Australian investment management firm Blue Sky Funds has created a $10 million fund to invest in the growing demand for citrus fruit in Asia.

Gathering investment from a range of investors in its network, such as family offices, investment companies, and self-managed superannuation funds in Australia, Blue Sky has bought a 300-hectare (740 acres) property in New South Wales. The property, which is operated by Southern Cross Farms, will convert its produce from oranges specifically for juice production, to fresh fruit of different orange varieties.

The investment decision was prompted by noticeable demand from Asia for fresh fruit and the farm will move its focus from domestic sales to export markets where Blue Sky has strong supply chain linkages, according to Michael Blakeney, investment director, Blue Sky Real Assets.

“On our analysis, we believe that Australian citrus is an overlooked sector,” he told AgFunderNews.

The project also takes advantage of more general demand in Asia for Australia-branded produce, which Blue Sky argues is cost competitive, high quality, safe and traceable food.

The property aims to produce fruits on a year-round basis using a range of different technologies such as computer-controlled irrigation and fertigation and integrated pest management programs. Blue Sky and its operator are also looking at using technologies to monitor tree health and input requirements, according to Blakeney.

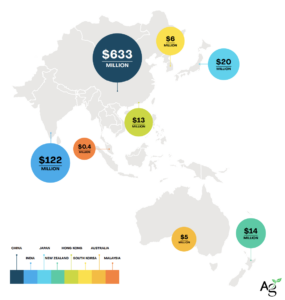

Blue Sky has centered much of its agriculture investment strategy around reaching Asian consumer markets and does so not just through investment into farmland, but through private equity, infrastructure and water investments too. The firm is currently fundraising its Strategic Australia Agriculture Fund, a multi-strategy fund targeting private equity agribusiness assets, ag infrastructure holdings and water asset, which it expects to hold a first close on early next year.

The fund was primarily structured to appeal to local superannuation funds, but it is also gaining traction from overseas investors in the US and the UK particularly, due to favorable macro conditions for Australia.

“The currency is supporting interest at the moment as it’s at a much more appealing rate and with good structural tail winds, good policy settings, and a relatively low risk, Australia’s competitiveness continues to grow,” said Blakeney. “We are a great diversifier and a natural progression from investments in other developed nations.”

Blue Sky has been one of few investment firms operating in the agriculture sector to successfully attract local institutional demand in recent years after winning a mandate from First State Super earlier this year. The mandate’s first deal was an A$150 million ($107.5 million) investment into almond farmland earlier this year.

The domestic pension industry has complained about low returns, lacking liquidity and uninvestable options in the farmland investment space, according to research from accounting firm BDO earlier this year. Australia’s venture capital industry is also a relatively inactive investor in agriculture innovation and technology.

Have news or tips? Email [email protected]

Sponsored

International Fresh Produce Association launches year 3 of its produce accelerator