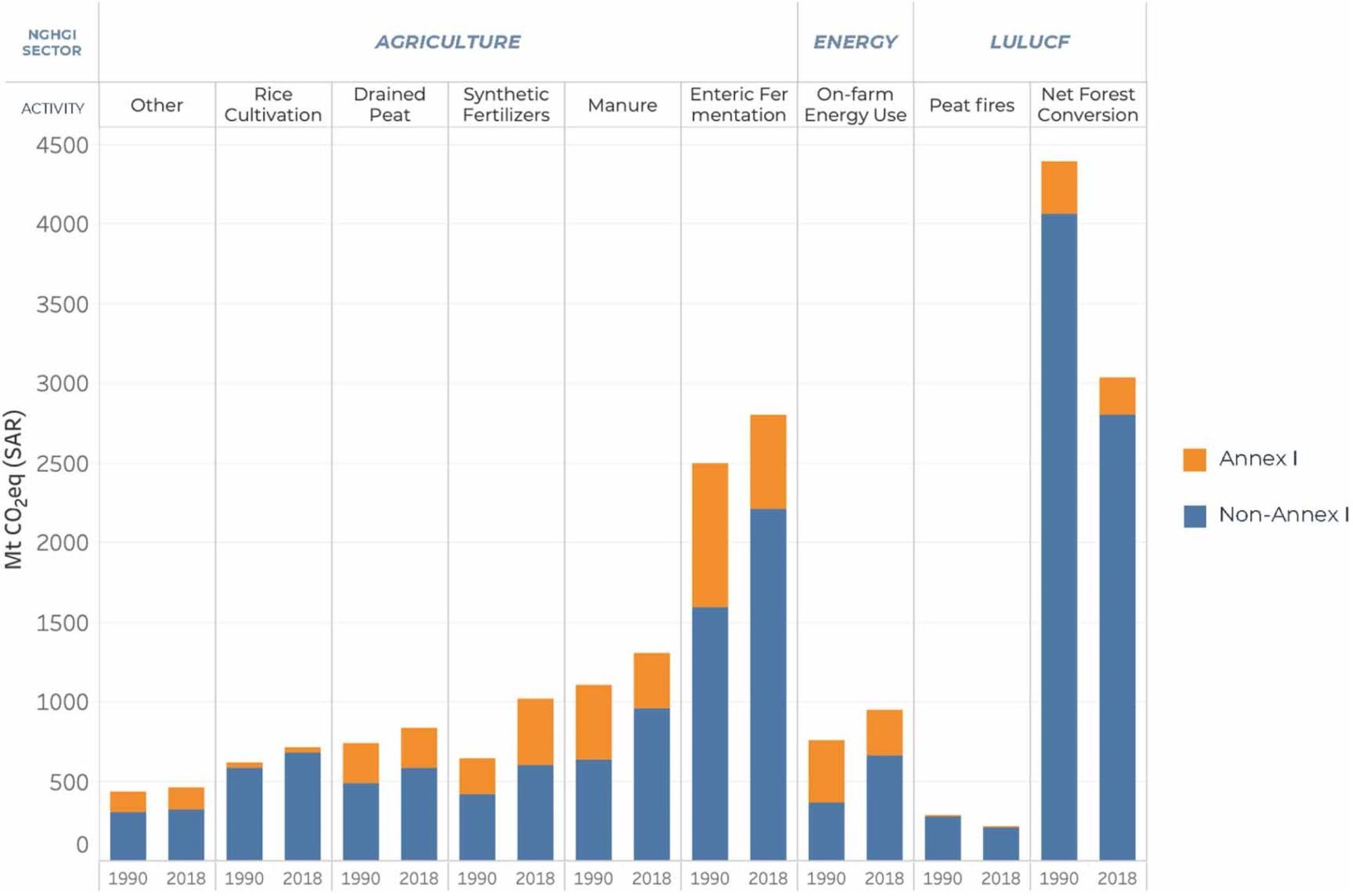

These investments underline the urgency of cutting emissions from food production and consumption. A global analysis published earlier this year showed the world’s food systems are responsible for a little over one-third of the global greenhouse gas emissions responsible for global heating.

A follow-up analysis found emissions caused by energy use along the food supply chain — including manufacturing of fertilizers and equipment, processing, packaging, and so on — increased by 50% between 1990 and 2018.

Many experts say technology and innovation are key to tackling the multiple and interconnected challenges facing food systems. Global warming is expected to hit crop yields in many parts of the world just as population growth and changing dietary patterns are expected to push up demand for food across the board.

Growing more food with less water, less emissions, and more environmentally friendly methods requires investment in agrifoodtech innovation – not just in developed nations, but also in the Global South.

Investing $15.2 billion more per year in agricultural R&D in poorer countries — less than what climate tech startups have raised in total so far this year, by Climate Tech VC’s count – could keep temperature rises below 2°C, reduce water use and pollution, and slash hunger levels, said an August report by the Commission on Sustainable Agriculture Intensification.

Sponsored

International Fresh Produce Association launches year 3 of its produce accelerator